If you’ve watched crypto long enough, you know Tron (TRX) evokes strong opinions. Bulls point to relentless network usage and stablecoin volume; skeptics point to regulatory overhang and centralization concerns. Below is a balanced, source-backed guide that puts TRX price, utility and risk into context—and compiles what trustworthy sources are predicting for the future TRX price.

Tron in one minute: why people care

Tron has quietly become the go-to settlement rail for stablecoins—especially USDT—thanks to low fees and fast finality. Multiple market reports tracked how USDT circulating on Tron overtook Ethereum’s share in 2025, reinforcing Tron’s role as a payments/transfer chain rather than a pure “DeFi summer” play. CoinDesk’s markets desk covered TRX strength as Tron overtook Ethereum in USDT circulation in May 2025, a fundamental tailwind for on-chain activity.

CoinDesk Research’s Tron primer also highlights scale metrics—hundreds of millions of accounts and billions of transactions—underscoring why traders discuss the Tron price outlook separately from “blue-chip” smart-contract platforms.

For corroboration from the source, Tether’s transparency portal tracks USDT issuance by network; this page is the reference many analysts use when they say “most USDT runs on Tron” at any given moment.

TRX historical backdrop

Source: Coinmarketcap

Through 2024–2025, TRX ground higher in a series of ranges rather than surging in classic boom-bust waves. For example, CoinDesk’s May 2025 technical note flagged a tight $0.271–$0.278 range as macro jitters capped breakouts—a good snapshot of TRX’s tendency to consolidate between incremental advances. That “step-ladder” profile often keeps volatility lower than meme-driven coins but can frustrate thrill-seekers.

Takeaway for analysis: when usage grows because of stablecoin settlement, price can appreciate more slowly than in speculative manias, but the floor can also prove stickier—until a regulatory shock or risk-off event hits.

Fundamentals that actually move TRX

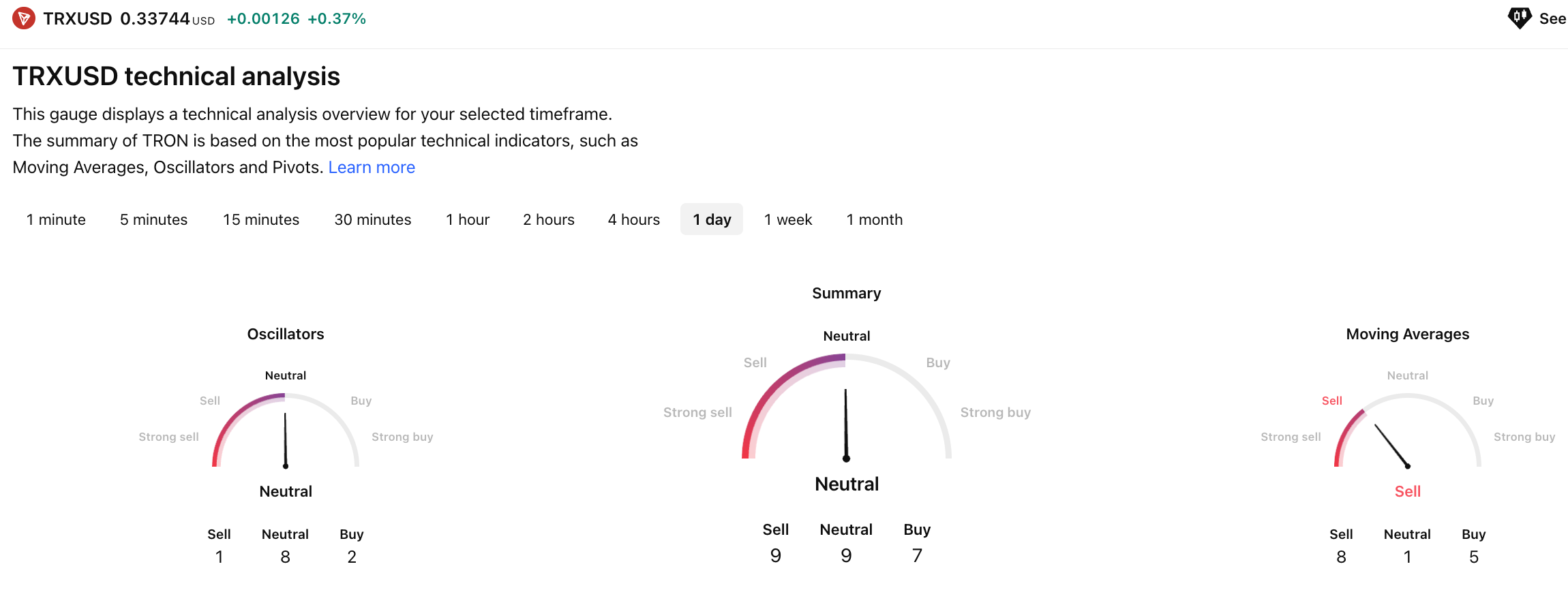

Source: TradingView

- Stablecoin gravity: Tron’s largest demand driver is USDT settlement. More value moving over Tron’s rails generally lifts network fees (burns) and Tron wallets’ demand for TRX to pay those fees, anchoring the TRX investment prediction story in real-world transfers rather than purely narrative hype. CoinDesk reporting confirmed USDT on Tron’s dominance through 2025.

