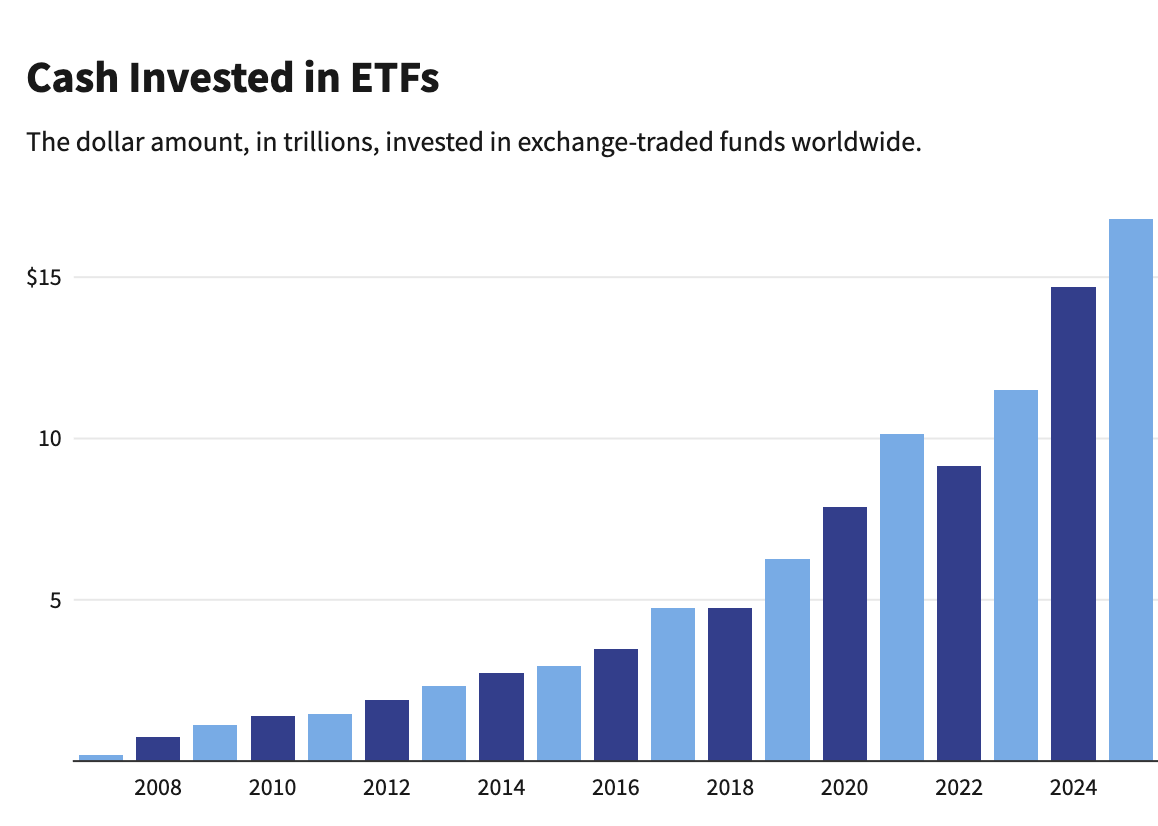

You want a simple way to invest without stock-picking headaches? Enter the ETF. In plain language, an exchange-traded fund lets you buy a ready-made basket of investments—often an entire stock or bond market—in a single trade. This guide answers the big questions—what are ETFs, how do they work, how to buy—and folds in practical notes on ETF index funds, pros and cons of ETFs, and choosing an ETF investment strategy you can actually stick with.

The 60-Second Answer: What Are ETFs?

An ETF is a fund you trade on an exchange like a stock. Most ETFs are registered investment companies overseen by the U.S. Securities and Exchange Commission; each share represents a slice of a professionally managed portfolio. You can buy and sell throughout the trading day at market prices.

Why do investors flock to them? Diversification in one swipe, typically low ongoing costs, intraday flexibility, and potential tax efficiency—especially for broad ETF index funds.

