If you’re trying to make sense of the ever-expanding Bitcoin ecosystem—from Lightning to sidechains, from wallets to regulation—this guide gives you the big picture. We’ll cover what Bitcoin is, core Bitcoin utilities and use cases, the major building blocks (L1/L2, DeFi-adjacent bits), how community and adoption are evolving, and the Bitcoin long-term outlook.

What Is Bitcoin (BTC)?

Bitcoin is the original peer-to-peer electronic cash system proposed by Satoshi Nakamoto in 2008. It solves the double-spend problem without relying on banks by using a public ledger (the blockchain) secured by proof-of-work (PoW) mining. Miners expend computational work to add blocks; nodes verify the rules, keeping the network decentralized and hard to censor. The whitepaper’s core insight: timestamping transactions in a chain of PoW makes altering history prohibitively expensive as long as honest majority compute power prevails.

At a high level:

- Scarcity & neutrality: Bitcoin’s supply is capped at 21 million BTC, issuance halves roughly every four years, and anyone can run a node to independently verify the rules.

- Upgrades with caution: Changes happen via open proposals (BIPs) and soft forks when there’s broad consensus. A major example is Taproot (Nov 2021), which introduced Schnorr signatures and script upgrades (Tapscript) to improve efficiency, privacy, and smart-contract primitives.

This conservative ethos—optimize security and decentralization first, add functionality carefully—shapes the entire ecosystem development story.

Key Use Cases

1) Store of value (“digital gold”)

Bitcoin’s hard cap and credible neutrality have made it a macro hedge for some investors. The U.S. SEC’s January 10, 2024 approval of spot Bitcoin ETFs lowered access barriers for traditional investors—arguably a milestone for institutional legitimacy.

2) Fast payments via Layer-2

On the base layer, blocks arrive about every 10 minutes; fees and space are limited. Enter Lightning Network, a web of payment channels anchored to Bitcoin that enables near-instant, low-cost transactions without trusting intermediaries. It routes payments across multiple channels, settling on-chain only when channels open/close—great for micro- and retail-style payments.

3) Cross-border transfers

Global remittances are still pricey. The World Bank tracks the average cost of sending money internationally at ~6% (varies by corridor and method), a gap Bitcoin-powered rails aim to compress by moving value over Lightning or sidechains and handling FX off-chain.

4) Self-custody & censorship resistance

Bitcoin’s UTXO model and mature wallet ecosystem (including hardware wallets) let users hold keys and transact globally with minimal permissioning. This is a feature, not a bug, for people living under capital controls.

5) Programmability via layers

While base-layer Bitcoin is intentionally simple, layers like Lightning and smart-contract-enabled Bitcoin layers extend functionality for DeFi ecosystem experiments (lending, swaps, tokenization) without altering Bitcoin’s L1 security guarantees. We’ll unpack those next.

Ecosystem Components

Source: Wikimedia

1. Layer-1 (the base chain)

- Consensus & validation: PoW mining secures blocks; Bitcoin Core nodes verify every rule independently, keeping the network trust-minimized. Developer docs describe the blockchain, PoW, and validation model in detail.

- Recent upgrade—Taproot: Enables Schnorr signatures and more flexible scripts (Tapscript), paving the way for better privacy and more advanced constructions on and off L1.

