Love them or hate them, memecoins are still moving markets in 2025. The smart approach isn’t guessing the next 100×—it’s following a tight process: research carefully, choose the right platform, fund correctly, execute cleanly, and lock down security. This guide walks you through each step using only reputable sources, with pointers to track best memecoins 2025, and how to turn your memecoin market analysis 2025 into a repeatable workflow.

Step 1: Research and Select a Memecoin

Start by casting a wide, data-driven net—then narrow fast.

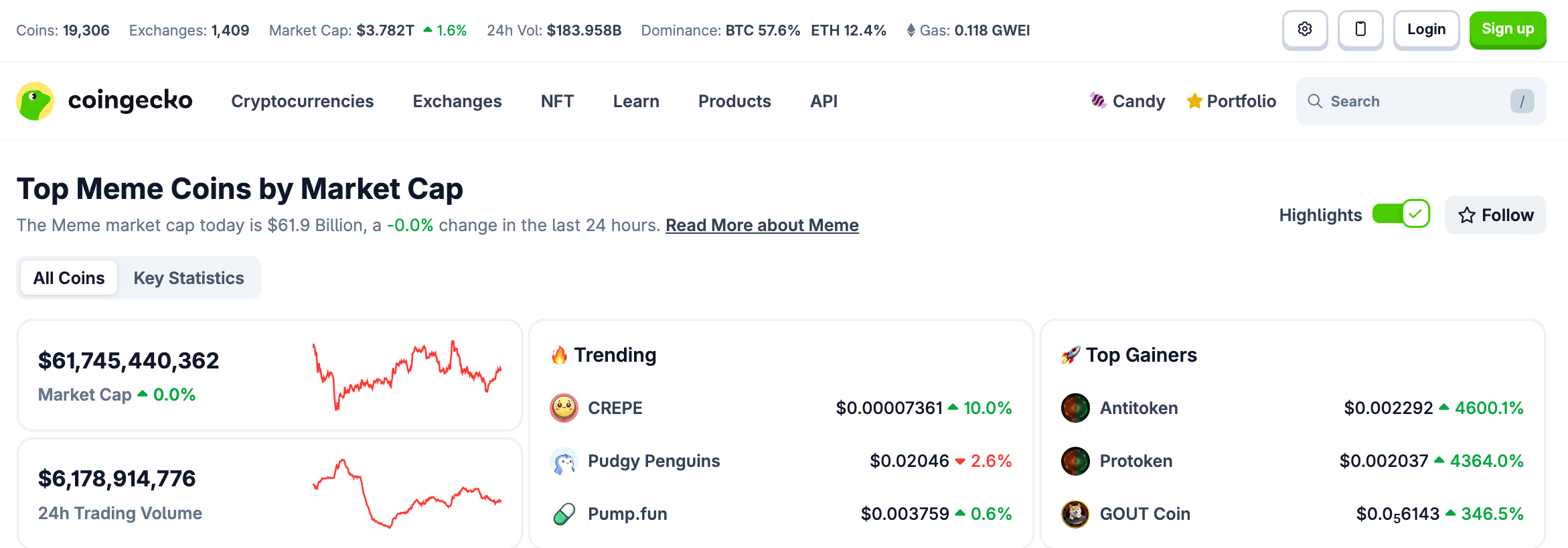

- Use neutral trackers. Check CoinGecko’s Meme category and sub-sectors to see leaders by market cap, volume, and trend; dig into token pages for contract links and historical performance.

- Cross-reference on CoinMarketCap. Its Memes view lists top and trending tokens with links to official sites, explorers, and exchanges—handy for fast due diligence.

- Read independent market coverage. CoinDesk’s ongoing memecoin reporting (including sector indices) provides useful context on liquidity cycles and whale behavior—essential if you’re hunting the best memecoins to invest 2025 rather than just chasing social buzz.

Now pressure-test the pick:

- Smart-contract basics. Is the contract verified on a legit explorer (e.g., Etherscan/Solscan)? Are there mint/blacklist functions?

- Liquidity sanity. Can liquidity be withdrawn easily? Binance Academy’s rug-pull primers list classic red flags and are a must-read for meme-coin sizing.

