If you follow memecoins, you know Shiba Inu (SHIB) can swing hard on hype—and on real fundamentals. Since launching in 2020, SHIB has built an ecosystem (Shibarium L2, ShibaSwap, NFTs) and a massive “ShibArmy.” Below is a clear, source-based guide to the SHIB price predictions into 2025-2030: what drives it, what trusted forecasters actually predict, and where the biggest risks sit.

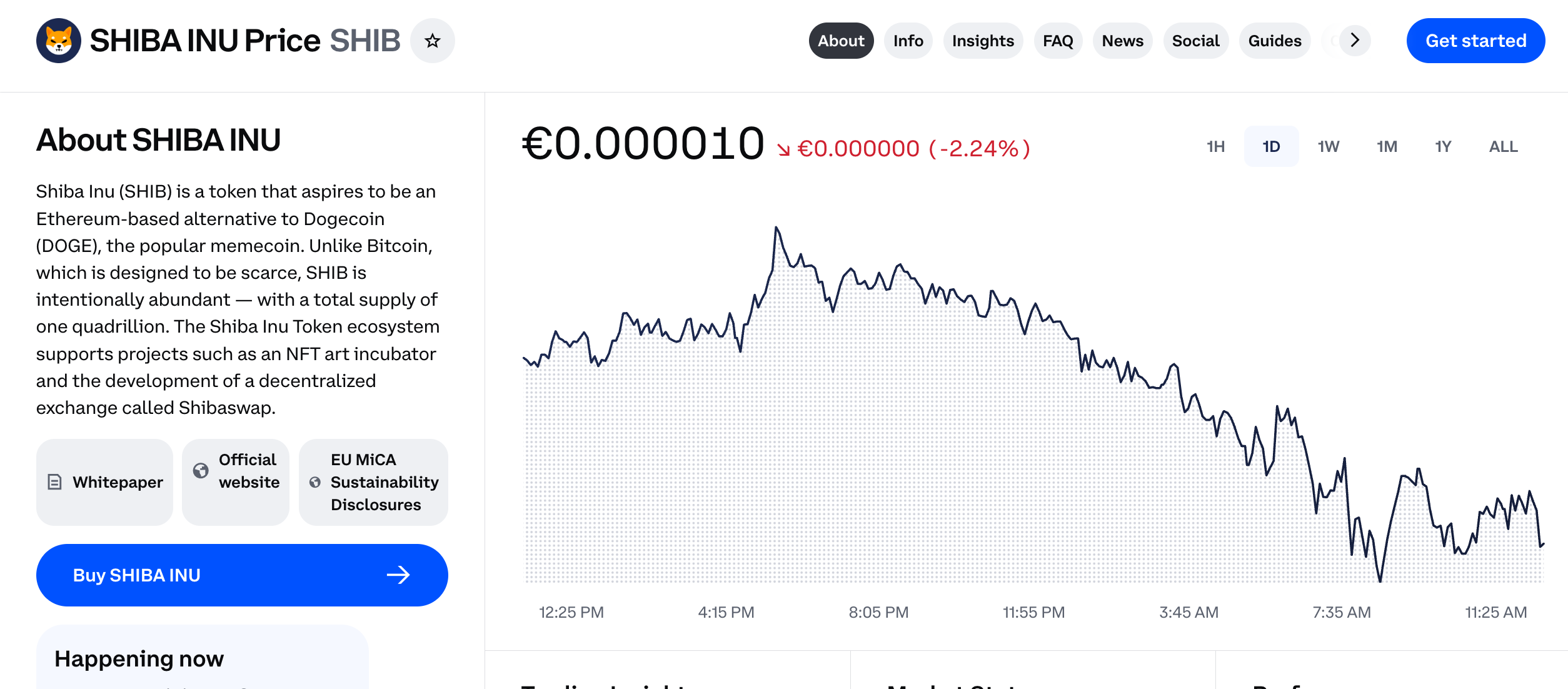

SHIB Market Snapshot

Source: Coinbase

- Token & supply. SHIB debuted in 2020 with a headline supply of 1 quadrillion tokens. Large burns and token allocations over time mean the current circulating supply is on the order of ~589 trillion, per Coinbase’s live asset page.

- Network utility. SHIB lives on Ethereum, but its ecosystem runs a dedicated Layer-2 called Shibarium—an EVM-compatible chain designed for low-fee, fast transactions (gas token: BONE). The official docs position Shibarium as a scaling rail for payments, creator apps, and dApps.

- Burn mechanics. In 2024 the project detailed a fee-to-burn mechanism on Shibarium that routes a portion of base fees to buy and burn SHIB—supportive of the long-term SHIB price outlook if on-chain activity grows.