Under the Hood: How Do ETFs Work?

Source: Investopedia

Two markets operate at once:

- Secondary market. We trade ETF shares on an exchange platform. Prices update constantly and include trading frictions like the bid-ask spread; a limit order helps you control execution.

- Primary market (behind the scenes). Large broker-dealers called authorized participants (APs) swap BTC, big “creation units” of ETF shares with the fund for baskets of securities or cash. That create/redeem process helps keep the ETF’s price near the value of its holdings (its NAV) and supports liquidity. It’s also a reason many index ETFs are tax-efficient.

Because ETFs trade in real time, they can show brief premiums or discounts to NAV—usually narrowed by that creation-redemption mechanism, but still worth watching when markets are jumpy or the fund is thinly traded.

Meet the Family: Types of ETFs

They come in flavors for almost any goal:

- Equity ETFs: Broad market, sectors (e.g., technology), size/style (small-cap, value), and factor or “smart beta.”

- Bond ETFs: U.S. Treasuries, investment-grade corporates, munis, international debt, and short-term cash-like funds.

- Commodity/alternative ETFs: Gold and diversified commodity exposures.

- Leveraged & inverse ETFs: Designed to magnify or invert daily index moves—specialized trading tools with extra risks (generally not core, long-term holdings).

If you’re understanding ETFs for the first time, you’ll likely stick with plain vanilla ETF index funds that track broad markets.

The Upside: Advantages of ETFs

Here are the headline advantages many investors care about:

- Diversification in a single click. One fund can spread your money across hundreds or thousands of securities, reducing single-company risk.

- Typically low ongoing costs. Expense ratios on broad index ETFs tend to be low; over decades, tiny fee differences add up.

- Tax efficiency (especially for index ETFs). The in-kind creation/redemption process can limit capital-gains payouts compared with many mutual funds. (Dividends/interest are still taxable.)

- Trading flexibility. Buy or sell during market hours and use order types (market, limit, stop) to manage Bitcoin price and timing.

These are the big advantages of ETFs that power their popularity.

The Flip Side: Pros and Cons of ETFs

No wrapper is perfect. Keep these trade-offs in mind:

- Market risk remains. If the index drops, the ETF falls with it; diversification doesn’t erase market swings.

- Premiums/discounts and spreads. In volatile conditions or in niche funds, spreads can widen and prices can stray from NAV. Favor higher-volume funds and consider limit orders.

- Tracking difference & tracking error. Real-world results rarely match a benchmark perfectly. “Tracking difference” shows the size of the gap; “tracking error” shows how consistent that gap is. Reviewing both helps set expectations.

- Complex products. Leveraged and inverse ETFs reset daily; over longer periods they may behave very differently than the multiple you expect—especially in volatile markets. Regulators flag them as specialized.

These are the practical pros and cons of ETFs you should check before buying.