Tip: Make a one-page checklist for every coin: contract link, holders distribution, liquidity lock, audits (if any), and core community channels. It keeps you objective when the price is screaming.

Step 2: Choose a Cryptocurrency Exchange or Platform

You have two broad paths:

- Centralized exchanges (CEXs) — deep order books, fiat on-ramps, and stronger compliance; you’ll likely complete KYC due to global AML standards and the FATF’s Travel Rule expectations for VASPs.

- Instant swap / non-custodial services — quick crypto-to-crypto swaps, wallet-to-wallet.

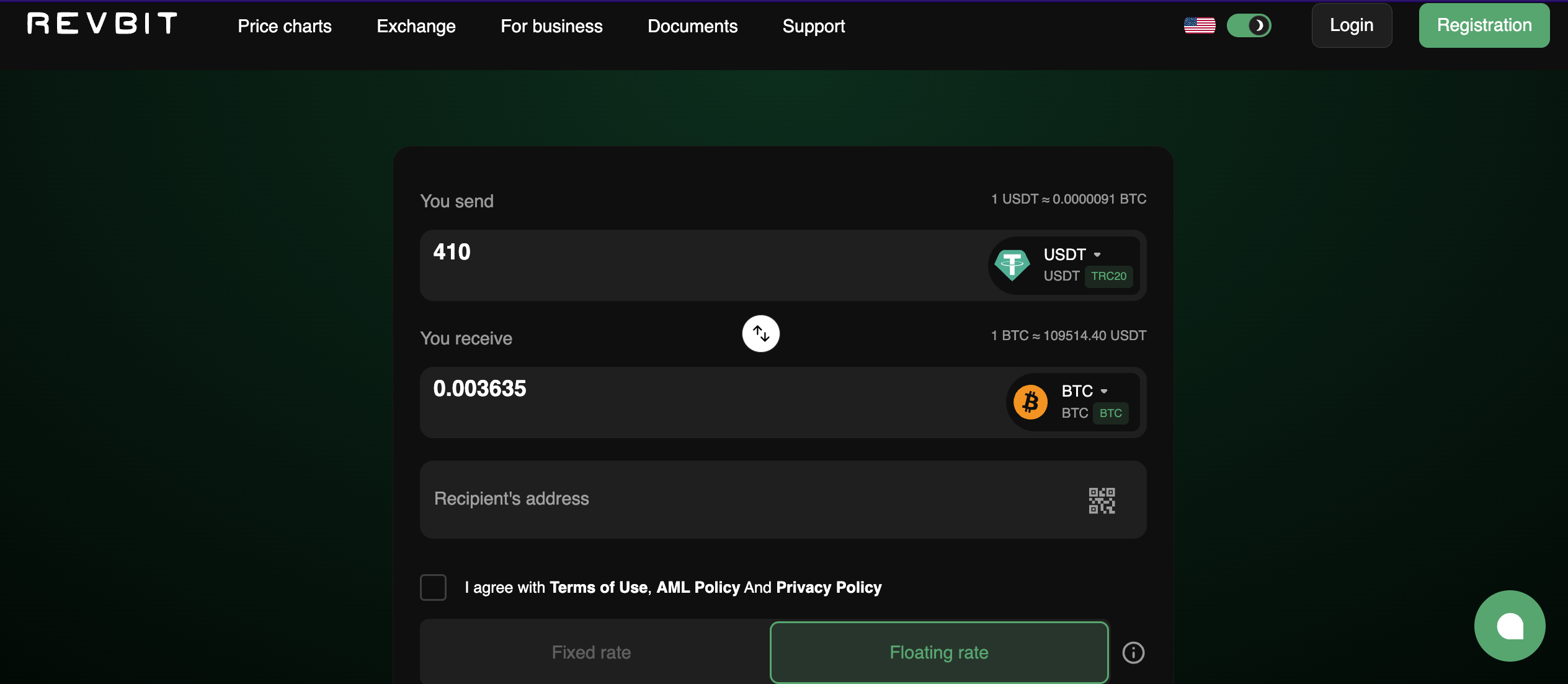

Revbit presents instant crypto swaps with floating/fixed rates, AML policy disclosures, and a simple “send → swap → receive” flow. Just enter a destination address, pick networks, and track status in real time; though AML checks may be triggered for high-risk flows.