- Recent market tone. 2025 hasn’t been quiet: CoinDesk flagged a flash-loan attack on Shibarium in mid-September with ~$2.4M losses (sentiment hit), and, days later, noted a range breakdown in SHIB with heavy volume. This is your reminder that risk remains high, even with strong community backing.

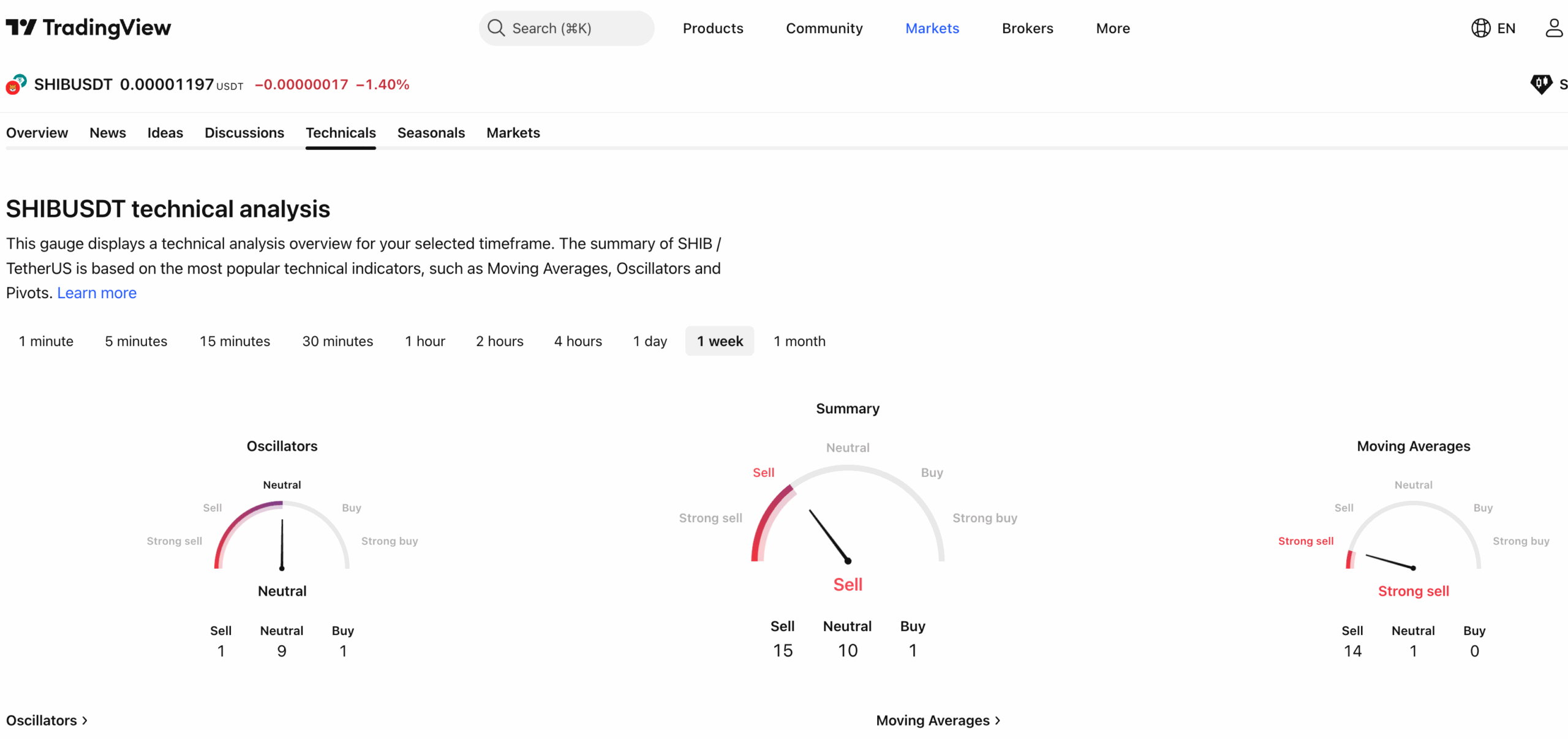

What Moves SHIB

Source: TradingView

- Burns + activity: If Shibarium usage rises, more base fees get converted and burned, reducing effective supply over time. Burns don’t guarantee gains—but they help counter dilution as network activity scales.

- Ecosystem delivery: Upgrades, builder tools, and integrations on Shibarium (docs, deploy guides, and product pages are public) can attract developers and users, supporting a constructive SHIB price analysis.

- Liquidity and listings: SHIB trades widely, including on major U.S. venues tracked by Coinbase/CoinDesk—deep spot liquidity tends to compress spreads and improve price discovery.

- Macro + headlines: Crypto beta, regulatory signals, and security events (like the September incident) can overwhelm token-specific news in the short run.