- Broad, persistent usage: CoinDesk Research notes >320M accounts and double-digit billions in cumulative transactions—evidence of sticky utility versus fleeting trends. That’s supportive for any TRX long term forecast that assumes network effects sustain.

- Regulatory noise (real risk): The U.S. SEC’s civil case against Tron founder Justin Sun moved toward a possible resolution in early 2025, with both sides seeking a stay to explore outcomes. Until finalized, that cloud remains a key risk to the Tron price outlook because it can affect listings, liquidity, or sentiment.

Bull vs. bear cases

Bull case (why TRX could go up):

- Tron holds its USDT settlement crown, keeping daily active addresses and transaction counts high. More throughput → more fee demand → constructive future TRX price path.

- The SEC matter resolves cleanly, removing an overhang and opening doors for deeper institutional participation.

Bear case (why TRX could go down):

- A regulatory train-wreck or adverse ruling dents exchange support or investor appetite.

- Stablecoin migration: if large issuers shift flows to competing L1s/L2s or bank-grade rails, Tron’s usage—and the TRX price outlook—could normalize lower. Tether’s transparency page is the dashboard to watch for chain-by-chain shifts.

Year-by-year cheat sheet (2025–2030)

These are not our predictions—they’re a curated range from credible/public models and outlets.

- TRX price prediction 2025: $0.34–$0.45 (CoinCodex model near the low; 99Bitcoins toward the high).

- TRX price prediction 2026: Models generally climb gradually in base cases; CoinCodex shows a higher band vs. 2025, consistent with cyclical recovery assumptions.

- TRX price prediction 2027–2028: Path depends on whether stablecoin transfer share stays elevated and whether any U.S. policy clarity boosts risk assets broadly. (Use CoinDesk Research + model pages for context.)

- TRX price prediction 2029: Model dispersion widens; keep an eye on USDT share (Tether transparency) and macro liquidity.

- TRX price prediction 2030: $0.66–$1.30 blended from Forbes Advisor’s conservative average and higher ends from data models/education sites.

How to think about Tron like an investor

Position sizing and thesis clarity: If you’re buying TRX for transfers or yield strategies, your thesis is about utility persistence; you’re essentially betting stablecoin velocity stays on Tron. If you’re buying for appreciation alone, you need a catalyst—e.g., resolution of regulatory risk or a new application wave—to push the TRX price beyond slow-grind mode.

Metrics to monitor:

- USDT on Tron (chain share and total float). Tether’s dashboard is your first stop.

- Active addresses & transactions (CoinDesk Research for longitudinal context).

- Legal updates around the SEC matter (Reuters for status-checked reporting).

Risks you shouldn’t gloss over

- Regulatory/issuer concentration: A large chunk of Tron activity is tied to a single stablecoin issuer. Any change in Tether’s policies or distribution patterns can affect the TRX investment prediction calculus. Watch Tether’s official transparency updates.

- Headline risk: Even without direct token mechanics changes, negative news around founders or ecosystem partners can hit sentiment quickly (see the SEC case context).

- Cycle sensitivity: Like most crypto, TRX is beholden to global liquidity. CoinDesk’s own market notes show how macro risk can pin assets in ranges even when on-chain usage looks strong.

So, is Tron a good investment?

Tron is one of the clearest, most battle-tested ways to express that view today. The network’s throughput and USDT gravity are real and well-documented, which supports a constructive TRX price outlook so long as those conditions hold.

If your definition is outsized upside with minimal headline risk, TRX may not fit. The SEC cloud hasn’t fully vanished, and Tron’s role as a payments rail can cap euphoric spikes compared with narrative-heavy L1s. On the numbers, credible 2025 targets cluster around $0.34–$0.45, and 2030 ranges sit near $0.66–$1.30, with the spread reflecting policy/market uncertainty. Use those guideposts to frame scenarios, not promises.

Final thought: If you do buy TRX, consider building a position over time (dollar-cost averaging), size it modestly, and keep a dashboard of the three metrics above. That’s how you turn a TRX long term forecast into a process you can actually manage—without losing sleep.

Not financial advice. Crypto is volatile—only invest what you can afford to lose.