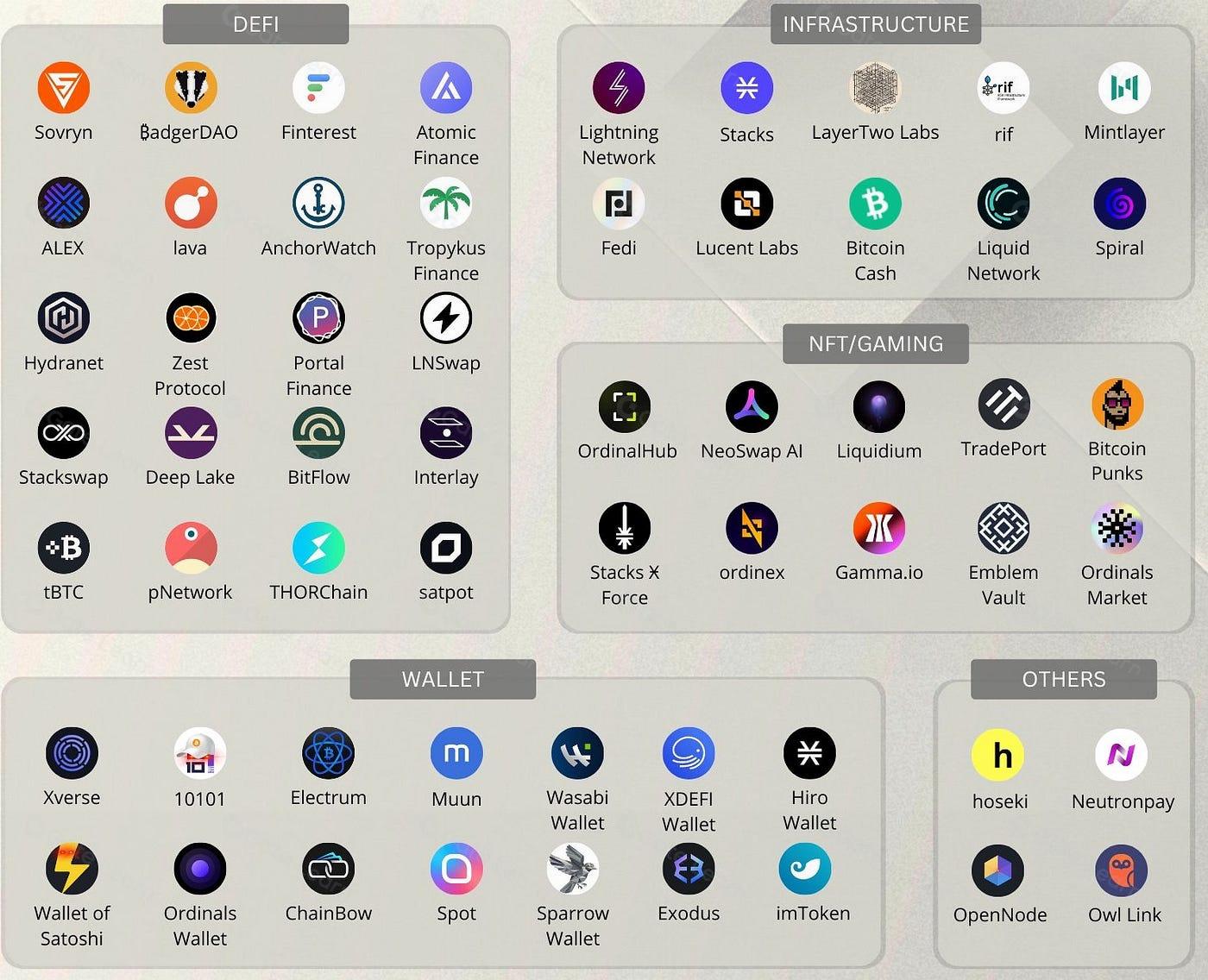

2. Layer-2 / Sidechains / Extensions

- Lightning Network (payments): Peer-to-peer channels for fast, cheap BTC transfers; ideal for day-to-day payments and machine-to-machine micro-transactions.

- Liquid Network (Blockstream): A federated Bitcoin sidechain with 1-minute blocks, Confidential Transactions, and token issuance (e.g., stablecoins, tokenized securities). BTC moves between chains via a 1:1 peg (LBTC on Liquid). Liquid targets capital markets, faster settlement, and privacy for institutions.

- Stacks: A Bitcoin-anchored layer bringing smart contracts (Clarity language) and a design called Proof of Transfer (PoX)—miners spend BTC to mine Stacks blocks, while Stackers lock STX and earn BTC rewards. This is not native Bitcoin staking; it’s a separate layer with its own tokenomics that interacts with Bitcoin.

- Rootstock (RSK): An EVM-compatible Bitcoin sidechain secured via merged mining, enabling solidity-based dApps and Bitcoin DeFi with RBTC (a BTC-pegged asset). Think Ethereum-style programmability while settling value back to Bitcoin. Bitcoin itself uses PoW and does not support native staking. Where you see staking-like yields connected to BTC, they come from other protocols (e.g., Stacks “stacking” BTC rewards paid by PoX miners) or from custodial/lending arrangements—not from Bitcoin’s base consensus.

3. Infrastructure & tools

- Nodes & wallets: From full nodes to light clients and hardware wallets, tooling lets users verify and self-custody. The Bitcoin.org dev guides are a solid starting point.

- Bridges and pegs: Sidechains like Liquid (federated peg) and Rootstock (two-way peg with merged mining) move BTC across domains to enable new Bitcoin use cases like tokenization or on-chain DeFi.

Community and Adoption

Source: Coinglass

Bitcoin adoption moves in waves—grassroots, developers, institutions, and even governments experimenting.

