Crypto can change your net worth faster than most assets—for better and for worse. Diversification is the antidote to single-bet risk, but how to diversify a crypto portfolio isn’t always obvious. Below is a research-backed playbook on how to build a diversified crypto portfolio, the trade-offs involved, and concrete ways to keep risk in check over years, not weeks.

Why diversify at all?

Three realities make diversification essential in digital assets:

- Big drawdowns happen. BlackRock’s iShares notes Bitcoin has suffered multiple >50% drawdowns since 2014, with the largest slumps averaging ~80%—helpful context for sizing any position.

- Correlations can spike. The IMF finds crypto’s correlation with equities rose meaningfully in recent years, limiting the “free lunch” of diversification during stress. That means spreading bets within crypto may still leave you exposed when markets move together.

- Policy and design risks are real. Regulators (FSB, BIS) continue to flag risks around crypto and stablecoins, which affects liquidity, market structure, and pricing. Diversification is one way to navigate evolving rules.

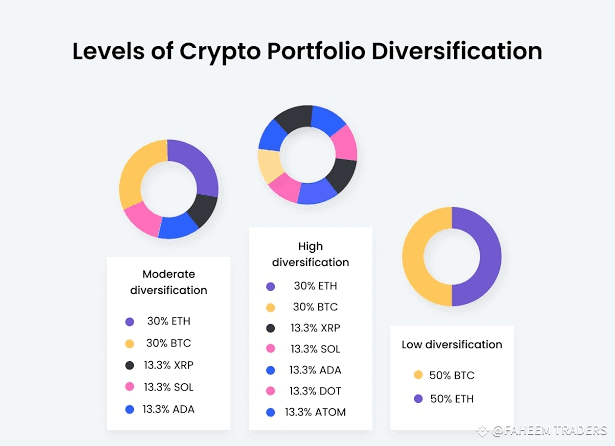

What “diversified” means in crypto

A balanced crypto portfolio spreads exposures across independent risk drivers—not just more tickers. In practice, that often means balancing by function (store-of-value, smart-contract platforms, scaling, DeFi, infrastructure), by consensus/tech stack, by liquidity, and by use of stablecoins or cash for dry powder. Classic investing research also reminds us that rebalancing, not just selection, is what keeps risk aligned to your target over time.

The core–satellite idea (crypto version)

- Core: High-liquidity, large-cap assets you plan to hold through cycles (commonly BTC and/or ETH).

- Satellites: Targeted themes—Layer-2s, alternative L1s, blue-chip DeFi, oracles/data, infrastructure, real-world-asset protocols—funded with smaller allocations you can trim or rotate.

- Cash/stablecoin sleeve: For opportunistic buys and to lower portfolio volatility—while remembering that stablecoins carry issuer, market, and regulatory risks (not bank deposits).

Quick check: If one coin can sink your account by itself, you haven’t really diversified your crypto portfolio.

Step-by-step: best way to diversify a crypto portfolio

1) Start with a risk budget

Before tickers, decide how much portfolio loss you’re willing to tolerate in a bad year. Bitcoin’s history makes a case for humility on sizing.

2) Map your building blocks

Think in buckets so you can see concentration:

- Store-of-value/“digital gold” (e.g., BTC)

- Smart-contract platforms & scaling (e.g., ETH, L2s)

- DeFi blue chips (DEX/liquidity, lending, liquid staking)

- Infrastructure & middleware (oracles, data, wallets, interoperability)

- Stablecoins/cash reserve (for liquidity and rebalancing; treat issuer risk seriously)

This simple grid helps answer, “How can I diversify my crypto portfolio effectively?” and reveals overexposure to any one narrative.

3) Choose a weighting style

- Market-cap tilt for the core (lets the market decide winners; easier to maintain).

- Equal-weight or capped-weight for satellites (prevents small names from becoming outsized).

- Keep each satellite small enough that failure won’t derail the whole plan—practical for anyone asking, “How can I diversify my crypto portfolio to minimize risks?”

4) Rebalance on a schedule or by thresholds

Vanguard’s research shows the main goal of rebalancing is risk control, and no single frequency dominates—quarterly, semiannual, or threshold rules (like “rebalance if a sleeve drifts >20% from target”) are all defensible. The key is to be consistent and mindful of costs and taxes.

