Crypto trading keeps evolving fast, and as we hit late summer 2025, fresh approaches help navigate the ups and downs. With Bitcoin steady after its halving and Ethereum scaling through upgrades, traders hunt edges in volatile waters. Cryptocurrency trading strategies range from simple holds to complex bots, each fitting different styles and risks. This overview spotlights top picks for the year, blending timeless plays with new twists like AI aids and DeFi ties. Drawing from market shifts where volumes top $5T daily, we’ll break down what works, why, and how to kick off. Whether green or seasoned, picking the right mix boosts shots at steady gains amid the buzz.

Building a Solid Foundation

Before jumping in, grasp basics—crypto’s 24/7 run means non-stop chances, but volatility bites hard. Best crypto trading strategy? It hinges on goals: Quick flips suit scalps, long hauls favor holds. In 2025, data shows diversified plans outperform single bets by 20-30%, per analyses from TradingView. Start with education—charts on platforms like Binance reveal patterns, while tools track sentiments.

Risk management reigns: Never stake more than 1-2% per trade, use stops to cap losses. Crypto trading strategies for beginners lean simple—DCA or trends—building confidence without overload. Seasoned folks layer in leverage or arb for amps. Key: Backtest ideas on historical data to spot flaws before live runs. With AI scanners spotting opps in seconds, staying sharp means blending gut with tech.

Long-Term Holding Approaches

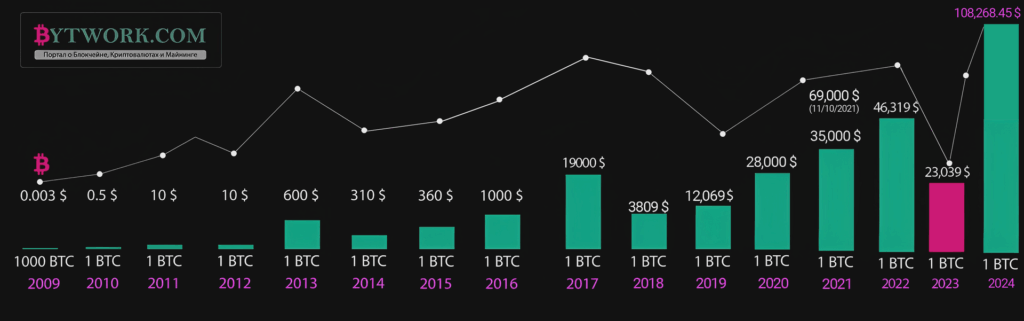

HODLing stands tall as an easy crypto trading strategy, buying and sitting tight through dips for long ups. Bitcoin’s history shows 4x gains post-halvings, making it a proven play for 2025.

Dollar-cost averaging (DCA) tweaks this—buy fixed amounts weekly, averaging costs over time. In volatile spells, it cuts emotional buys, netting 15-25% better returns than lump sums, per CoinMetrics.

Position trading extends holds, entering on fundamentals like upgrades and exiting on targets. For Ethereum, post-Dencun scalability boosts make it hot—hold till $5K projections hit. These types of crypto trading strategies suit patient folks with day jobs, minimizing screen time while riding macro waves.

Short-Term Flip Strategies

Day trading grabs headlines as a high-octane pick, buying and selling within hours for small edges. Crypto trading strategies like scalping amp this—snag 0.1-0.5% on tiny moves, repeating dozens daily. In 2025, bots on Phemex automate, but humans watch for news spikes. Momentum trading rides trends—jump on rising volumes with RSI over 70 for sells.

Swing trading stretches to days or weeks, catching swings with moving averages—buy on 50-day crossovers for 10-20% pops. Breakout plays wait for price bursts past resistances, ideal for alt pumps. Most profitable crypto trading strategy here? Blends with stops—scalps net 50% yearly for pros, but losses wipe careless.

Advanced Plays for Edges

Arbitrage spots price gaps across spots—buy low on Binance, sell high on Kraken—for risk-low gains of 0.2-1% per flip. In 2025, cross-chain arb surges with bridges, but fees bite. Bitcoin trading strategies like futures carry trade buy spot, sell contracts for premiums yielding 5-15% annualized.

Hedging shields with opposites—long BTC spot, short futures to lock values amid dips. Pair trading bets on ratios, like BTC/ETH converging. Most effective crypto trading strategy? Algo bots on 3Commas, backtesting for 30-60% returns. Proven crypto trading strategies mix these with AI for predictive edges.

