Crypto trading pulls in crowds with dreams of quick wins, but slips along the way can turn hopes sour fast. As 2025 chugs on, with Bitcoin holding ground after its halving and Ethereum ramping up from tech boosts, new players flood in chasing highs. Yet common mistakes in crypto trading wipe accounts quicker than rallies build them. This piece spotlights frequent flubs and how to steer clear, drawing from trader tales and fresh data where hacks and hype cost billions last year. From emotional slips to skimping on safety, we’ll cover traps and fixes to keep your stack growing steady. Whether fresh to the game or brushing up, sidestepping these boosts odds in this wild ride.

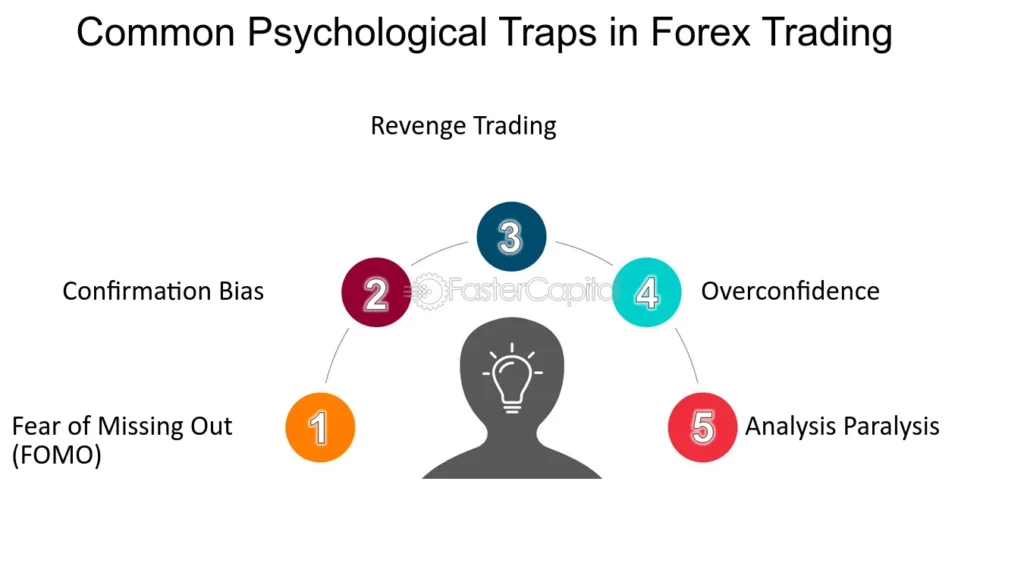

Emotional Traps That Trip Traders

Emotions run hot in crypto, leading to rash calls that burn cash. Common trading mistakes new crypto investors make include chasing peaks out of fear of missing out — FOMO pushes buys at tops, only for crashes to follow. Panic sells during dips lock losses, missing rebounds. In 2025, data shows 70% of retail trades stem from gut feels, netting averages 20% below planned plays.

To duck this, set rules upfront — stick to plans, ignore noise. Journal trades to spot patterns, like buying on hype. Use stops to auto-exit at set points, cutting impulse. Crypto trading tips and common mistakes often highlight mindfulness — step back during vols, trade only calm. Pros swear by this, turning feelings into foes beat by discipline.

Skipping Homework and Plans

Jumping in blind ranks high among common mistakes in cryptocurrency trading. Newbies skip research, buying on tips without checking projects or charts. What are the most common mistakes beginners make in crypto trading? Ignoring whitepapers or tokenomics leads to rug pulls or dead coins.

Fix by DYOR — dig roadmaps, teams, and communities. Set goals: Short flips or long holds? Build plans with entry/exit points based on analysis. In 2025, tools like CoinMarketCap dish fundamentals fast. Backtest ideas on historical charts to vet. This groundwork turns guesses into calculated bets, slashing regrets.

Overlooking Risk Controls

Skimping on safeguards sinks ships quick. Common crypto trading mistakes include overleveraging — borrowing to amp positions, only for small dips to wipe margins. Not diversifying spreads bets thin, one crash tanks all.

Counter with 1% rules — risk no more than that per trade. Diversify across coins and types — mix BTC holds with alt plays. Use stops and takes for auto locks. Position size right: Small on high-risk, bigger on solids. In 2025, apps like TradingView simulate risks, helping set smart limits. What are some common mistakes beginners make in crypto trading? Forgetting these leaves you exposed — risk management keeps you in longer.

Falling for Scams and Security Lapses

Crypto’s wild west draws crooks, and lax guards invite trouble. Common cryptocurrency trading mistakes beginners make include clicking phishing links or using weak passwords, leading to drained wallets. Fake apps or giveaways snag keys too.

Bolster with hardware wallets like Ledger for offline keys. Enable 2FA everywhere, prefer app over SMS. Vet sites — check URLs, avoid unsolicited offers. In 2025, AI scanners on exchanges flag sus moves. Backup seeds on metal, never digital. Crypto trading mistakes to avoid also cover sharing info — keep private keys solo. These steps shield from the bulk of breaches.

