You want exposure to digital assets but don’t want to manage wallets, seed phrases, or private keys. Good news: in 2025 there are several ways to learn how to invest in crypto—and even how to invest in Bitcoin—without ever holding a coin directly. This guide explains your main options, what each does under the hood, and how to choose the safest way to invest in cryptocurrency for your situation.

Option 1 — Spot crypto ETFs

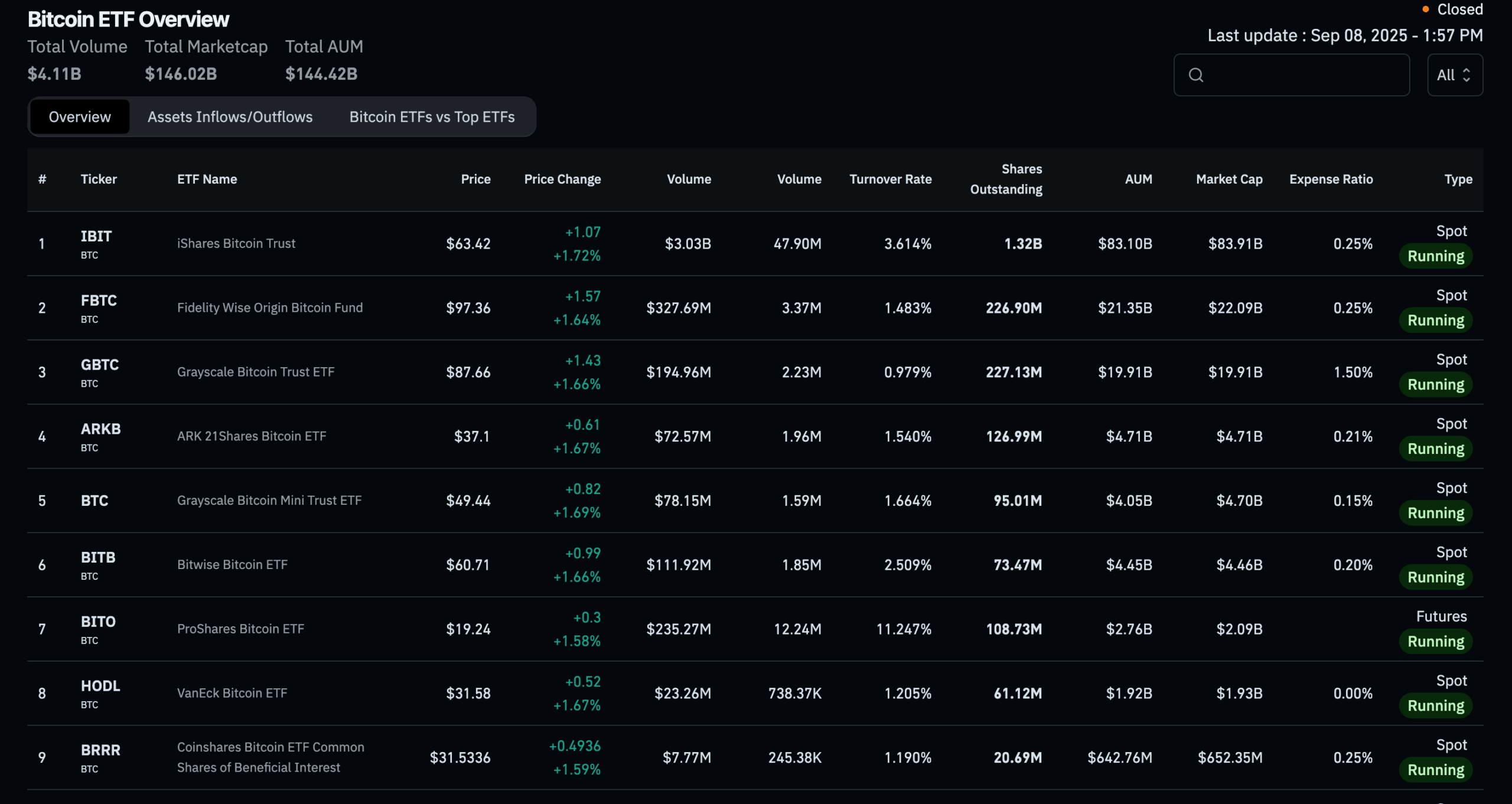

Source: Coinglass

If you ask, what is the best way to invest in bitcoin without touching a wallet, spot Bitcoin ETFs are the most straightforward path. In January 2024, the U.S. Securities and Exchange Commission approved the listing and trading of multiple spot Bitcoin ETPs—shares that hold actual bitcoin with qualified custodians. That opened mainstream access through a regular brokerage account.

In May 2024, the SEC also approved exchange applications to list spot Ether ETFs, paving the way for U.S. investors to buy ETH exposure via ticker symbols instead of private keys. Many of those products launched subsequently.

Pros

- Simple brokerage purchase; no wallet management.

- Institutional-grade custody and audited reporting.

- Clean for IRAs and many advisory platforms.

Cons

- Annual expense ratios reduce returns vs. holding coins.

- Trading hour limits vs. 24/7 crypto markets.

- Possible tracking error.

If your goal is to start investing in bitcoin with minimal friction, a low-cost spot ETF via your broker is often the practical answer. (Compare fees, liquidity, and creation/redemption mechanics among tickers.)

Option 2 — Futures-based crypto ETFs (when spot isn’t available)