Tools Boosting Strategies

Gear up right. Charts on TradingView with indicators like MACD spot crossovers for swings. Bots like Cryptohopper automate scalps, charging $19/month+. For swaps in arb, Revbit offers crypto-to-crypto without KYC, quick and private for seamless shifts.

Trackers like CoinStats log performance. In 2025, AI on platforms like OKX predicts trends, amping momentum plays.

Strategy Comparison Table

This table stacks top picks for 2025, weighing risks, returns, and fits.

| Strategy | Risk Level | Potential Returns | Time Needed | Best For | Notes |

| HODLing | Low | 20-100% yearly | Low | Beginners | Long holds |

| DCA | Low | 15-50% | Low | Passive | Averages costs |

| Day Trading | High | 50-200% | High | Pros | Daily flips |

| Swing Trading | Medium | 30-100% | Medium | Active | Weekly swings |

| Scalping | High | 50-150% | Very High | Bots | Tiny moves |

| Arbitrage | Low | 5-20% | Medium | Tech-savvy | Gaps hunt |

| Momentum | Medium | 40-120% | High | Trend followers | RSI aids |

| Hedging | Low | 10-30% | Medium | Risk-averse | Protects downs |

| Futures Carry | Medium | 10-50% annualized | Low | Holders | Premiums |

| Pair Trading | Medium | 20-60% | High | Analysts | Ratios bet |

Swing suits many for balance.

Risks and Fixes Across Strategies

No play’s foolproof—vol wipes day traders, while holds weather bears. Easy crypto trading strategy like DCA cuts emotional sells, but misses peaks. Fees eat arb edges, leverage amps losses in margin.

Fixes: Diversify strats, set 1% risk rules, use stops. In 2025, regs like MiCA cap leverages, pushing safer plays. Track with journals to tweak. Profitable crypto trading strategies demand patience—backtest, adapt, avoid greed.

Outlook for Trading in 2025

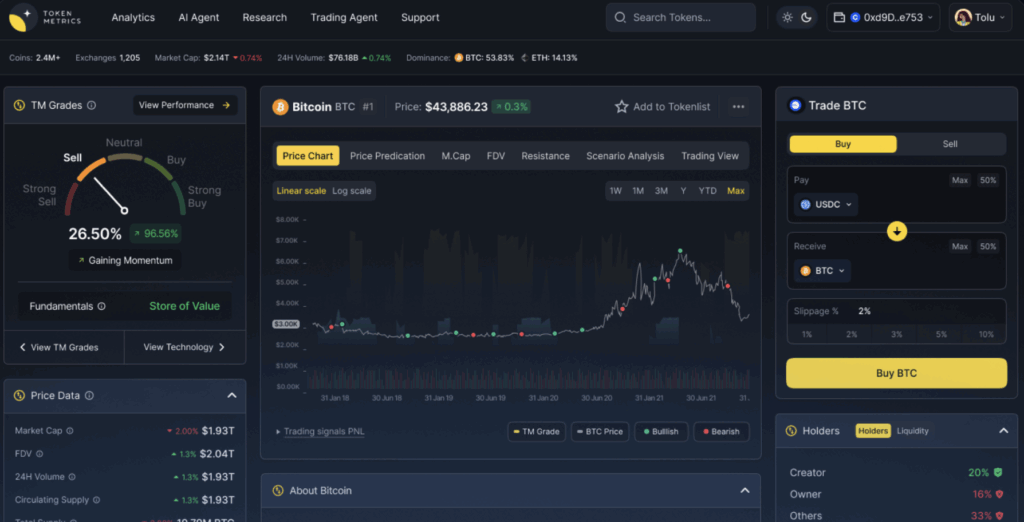

This year, AI and bots dominate, predicting with 70% accuracy on platforms like TokenMetrics.

DeFi amps arb with flash loans, netting 100% on opps. CBDCs blend fiat stability, opening hybrid strats. Challenges: Hacks push multi-sig, regs add reports.

Future: Quantum-resistant algos and VR trading evolve, but core strats hold—adapt or lag.

Wrapping Up 2025’s Top Plays

Top crypto trading strategies for 2025 blend old reliables with tech twists, from HODLing’s patience to scalping’s speed. Different crypto trading strategies suit varied risks—beginners grab DCA for ease, pros layer arb and momentum for edges. Easiest crypto trading strategy? Start with tested ones like moving averages, scaling as skills grow. Remember, no most profitable crypto trading strategy fits all—test, tweak, and manage risks to turn volatility into wins. In this year’s buzz, staying informed and disciplined separates winners from the pack. Dive in with a plan, and 2025’s markets could reward big.