5) Add time diversification (DCA)

Dollar-cost averaging won’t magically boost returns versus lump-sum on average, but it reduces timing risk and can help investors stick to the plan—useful in a volatile asset class.

6) Fortify the “plumbing”

- Custody: Prefer self-custody for long-term holdings; split keys/devices; test restores.

- Venue risk: The SEC and FINRA repeatedly warn that crypto platforms may lack traditional protections; don’t rely solely on “proof of reserves.” Diversify venues and avoid overusing leverage.

What are the best strategies for diversifying a crypto portfolio?

Source: Binance

Here are some practical, research-aligned tactics you can mix and match:

- Core–satellite with risk caps: Keep 60–80% in core (BTC/ETH mix tailored to your thesis), 10–30% in satellites (L2s, alt-L1s, DeFi, infra), and 10–20% in cash/stablecoins. Treat this as an illustrative starting map, not advice. Rebalance quarterly or at ±20% sleeves. (This answers on what are the best strategies to diversify my crypto portfolio while keeping drawdown awareness front-and-center.)

- Theme buckets with limits: Cap any single theme at, say, 25% of the portfolio and any single asset at 10%. This controls blow-up risk from one codebase or tokenomic model.

- Liquidity-aware tilts: Size smaller, illiquid names modestly; use your stablecoin sleeve to buy dips rather than chasing thin markets.

- Policy-risk hedges: BIS/IMF work shows macro and policy news can hit crypto broadly; avoid overconcentration in assets heavily exposed to a single jurisdiction or regulatory trigger (e.g., stablecoin issuer risk, exchange dependencies).

- Behavioral guardrails: Pre-commit to a sell discipline (e.g., trim winners back to target at rebalance) to avoid letting a moonshot become your whole portfolio—Vanguard calls this the essence of rebalancing: keeping risk aligned to plan.

If you’re asking, should I diversify my crypto portfolio?—yes, if your goal is to stay invested through full cycles without a single protocol or theme dictating your fate.

Limits of diversification

Diversification is not a force field. The IMF documented that crypto’s co-movement with stocks rose during the pandemic era, which can reduce diversification benefits exactly when you want them most. Planning for that correlation spike—bigger cash buffers, stricter position caps, and a formal rebalance rule—is prudent.

Stablecoins won’t save you if design or regulatory problems surface. Global standard-setters have warned about runs, opacity, and cross-border supervisory gaps; treat them as tools, not risk-free cash.