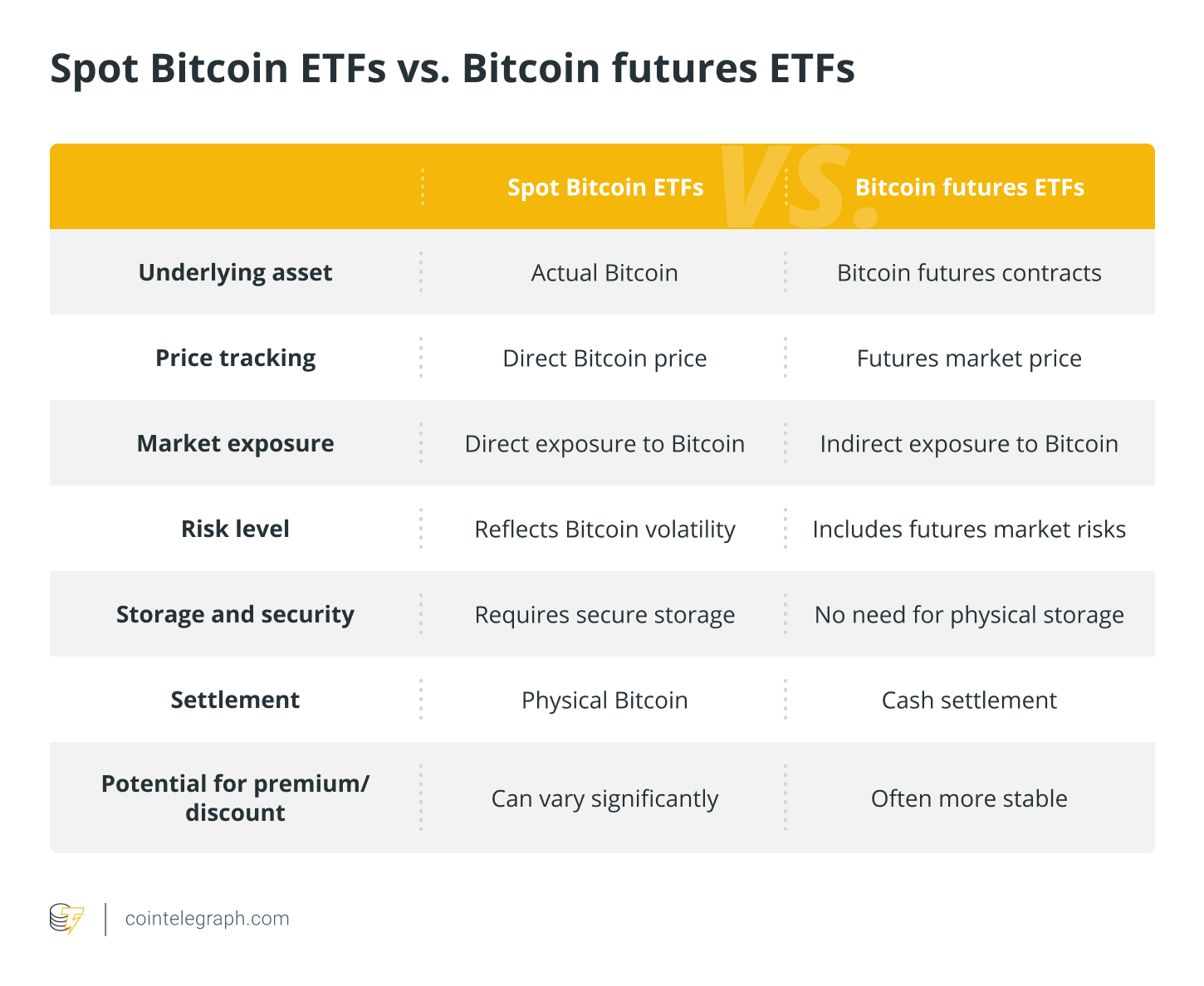

Source: Cointelegraph

Before spot ETFs existed, futures funds provided exposure using regulated futures on the CME. They still have a role—especially in accounts that prefer futures exposure or tactical tools (long/short, leveraged). ProShares BITO, launched in October 2021, was the first U.S. bitcoin-linked ETF and remains widely used. Note that futures funds don’t own coins; they hold futures and roll them, which can create “carry” costs over time.

Pros

- Regulated structure accessible in most brokerage accounts.

- Useful for tactical exposure.

Cons

- Roll costs/contango can erode long-term returns.

- Not a 1:1 tracker of spot prices.

Option 3 — Public companies with crypto beta

Another route to to invest in cryptocurrency without buying coins is to own businesses tied to the crypto economy:

- Exchanges/brokerages. Coinbase (NASDAQ: COIN) is a publicly traded exchange and custodian—its revenues rise and fall with trading and institutional activity, offering indirect exposure to the Bitcoin ecosystem.

- Miners. Marathon Digital (MARA) and Riot Platforms (RIOT) are U.S. bitcoin miners. They earn block rewards (in BTC) and operate large-scale infrastructure; the stocks are historically higher-beta than Bitcoin itself—great in bull markets, painful in drawdowns.