- Grassroots usage: Chainalysis’ Global Crypto Adoption Index tracks where crypto penetration is highest. It’s not a Bitcoin-only metric, but the index helps show where on-chain activity (including BTC) is gaining momentum and which regions lead in retail-weighted adoption.

- Regulated market access: The spot Bitcoin ETF approvals in the U.S. (Jan 10, 2024) made BTC exposure easier for retirement accounts, RIAs, and institutions constrained by mandate—important for the next leg of Bitcoin adoption forecast narratives.

- Payments and remittances: Remittance corridors still average meaningful costs; innovations that route value over Bitcoin rails aim to compress these frictions. Even if end users see dollars at both ends, BTC (and Lightning) can be the neutral, always-on settlement fabric in the middle.

- Policy and ESG debates: Mining’s electricity use draws scrutiny, with credible estimates and methodologies tracked by Cambridge’s CBECI and U.S. EIA. There’s an active (and sometimes heated) debate about how much mining utilizes renewables or stranded energy, and whether miners can encourage new renewable build-out. Expect this to remain a front-page topic as hash rate trends up.

Long-Term Potential

Here’s the realistic (but optimistic) Bitcoin long-term outlook:

1) Monetary premium, not just tech premium

Bitcoin’s core feature is credible, programmatic scarcity enforced by a vast, permissionless validator set (nodes) and economic alignment via PoW. As more capital accesses BTC through familiar wrappers (ETFs, qualified custody), the asset’s monetary premium could deepen. The ETF greenlight was a watershed moment for mainstream distribution.

2) Payments that actually scale

Lightning continues to mature, enabling instant, high-throughput payments denominated in sats. Combined with better UX (mobile wallets, NWC/Keysend, LNURL), Lightning can undercut card rails for small payments and power machine-to-machine commerce—without sacrificing Bitcoin’s neutrality.

3) Bitcoin-anchored programmability

Instead of bloating L1, programmability is migrating to layer-2/sidechains where risk can be contained. Liquid targets capital markets and tokenization; Stacks and Rootstock target smart contracts and Bitcoin-centric DeFi. If these layers continue to harden and improve UX (bridges, wallets, on-ramps), expect a richer BTC economy: lending markets, BTC-collateralized stablecoins, tokenized real-world assets, and compliant issuance—all while L1 stays conservative.

4) Protocol headroom via future BIPs

There’s ongoing research into upgrades that don’t compromise Bitcoin’s simplicity but unlock meaningful utility. One example is BIP-119 (OP_CHECKTEMPLATEVERIFY), a proposed covenant enabling templated spending conditions. If ever adopted via broad consensus, CTV could improve self-custody “vaults,” channel factories for Lightning, congestion control, and safer L1-to-L2 bridges—essentially better rails for scaling without sacrificing security. (It’s still a proposal; community caution is the point.)

5) Energy & sustainability trajectory

Energy usage will stay under the microscope. Transparent methodologies (CBECI) and official analyses (EIA) help the conversation. The sector’s efficiency tends to improve over time (newer ASICs, smarter placement, flexible load participation), and more miners seek low-cost, low-carbon power. Whether this becomes a net positive narrative hinges on data, not vibes.

6) Enterprise and sovereign experiments

From treasury allocations to tokenization pilots and cross-border settlement experiments, institutions will keep poking at Bitcoin. Some countries may explore BTC rails for remittances or reserves; others will steer clear. The throughline: Bitcoin’s neutrality and portability make it a candidate for some jobs that today rely on FX and correspondent banks—especially where those systems are slow, expensive, or politically brittle.

Conclusion

The Bitcoin ecosystem has matured far beyond “number go up.” On L1, Bitcoin remains a minimalist, robust settlement network with a simple rulebook and a conservative roadmap (deliberate, BIP-driven, consensus-oriented). On L2 and adjacent layers, we’re seeing credible ecosystem development: Lightning for everyday payments; layer-1/2 solutions like Liquid, Stacks, and Rootstock for tokenization, programmable contracts, and DeFi ecosystem experiments—while keeping Bitcoin’s base secure and uncluttered.

Bitcoin utilities today include store of value, global settlement, self-custody, and fast payments. Bitcoin use cases are expanding through sidechains and L2s that integrate with BTC as the reserve asset. Adoption data and regulatory breakthroughs (like spot ETFs) point to deeper integration with traditional finance, even as energy debates and policy risks persist.

Bitcoin is the settlement anchor; layers build the user experience. That’s why the Bitcoin long-term outlook remains compelling—scarce base money plus open, composable networks that keep getting faster, cheaper, and more capable around it.