Litecoin is one of the oldest and most capitalized cryptocurrencies on the market, which is why many investors consider adding it to their portfolios. Investing in crypto is easier when you understand the specific coin’s potential. To figure out what to expect from LTC over the next five years, the Revbit editorial team has compiled the Litecoin price prediction 2025–2030.

Key features and use cases of litecoin

Litecoin was launched in October 2011 by developer Charlie Lee as an alternative to Bitcoin. He pointed out that BTC is not suitable for everyday payments for several reasons:

- high fees;

- the need to wait a long time for a transaction to be confirmed;

- high price and strong volatility that make it impossible to lock in a price at the moment of payment.

Litecoin became the answer to Bitcoin’s problems. Within the crypto community the coin is often called “digital silver,” by analogy with BTC — “digital gold.”

Today Litecoin is used both as a convenient cryptocurrency for payments and as an investment vehicle.

Interesting! Because Litecoin is one of the oldest coins, many community members believe Charlie Lee might actually be the creator of Bitcoin. The developer himself denies any connection with the true author of the first cryptocurrency, Satoshi Nakamoto.

Watch Litecoin price online on Revbit

Litecoin price performance: past to present

Like Bitcoin, the coin’s movements are cyclical due to halvings — a term that refers to cutting the mining speed in half, meaning the rate at which new tokens are released from the network.

Historical price trends

Any Litecoin price prediction is impossible without analyzing the coin’s previous behavior patterns, many of which trace back to halvings.

First, let’s look at exactly how halving the speed of minting new coins affects the price. Here is what you need to know:

- The coin’s supply is limited. A total of 84 million LTC will ever be mined. At the time of writing, miners have already extracted 76 million coins, and every four years the release of new tokens will slow down.

- As market participants’ interest in the cryptocurrency grows, so does demand. Demand climbs while supply shrinks thanks to halvings, creating scarcity that pushes the price upward.