Pros

- Equityholder rights (dividends possible, disclosures, earnings calls).

- Potential to outperform in strong cycles.

Cons

- Company-specific risks (operations, energy costs, regulation).

- Equity valuation may diverge from coin prices.

Option 4 — Blockchain/thematic equity ETFs

If you prefer a basket of crypto-linked equities instead of picking single names, consider thematic ETFs:

- Amplify Transformational Data Sharing ETF (BLOK): an actively managed fund investing in companies “actively involved in blockchain technologies.”

- Bitwise Crypto Industry Innovators ETF (BITQ): tracks an index of crypto-focused companies (miners, brokerages, infrastructure), offering concentrated “pure-play” exposure inside a traditional ETF wrapper.

Pros

- Diversification vs. single-stock risk.

- Simple rebalance/one-ticker exposure.

Cons

- Expense ratios; underlying holdings may be volatile.

- Still equity risk, not direct coin exposure.

Building a no-coin crypto sleeve

There’s no universal best way to invest in bitcoin or crypto broadly; instead, design a sleeve that fits your risk tolerance and account type.

Conservative core

- 70–100%: Spot Bitcoin ETF (and/or spot Ether ETF) at low cost.

- 0–30%: Thematic blockchain ETF (e.g., BLOK, BITQ) for equity diversification.