What Credible Sources Predict for SHIB

Price targets vary—so we’ve focused on named media/research outlets with transparent methods or expert panels. Treat numbers as scenarios, not promises.

- Finder expert panel (26 specialists):

- SHIB price prediction 2025: $0.0000399 (panel average).

- SHIB price prediction 2030: $0.0001971 (panel average, “one zero erased” case).

Finder runs recurring surveys and publishes the methodology and names of panelists.

- Forbes Advisor (regional editions):

- Forbes Advisor India cited an optimistic 2024–2025 range of $0.0001–$0.0003 (high-beta scenario, conditional on favorable markets).

- Forbes Advisor Australia discussed 2025’s drawdown and long-term potential, underscoring how volatile SHIB remains even if the multi-year thesis is positive.

Use these as upper-bound sentiment checks, not base cases.

- Benzinga (editorial model):

- 2030 range: $0.00001–$0.00005 (average $0.00002).

This frames a more conservative long-run path than the Finder panel.

- 2030 range: $0.00001–$0.00005 (average $0.00002).

- CoinCodex (algorithmic models):

- Near-to-midterm model projections (e.g., 2026) show incremental gains under neutral assumptions; longer-dated outputs vary with momentum inputs.

Use this to sense how purely technical models evolve with trend and volatility.

- Near-to-midterm model projections (e.g., 2026) show incremental gains under neutral assumptions; longer-dated outputs vary with momentum inputs.

Credible forecasts for 2025 cluster around $0.00003–$0.00004 (Finder’s average sits near the top of that band), while 2030 projections diverge sharply: Benzinga’s conservative band near $0.00001–$0.00005 versus Finder’s ambitious $0.0001971. If you average across these, a neutral investor might frame 2030 as somewhere in the low-five-zeroes (with very wide error bars).

SHIB Long-Term Forecast: Scenarios (2025–2030)

Bull case (why SHIB could go up):

- Shibarium adoption compounds (more apps, users, and payments), making the fee-to-burn loop material at scale.

- Security hardens post-incident; upgrade cadence improves trust.

- Broader crypto risk-on cycle lifts memecoins, with SHIB benefiting from deep liquidity and brand recognition.

Base case (grind with spikes):

- Activity/burns help offset issuance over time, but most returns come during cyclical risk-on periods.

- Forecasts like Finder’s 2025 $0.0000399 and Benzinga’s 2030 $0.00001–$0.00005 illustrate a steady but choppy path, punctuated by rallies around roadmap or macro catalysts.

Bear case (why SHIB could go down):

- More security shocks, or a long crypto risk-off, cap usage and shrink burn throughput.

- Builders and flows prioritize other L2s; memecoin rotation saps attention/liquidity.

- News-driven breakdowns like September’s range crack recur.

Risk Factors You Should Not Ignore

- Security/ops risk: Shibarium’s September exploit shows execution risk is real; treasuries and retail alike react quickly to security headlines.

- Forecast dispersion: Even among reputable outlets, 2030 ranges span 5–10×. This isn’t a bug—it’s how high-volatility assets behave under different macro and adoption paths.

- Supply optics: Despite burns, SHIB’s float remains enormous (hundreds of trillions). Any “one-cent” dreams require heroic math; stick to grounded bands from outlets that explain assumptions.

How to Use These Predictions

- Anchor to ranges, not single targets. For 2025, sensible ranges center on ~$0.00003–$0.00004 (Finder’s average $0.0000399). For 2030, balance Finder’s $0.0001971 optimism with Benzinga’s $0.00001–$0.00005 conservatism.

- Watch the right dashboards:

- Supply/burn & liquidity: Coinbase asset page; official Shibarium docs/blog for mechanism changes.

- Market tone: CoinDesk price page and news feed for breakout/breakdown context.

- Size positions for volatility. Memecoins can move double-digits in a day—set allocations you can live with through 50–70% drawdowns. (September’s newsflow is a live example.)

- Focus on execution signals: More shipped features, developer adoption, and post-mortem transparency after incidents generally correlate with healthier SHIB investment prediction odds over multi-year horizons.

Will SHIB Go Up or Down?

There’s a credible SHIB price outlook where usage on Shibarium grows, the burn stays active, and the next crypto up-cycle rewards liquid, brand-name memecoins. In that world, 2025 finishing around $0.00003–$0.00004 looks reasonable (Finder’s panel), and 2030 lands somewhere between Benzinga’s $0.00001–$0.00005 and Finder’s $0.0001971, depending on adoption and macro conditions. Just as plausibly, security or market shocks can derail momentum—2025’s headlines already reminded everyone of that.

If you choose to invest, treat SHIB as a high-volatility bet with asymmetric outcomes. Use ranges, not wishes; monitor supply, burn and security updates; and size positions so a bad week doesn’t ruin a good plan.