Margin trading crypto opens doors to bigger plays in the volatile world of digital assets, letting folks amp up their bets with borrowed cash. As we hit the middle of 2025, with Bitcoin steady after its halving and altcoins riding waves from fresh upgrades, more newcomers eye this approach for potential quick wins. But it’s no walk in the park — margin trading cryptocurrency amps risks alongside rewards, demanding sharp know-how to avoid wipeouts. What is margin trading crypto? At its core, it’s using leverage from exchanges to trade more than your own stash holds, multiplying gains or losses. This beginner rundown covers basics, workings, spots to jump in, and safe plays, pulling from 2025 trends where platforms like Binance and Bybit see billions in leveraged volume. Whether dipping toes or scaling up, grasping this helps navigate without sinking.

Basics Behind Margin Trading

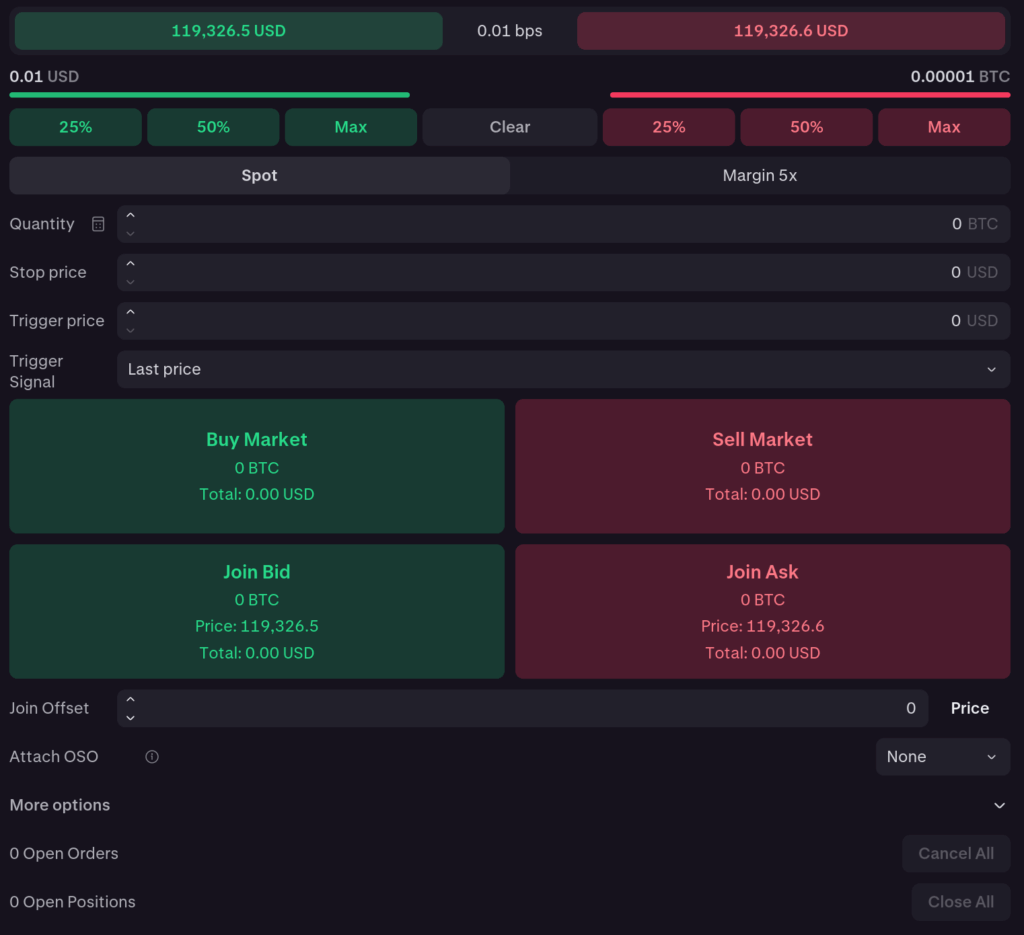

Margin trading crypto lets you borrow funds to boost position sizes, aiming for higher returns on price moves. Say you spot Bitcoin climbing — you put down $1,000 as margin for a $5,000 trade at 5x leverage. If it rises 10%, your profit hits $500 minus fees, far above a straight buy. Exchanges loan the extra, charging interest, and demand collateral to cover dips.