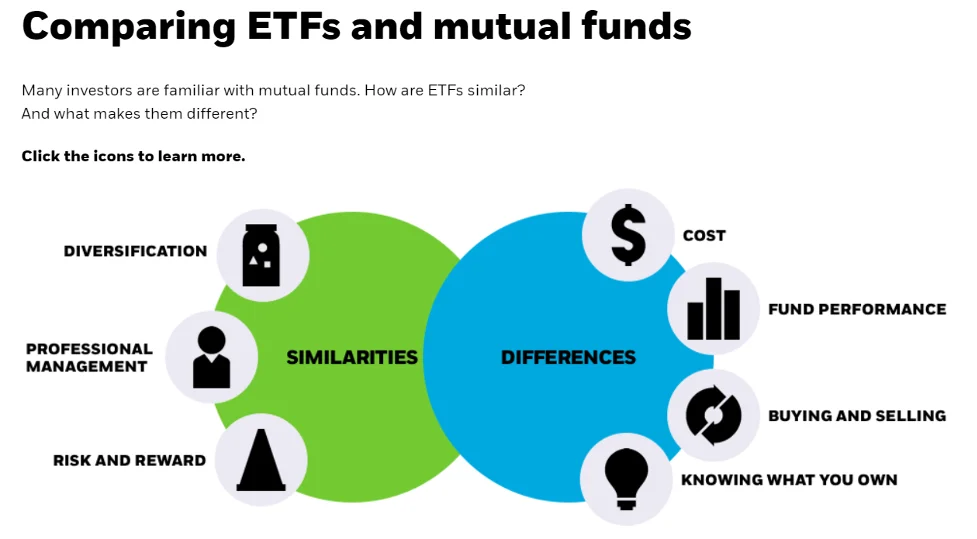

ETFs in Context: Comparing to Other Options

Source: Bulbapp

- ETFs vs. mutual funds. Both are diversified funds, but mutual funds price once per day at NAV and make automatic contributions simple, while ETFs trade all day at market prices. Tax efficiency can be strong for both index mutual funds and ETFs, though the ETF structure often has an edge due to creation/redemption.

- ETFs vs. individual stocks. Building a diversified portfolio one company at a time is time-intensive and risky. A broad ETF index fund delivers instant diversification with transparent, usually low fees.

A Simple ETF Investment Strategy You Can Maintain

You don’t need 15 funds to look “sophisticated.” Many long-term investors use a “core-and-satellite” ETF investment strategy:

- Core: One or two broad ETF index funds (e.g., total U.S. or global stocks; total investment-grade bonds) as your main engine.

- Satellite (optional): Small tilts to a sector or factor you believe in—kept modest to avoid turning the portfolio into a guess.

- Rebalance: Once or twice a year, nudge allocations back to target. Consistency beats cleverness.

This keeps fees low, taxes simple, and decisions rare—helpful traits for real humans.

How to Buy ETFs (Step-by-Step)

If you’re wondering how to buy ETF, here’s a quick playbook you can follow today:

- Open and fund a brokerage account. You’ll buy ETFs the same way you buy stocks. Check commissions and account fees.

- Screen for plain-vanilla, low-cost funds. Read the fund page and summary prospectus: which index does it track, what’s the expense ratio, how liquid is it (average volume, typical spread), and what’s its premium/discount history? Learn how spreads and discounts work before placing a trade.

- Check tracking quality. Look at both tracking difference (average gap to the benchmark over time) and tracking error (consistency of that gap). Lower is better for core holdings.

- Place the order wisely. Consider a limit order, especially in thinly traded funds, and be careful at the open/close when prices can be jumpier.

- Automate contributions and rebalance. Many platforms support recurring investments and simple rebalancing rules for ETFs and mutual funds alike.

Best ETFs for Beginners: What That Usually Means

No single fund wins for everyone, but when people say best ETFs for beginners, they typically mean:

- Broad, low-cost stock market exposure (total U.S. or total global).

- A high-quality bond index ETF for stability if your time horizon is shorter or you prefer a smoother ride.

- Transparent, liquid funds from established providers, with tight spreads and long records of tracking their indexes well.

That keeps your plan simple and your behavior steady—two of the most underrated edges in investing.

A Quick Word on Complex ETFs

Curious about leveraged or inverse funds? They’re engineered to deliver multiples of daily returns or the opposite of the index for short-term trading. Holding periods longer than a day can produce outcomes far from what you might expect, and risk can compound in volatile markets. If you’re new to ETFs, treat these as advanced tools and read the regulator bulletins before considering them.

The Conclusion

If you’re understanding ETFs for the first time, remember this: they are just wrappers. The magic is in your behavior and the index you choose, not the three-letter ticker. Use simple ETF index funds to diversify, keep costs low, and automate good habits. Be mindful of pros and cons of ETFs—spreads, premiums/discounts, tracking difference—and stick with an ETF investment strategy you can live with through ups and downs. With that foundation, you’ll know exactly what they are, how do ETFs work, and how to buy them—without turning investing into a full-time job.