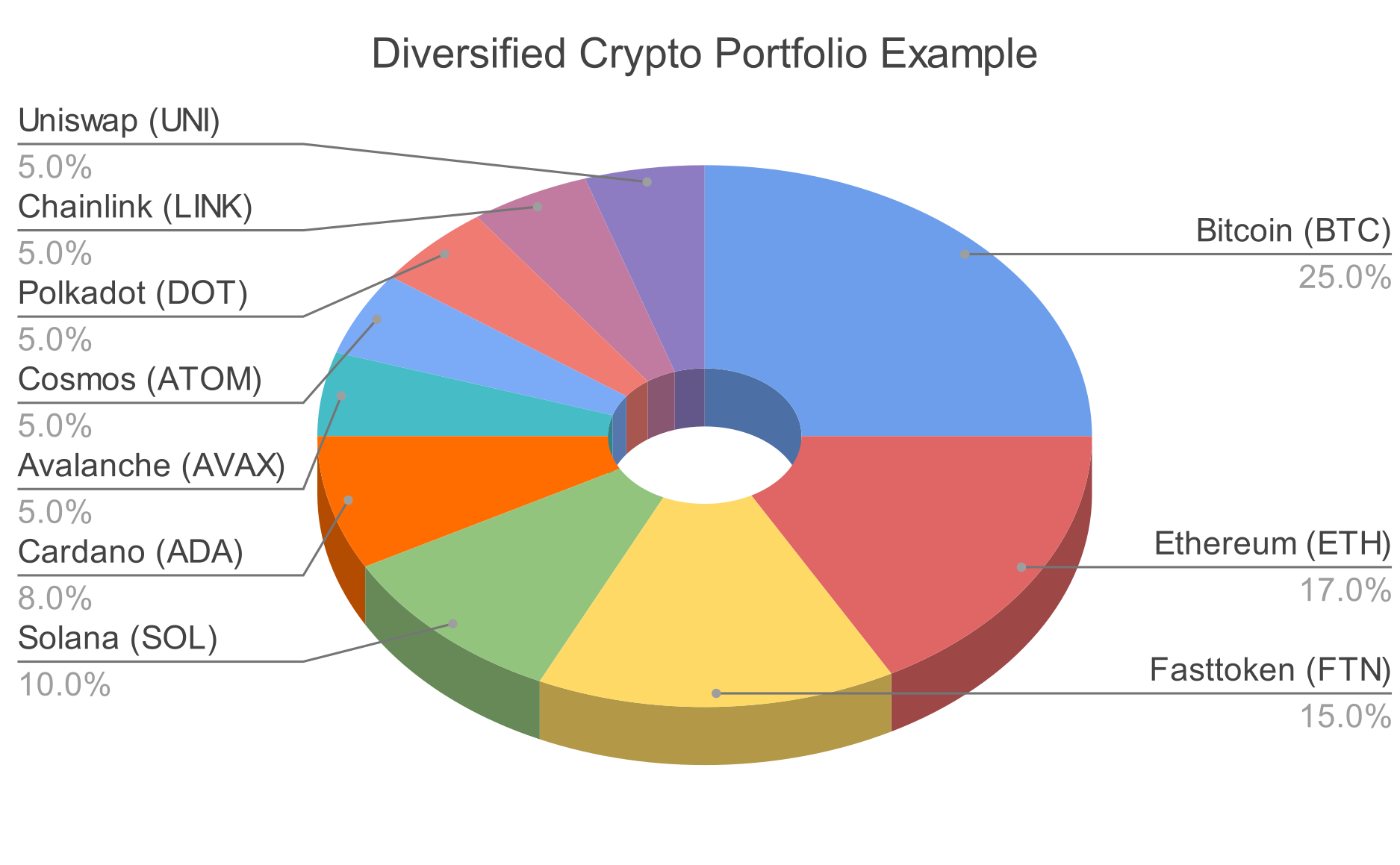

An example of the balanced crypto portfolio

Source: Fastex

One way investors sketch a best diversified crypto portfolio—again, not advice, just an educational template to test in a paper portfolio:

- 35% BTC (store-of-value/liquidity core)

- 25% ETH (smart-contract core)

- 10% Scaling (L2s)

- 10% Alt-L1s (capped, equal-weight)

- 5% DeFi blue chips

- 5% Infrastructure/oracles/data

- 10% Stablecoins/cash (for rebalancing and opportunistic buys)

Rebalance quarterly or when any sleeve drifts by ±20% from its target. The logic mirrors mainstream portfolio practice: the discipline of rebalancing matters more than hyper-optimizing the exact date.

Risk checklist before you hit “buy”

- Drawdown awareness: Could you sit through a 60–80% drawdown on a given sleeve? Size accordingly.

- Venue and custody: Use reputable venues and consider self-custody; remember SEC/FINRA cautions about platform protections and non-audit “proofs.”

- Policy watch: Follow FSB/BIS/IMF updates—policy can move correlations and liquidity.

- Process, not prediction: A written plan (allocation, DCA cadence, rebalance rules) beats ad-hoc trades. Vanguard research supports rules-based rebalancing for risk control.

Quick FAQ

- How can I diversify my crypto portfolio effectively? Use a core–satellite mix, cap single names/themes, keep a cash sleeve, and rebalance on a set cadence.

- How can I diversify my crypto portfolio to minimize risks? Position sizing + cash buffers + custody diversification + rebalancing. Recognize correlation spikes.

- What are the best strategies to diversify my crypto portfolio / best way to diversify crypto portfolio? Theme buckets with limits, market-cap tilt for core, equal-weight satellites, threshold rebalancing, and DCA if timing risk stresses you out.

Final Words

There is no single best diversified crypto portfolio. There is a best process: define risk, spread exposures by genuine drivers (not just more coins), and rebalance on rules you can stick with. Combine that with sober expectations—crypto’s deep drawdowns, correlations that rise in stress, and evolving policy—and you’ll be closer to a long-term, balanced crypto portfolio you can actually hold.

This is education, not financial advice; if in doubt, consult a licensed advisor.