How does crypto margin trading work? You open an account, deposit margin, pick leverage (2x to 100x on some spots), and trade long (bet up) or short (bet down). Platforms track ratios — if your position slips too far, they liquidate to recoup loans. In 2025, regs tighten in places like the US, capping leverage on spots like Coinbase to cut wild swings, while offshore sites offer higher multiples. It’s not gambling — smart use ties to analysis, but beginners often overlook fees eating small edges.

Picking Platforms for Margin Trades

Where to margin trade crypto? Choices abound, but pick based on fees, leverage, and safety. Binance leads with up to 125x on futures, user-friendly for starters. Bybit draws with zero-fee spots and high limits, while Kraken suits regulated plays in the US. Phemex offers demo modes for practice.

This table compares top picks for 2025 beginners, focusing on key bits.

| Platform | Max Leverage | Fees (Maker/Taker) | Verification | Notes |

| Binance | 125x | 0.02%/0.04% | KYC required | Huge volume, app ease |

| Bybit | 100x | 0.01%/0.06% | Optional for basics | Demo accounts, bonuses |

| Kraken | 5x | 0.02%/0.05% | Full ID | US-friendly, secure |

| Coinbase | 3x | 0.5% flat | Strict KYC | Beginner tools, insured |

| Phemex | 100x | 0.01%/0.06% | Low for starts | Practice mode, fast |

| OKX | 100x | Tiered low | Variable | Futures focus |

| BitMEX | 100x | 0.02%/0.075% | No KYC | Veteran spot, high risk |

Binance tops for variety, but check local laws — some ban high leverage.

Steps to Kick Off Margin Trading

Crypto margin trading guide starts simple, but builds slowly to learn ropes. Here’s a step list for beginners.

- Sign up on a platform: Choose like Bybit, verify basics.

- Fund your margin account: Deposit crypto or fiat, transfer to margin wallet.

- Pick a pair: Start with BTC/USDT for liquidity.

- Set leverage: Beginners stick 2-5x to limit blows.

- Open position: Go long or short, set stops for protection.

- Monitor closely: Watch ratios, add margin if near liquidation.

- Close and settle: Exit when targets hit, pay back borrows.

Practice on demos first — Phemex lets you test without real cash. How to margin trade crypto safely? Set strict stops, never risk more than 1-2% per trade.

Grasping Risks and Management

Margin amps wins but cranks losses — a 10% drop at 10x wipes your margin. Liquidation hits when equity dips below thresholds, forcing sales at loss. Fees add up: Interest on borrows (0.01-0.1% daily) and trading cuts. Volatility in crypto makes this dicey — 2025’s halving swings showed quick wipes.

Manage by sizing small, using stops, and diversifying. Tools like calculators on Kraken help gauge risks. For swaps between positions, Revbit offers crypto-to-crypto without KYC, keeping moves quick and private.

Strategies for Newcomers

Margin trade crypto with plans to stay afloat. Trend following rides momentum with leverage, but set trails. Scalping grabs tiny moves often, suiting high multiples but demanding time. Arbitrage plays spreads across spots, low risk but needs speed.

In 2025, bots on 3Commas automate, but learn manual first. Mix long/shorts for hedges. Key: Backtest ideas on historical data before live.

Tax and Rule Angles

Taxes bite margin trades — gains count as income in many spots, losses offset. US folks report to the IRS, with platforms like Coinbase sending forms. Regs vary: EU caps leverage at 2x, US at 3-5x on licensed sites. Offshore like BitMEX offer more but risk bans.

Track with apps like Koinly for compliance. In shifting 2025 rules, stay updated via SEC or ESMA news.

Closing Thoughts on Margin in 2025

This year, AI aids platforms spot risks, auto-adjusting leverages. DeFi margin on Uniswap grows, decentralized but gassy. ETF inflows boost liquidity, easing entries. Watch for CBDC ties, blending fiat stability with crypto leverage.

Challenges: Hacks prompt tighter KYC, but privacy tools rise. Margin trading crypto suits bold beginners ready for homework, offering leverage in buzzing markets. From grasping how crypto margin trading works to picking spots and managing hits, this path demands caution. Start tiny, learn from slips, and scale smart — 2025’s tools make it reachable, but discipline seals success.