Chasing Hype and Overtrading

Hype clouds judgment, pushing buys on buzz without base. Common mistakes crypto day trading include FOMO on memecoins, only for pumps to dump. Overtrading — too many moves — racks fees and stress, eroding edges.

Steer clear by sticking to researched picks, ignore social noise. Set trade caps — say 3-5 weekly — to curb excess. Focus quality over quantity. In 2025, sentiment tools on LunarCrush gauge hype vs reality. Easy fix: Wait 24 hours before acting on tips, letting impulse fade.

Ignoring Fees and Taxes

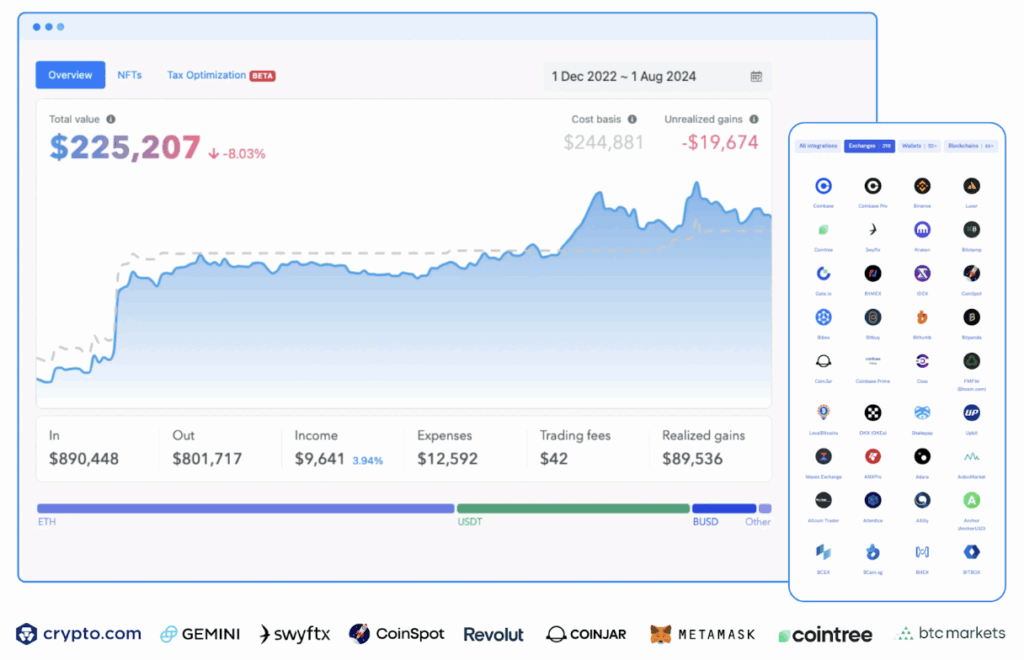

Costs sneak up, turning wins slim. Common mistakes in crypto trading cover overlooking exchange fees (0.1-0.5%) or gas on chains like Ethereum, eating 5-10% on small trades. Taxes blindside too — gains count as income in most spots, with fines for misses.

Track with apps like Koinly, logging all for reports. Pick low-fee platforms — Bybit for futures, Uniswap for DeFi. Batch trades to cut hits. In 2025, tax rules tighten under MiCA, so stay compliant. How to avoid common trading mistakes as a new crypto investor? Factor these in plans — net after costs counts.

Table of Common Slips and Fixes

This chart rounds up frequent flubs with quick counters for 2025.

| Mistake | Why It Hurts | How to Fix | Impact Cut |

| Emotional Trades | Rash buys/sells lock losses | Set rules, use stops | 30-50% better returns |

| No Research | Bad picks lead to rugs | DYOR, check fundamentals | Avoid 70% duds |

| Overleverage | Small dips wipe margins | 1% risk rule | Cap losses to 2% |

| Weak Security | Hacks drain wallets | Hardware, 2FA | Block 90% breaches |

| Hype Chases | Buy tops, sell bottoms | Wait, analyze | 20% edge gains |

| Overtrading | Fees eat profits | Trade limits | Save 10-15% costs |

| Ignore Taxes | Fines pile up | Track apps | Compliance peace |

| No Diversification | One crash tanks all | Spread assets | Balance 40% risks |

| Poor Timing | Miss entries/exits | Backtest patterns | 15% timing boost |

| Greed Over Plan | Hold too long | Take profits | Lock 25% wins |

Data shows fixing these lifts averages 40%.

Wrapping Up Avoidance Tactics

Crypto trading mistakes abound, but dodging them turns losses to lessons for lasting wins. From emotional slips that push rash calls to skimping on research leading to duds, awareness is your shield. Common mistakes in crypto trading like overleveraging or ignoring fees compound quick in this volatile arena, but rules and tools flip the script. For newbies, start simple — build plans, risk small, learn from each trade. Pros refine with data, staying ahead of 2025’s twists like regs and AI plays. Remember, the game rewards patience over greed; blend strategies, track progress, and adjust as markets shift. In the end, avoiding these pitfalls not only saves cash but builds skills for sustainable success in crypto’s endless ride.