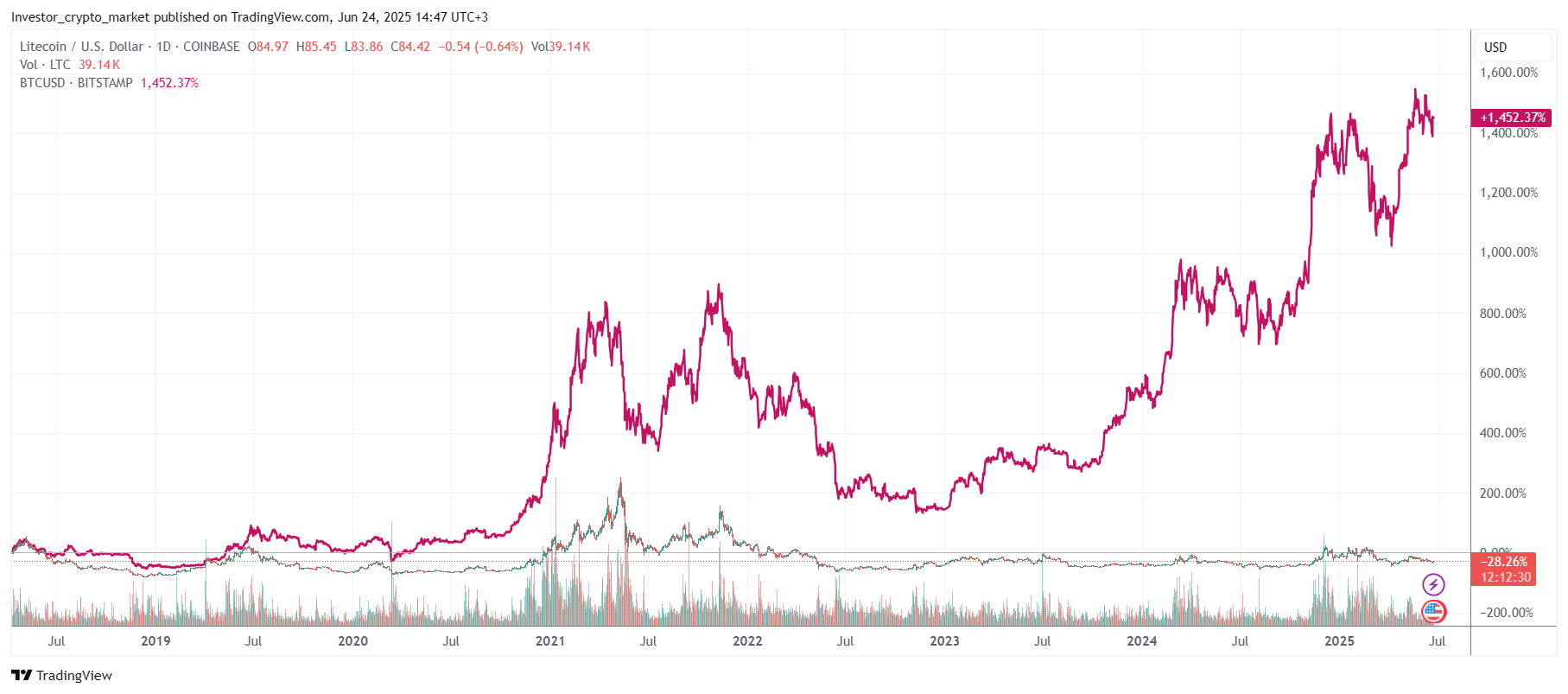

Unfortunately, standing in the path of “digital silver” is Bitcoin — the most capitalized cryptocurrency, whose movements set the tone for the entire market. BTC’s influence on LTC can be seen on the chart:

- Vertical green lines mark Litecoin halvings.

- Vertical orange lines mark Bitcoin halvings.

Notice that the coin starts rising not after its own halvings but after the flagship’s mining speed is cut in half.

Comparison of Litecoin’s reaction to its own halvings and Bitcoin halvings. Chart: TradingView

Sadly, LTC’s effectiveness as an investment instrument has dropped sharply. The chart below compares BTC and Litecoin price curves; note the pronounced lag of “digital silver” behind the flagship since 2023. This happens for several reasons:

- Competition. Since 2011 many other, far more technologically advanced coins have entered the market and captured part of the audience.

- Low efficiency. With the advent of stablecoins — tokens whose price is pegged to an asset with a stable rate, such as the US dollar — the need for highly volatile coins like Litecoin has decreased. Recall that the developer positioned his project specifically as a tool for everyday payments.

Comparison of LTC and Bitcoin performance. Source: TradingView

Interesting! Litecoin’s all-time high was set on 10 May 2021 at $412.96. Since then many top-cap cryptocurrencies have renewed their highs. LTC’s inability to climb to new peaks once again confirms waning market interest in the project.

As a result, the cryptocurrency has simply gotten lost among much stronger and more compelling competitors. It is also worth noting that LTC is technically similar to Bitcoin, but why invest in “digital silver” when you can buy “digital gold”?

Major milestones and market events

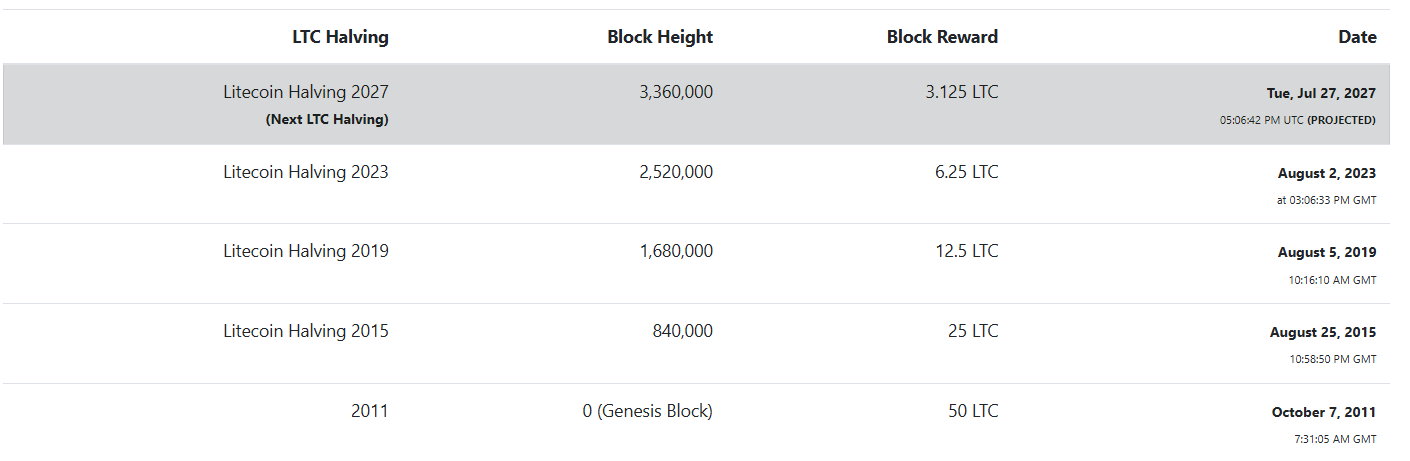

When compiling a Litecoin future price prediction one cannot ignore the upcoming 2027 halving. In theory, shrinking supply could support price growth. In practice, however, the coin reacts more to Bitcoin halvings. Since 2023 interest in the project has been fading, so there is only a small hope that slower mining will bring new highs.