Use case: “I want simple, regulated how to invest safely in cryptocurrency exposure.”

Balanced barbell

- 60%: Spot Bitcoin ETF (core beta).

- 20%: Crypto industry ETF (diversification).

- 20%: Single-name equities (e.g., COIN, a miner) sized small for upside/learning.

Use case: “I want some growth shots without juggling wallets.”

Tactical toolkit

- Core as above plus a modest sleeve of futures-based ETFs for short-term views (understand roll costs first).

Use case: “I sometimes tilt risk but don’t want to manage margin or options.”

Risk controls

- Structure awareness. Spot ETFs hold coins; futures ETFs hold futures; equities/ETFs hold businesses. Costs, taxes, and behavior differ. (Investopedia has a clear explainer on spot vs. futures crypto ETFs and their pros/cons.)

- Fees & tracking. Compare expense ratios and historical tracking to spot. Higher fees or persistent tracking error can quietly drag returns.

- Company-specific risk. For miners/exchanges, read 10-Ks and risk factors (energy prices, hash-rate plans, regulatory exposure). Start with official investor pages.

- Regulatory changes. Product availability can shift. The SEC’s 2024 actions opened spot ETFs for BTC and approved exchange listings for ETH ETFs—great for access, but rules evolve. Keep an eye on product notices.

- Brokerage basics. Use strong 2FA, withdrawal whitelists (if supported), and verify tickers before you click buy.

Step-by-step: how to invest in cryptocurrency for beginners

- Pick your account. A standard brokerage (taxable) or retirement account (if allowed) can hold spot/futures ETFs and blockchain equity ETFs.

- Choose your core. If your target is Bitcoin, shortlist several spot BTC ETFs and compare fees/liquidity; Ether investors can do the same with spot ETH ETFs.

- Add satellites. Decide if you want a small sleeve of crypto-industry equities (COIN, miners) or a thematic ETF like BLOK/BITQ for diversification.

- Automate. Use recurring purchases (weekly/monthly) to dollar-cost average—helpful for anyone who wants to start investing in crypto with less timing stress.

- Rebalance. Set rules (e.g., quarterly) to trim gains or add on dips while keeping your overall risk in line.

- Track taxes. ETFs and stocks generate capital gains/losses; futures ETFs can have distinct tax treatments. Keep trade confirms and statements.

FAQs

- What’s the best way to invest in bitcoin if I don’t want a wallet?

A low-fee spot Bitcoin ETF via your brokerage is the simplest route. It offers regulated custody and easy portfolio integration. - Are futures ETFs okay for long-term holding?

They can work, but rolling futures may add costs over time. Many long-term investors prefer spot ETFs for simple tracking. - I want diversification—what else besides Bitcoin?

Consider a small allocation to spot Ether ETFs (if suitable) and/or a blockchain equity ETF (BLOK, BITQ) for “picks and shovels” exposure. - Is buying mining or exchange stocks the same as owning crypto?

No. You’re buying businesses influenced by crypto markets, which introduces operational and equity-market risks in addition to crypto price moves. Review company filings and risk pages. - I’m brand new—how to invest in cryptocurrency for dummies?

Start with education and tiny amounts. Open a brokerage account, research two or three spot ETFs, set a small recurring buy, and review performance and fees quarterly. Scale only after you’re comfortable.

The conclusion

You don’t have to custody coins to get meaningful exposure. In 2025, a clean “no-coin” plan might combine: a spot Bitcoin ETF as the core, a spot Ether ETF or blockchain equity ETF for diversification, and—optionally—select stocks like Coinbase or a miner sized modestly for growth. Used thoughtfully, these tools answer how to invest safely in cryptocurrency while fitting neatly inside the accounts you already use.

Keep your process boring: compare fees, verify structures, automate contributions, and rebalance on a schedule. That’s the best way to invest in bitcoin (and crypto generally) when your aim is long-term exposure with fewer moving parts.