Step 3: Set Up a Crypto Wallet

For EVM chains (ETH, Base, BNB Chain), MetaMask is a common self-custody option. Learn how Secret Recovery Phrases work and how to back them up securely—never share them; anyone with the phrase controls your funds.

For Solana memecoins, Phantom is a popular multichain wallet with official downloads on the web, App Store, and Google Play—always install from the official source.

Security hygiene (even for small bets):

- Store the recovery phrase offline; never in screenshots or cloud notes.

- Enable strong passwords and 2FA on any related exchange accounts; Coinbase’s security tips are a good baseline.

- Consider a hardware wallet for larger holdings and review best practices before connecting.

Step 4: Fund Your Wallet or Exchange Account

- On a CEX: Deposit fiat (bank transfer/card) or transfer crypto in, then buy your target pair. CEX guides typically note KYC/AML steps and settlement times.

- On a swap service (e.g., Revbit): You’ll send a source coin and provide the destination address for the memecoin’s network. Double-check networks (ERC-20 vs. Solana SPL vs. Base) before sending; the platform’s order page will show the required network and address format.

Regulatory note: many jurisdictions expect VASPs to collect certain sender/receiver details for larger or risk-flagged transfers under the FATF Travel Rule. If a platform asks for extra info in those cases, it’s usually part of compliance.

Step 5: Execute the Purchase

On a CEX (order-book flow):

- Find the trading pair (e.g., ETH/USDT).

- Choose limit (price control) or market (speed).

- Size prudently—small orders often fill with lower slippage on thin pairs.

- Withdraw to your self-custody wallet once settled.

On another instant swap service:

- Select pair (e.g., USDT → your memecoin), choose floating or fixed quote.

- Paste the correct destination address (chain-specific).

- Send the exact amount to the one-time deposit address; watch the live order status until “sent out/complete.”

Cross-check: if your wallet supports token detection, ensure the correct contract address is added (avoid fake look-alikes). Track first with a small test—it’s the cheapest risk control you have.

Step 6: Secure and Manage Your Memecoins

- Self-custody basics: Keep the seed phrase offline; consider a hardware wallet for long-term storage. Review wallet-security guides (e.g., Coinbase Learn) for revoking dapp approvals and avoiding public Wi-Fi.

- Label and monitor. Use portfolio trackers or the wallet’s activity tab; label inbound transactions so you can reconcile later.

- Plan exits. For microcaps, liquidity can vanish. Pre-plan partial take-profits and keep a stablecoin buffer for fees.

Risks and Precautions

- Rug pulls and liquidity traps. Read our guide on How to Avoid Common Mistakes When Trading Crypto. Treat it as required reading before any meme-coin buy.

- Volatility & slippage. Even “popular memecoins 2025” can swing double digits in minutes. Use limit orders on CEXs; on swaps, expect price movement between deposit and execution (especially with floating quotes).

- Regulatory & compliance. Expect KYC/Travel-Rule checks at regulated VASPs; unfamiliar platforms that never ask for anything deserve extra scrutiny.

- Platform risk. For newer services, review terms, AML policy, and independent feedback first. Limited third-party reviews mean you should size tiny and scale only after several clean test swaps.

- Impersonation & phishing. Always type official URLs, verify contract addresses via CoinGecko/CoinMarketCap pages, and beware of “support” DMs.

Conclusion

Buying memecoins in 2025 isn’t guesswork—it’s a checklist. Start with neutral data (CoinGecko/CoinMarketCap), read independent coverage to frame the narrative, and pressure-test each token with on-chain basics and rug-pull red flags. Choose the right venue for your needs: a compliant CEX if you want fiat rails and deeper books, or a quick wallet-to-wallet swap service (like Revbit) if you’re simply rotating crypto to a new memecoin—beginning with a small test and careful network checks. Lock down your wallet security (MetaMask/Phantom best practices, 2FA, seed-phrase hygiene) and size positions for volatility. Do that consistently, and your memecoin market analysis 2025 translates into action—without leaving your risk management behind.