Litecoin halving chart. Source: litecoinhalving

A small boost could also come from the launch of spot ETFs based on the coin in the United States — applications for trading are pending before the Securities and Exchange Commission (SEC). At the time of writing, the regulator is repeatedly postponing decisions, but approval is possible.

A similar product built on BTC quickly sparked institutional interest in the market leader. One can assume that the same could happen with a Litecoin-ETF.

How litecoin responded to market cycles

The answer to the question “will Litecoin go up in value” largely depends on market cycles. During a general bull run most coins appreciate, and “digital silver,” which remains in the top 30 by market cap, is no exception. However, remember that interest in the coin has fallen significantly, so even in bull phases you shouldn’t expect parabolic growth.

Key factors influencing litecoin future price

Before making any Litecoin prediction it is worth reviewing the key factors that drive the coin’s behavior.

Market sentiment

The mood of market participants is an important metric for forecasting crypto prices. For example, heightened community interest in an ETF based on the coin can temporarily support price growth.

Technological developments

Unfortunately, the Litecon team cannot boast of any landmark technical upgrades. Still, announcements are worth watching: if the developers decide to modernize the project, the initiative could temporarily draw attention to the cryptocurrency and lift its price.

Regulatory landscape

When preparing an LTC forecast you should also pay attention to regulators’ work on shaping a legal framework for digital assets. Notably, after crypto-friendly leadership arrived at the SEC the project was cleared of securities-law violations.

Today many countries — including the US — are moving toward crypto legalization, but Litecoin, unfortunately, often remains on the sidelines.

Expert analysis and LTC forecast for 2025–2030

Now let’s move on to the key question: how high can Litecoin go?

Price prediction for 2025

The LTC price prediction 2025 largely depends on Bitcoin’s behavior. Observations show that BTC’s post-halving growth cycle lasts about a year and a half. If history repeats, the cryptocurrency could set a cyclical high in autumn 2025.

For the gradually weakening LTC, assuming no positive news about an ETF, autumn 2025 may see the coin near its local high of roughly $140.

Price prediction for 2026

Unlike Bitcoin, Litecoin is not being scooped up by institutions, so hopes that the coin will avoid a crypto winter are slim. In 2026 further weakening of the already soft price is quite possible, down to the $40–50 range.

Price prediction for 2027

Litecoin potential in 2027 is driven by the halving. Experience shows that a couple of months before the event the coin usually gains value. There is reason to believe that even in a crypto winter investor will see a stronger price this time as well.

Given the coin’s overall weakness, it is plausible that on the eve of the halving it will again strive for its 2025 highs — around $140.

Price prediction for 2028

The Litecoin price forecast for 2028 must take into account Bitcoin’s upcoming halving. We have already found that the event helps support LTC’s price. If by that time ETFs on the cryptocurrency are available and in demand, a move toward $200 is conceivable.

Price prediction for 2029

Now to the LTC price prediction 2029. If a bull run resumes after Bitcoin’s 2028 halving, Litecoin will also receive a bullish impulse. The pace and range of growth will depend largely on the coin’s position. If interest keeps fading and ETFs fail to gain popularity, drifting around $200 is quite possible.

Price prediction for 2030

Making a Litecoin price prediction 2030 is impossible, as anything could happen over five years. This year will likely fall into the next crypto winter, and if that assumption is correct we should expect the price to decline from local highs.

Bullish and bearish scenarios

The LTC future price depends on too many variables, so any forecast should not be taken literally — it is only an attempt to look ahead using available information, observations, and experience.

Bullish scenario: Litecoin returns to its all-time high (unlikely at present).

Bearish scenario: the coin stagnates below $100.

Frequently asked questions

Does litecoin have a future?

A Litecoin forecast based on the project’s achievements suggests it is more likely facing stagnation.

How high can litecoin go?

The most optimistic scenario for the coming years envisions a return to the all-time high.

Can litecoin reach $1,000 or more?

Under 2025 conditions — hardly. Something extraordinary would have to happen for the old project to regain audience interest.

What’s the long-term outlook for LTC?

Most likely the project will stagnate; the market is crowded with competitors ready to take Litecoin’s share.

Follow the link to purchase some Litecoin.