Here’s today’s live snapshot of ETH:

Two structural changes shape the ETH price outlook right now:

- U.S. spot Ether ETFs went live in July 2024, giving mainstream investors a simple ticker to buy ETH exposure. That broadened access, much like spot Bitcoin ETFs did earlier.

- ETF flows now matter for ETH, not just Bitcoin. Through 2025, major outlets have tracked how these products can amplify uptrends and speed up pullbacks as flows ebb and surge.

Ethereum Historical Price Performance

Source: Coinmarketcap

Ethereum’s long-term chart has featured huge runs (2017, 2021, and 2024–2025) and deep drawdowns. What’s different since 2024 is who can buy dips: brokerage and retirement accounts can allocate via ETFs, potentially smoothing some volatility while still leaving crypto-style swings in play.

Technical Analysis of ETH

- Trend: Many traders watch ETH versus its 200-day moving average and the prior cycle’s highs as support/resistance.

- Momentum: RSI/MACD help spot overbought/oversold stretches, but macro and flows can overpower short-term signals.

- Levels: ETF news and big macro prints (inflation, rates) can create gaps and trend days. Treat TA as timing, not destiny.

Fundamental Factors Impacting Ethereum

Technology & Ecosystem

Two upgrades frame the ETH long-term forecast:

- The Merge (2022) moved ETH to proof-of-stake, enabling staking yield and changing issuance.

- Dencun (Mar 13, 2024) added EIP-4844 (proto-danksharding), introducing data “blobs” that cut costs on Layer-2s—aimed at cheaper, faster apps and higher network capacity over time. Cheaper L2 activity can be a tailwind for usage and fees.

Adoption & Partnerships

The spot Ether ETF launch in July 2024 was the adoption headline: institutions and advisors can now hold ETH exposure in familiar wrappers. That access helped fuel rallies when inflows were hot, and it can also weigh on price when redemptions pick up.

Market Sentiment

Macro liquidity (rate-cut hopes, growth worries) and ETF AUM/flows drive near-term sentiment. U.S. ETF assets hit records in 2025, and crypto ETFs (Bitcoin and Ether) are a visible slice—another reason prices can lurch on flow headlines.

Risks & Challenges for Ethereum

- Regulation: Rule changes can swing ETF flows, token classifications, or exchange operations. (The 2024 ETF approval shows rules can evolve, but policy risk never disappears.)

- Execution risk: Scaling roadmaps (EIP-4844 today, full danksharding tomorrow) must translate into real-world usage.

- Competition: Alternative L1/L2 ecosystems stay aggressive on incentives and performance.

- Flow risk: The very ETF flows that buoyed rallies can also accelerate drawdowns when sentiment flips.

Ethereum (ETH) Price Prediction by Year

Below, we stick to named, public forecasts from reputable sources—and fill gaps with scenario logic when banks/asset managers don’t publish a specific year.

Ethereum Price Forecast 2025

- Citi (via Reuters, Sept. 16, 2025): $4,300 year-end target; bull case $6,400, bear case $2,200 depending on adoption and macro.

- Standard Chartered (via Reuters, Aug. 13, 2025): $7,500 by year-end, citing stronger industry engagement and the growing role of stablecoins on Ethereum.

Ethereum Price Forecast 2026

- Standard Chartered (Oct. 2023 note, via Reuters): $8,000 by end-2026 on broader smart-contract adoption and tokenization trends. Treat this as a directional anchor rather than a hard promise; markets have evolved a lot since 2023.

Ethereum Price Forecast 2027

Few top-tier institutions publish a 2027 number. A prudent ETH price analysis for 2027 is scenario-based: if ETF AUM compounds and L2 activity keeps rising (thanks to Dencun’s effect and future upgrades), an incremental grind higher is plausible; a macro risk-off and slower on-chain demand would argue for consolidation.

Ethereum Price Forecast 2028

Some bank commentary (e.g., StanChart) ties ETH upside to an expanding stablecoin sector by ~2028—because more stablecoin volume can mean more Ethereum fees and activity. Directional, not a precise target.

Ethereum Price Forecast 2029

Again, reputable point estimates are scarce. A 2029 view typically hinges on whether Ethereum’s L2 economy and real-world tokenization meaningfully scale—both are multi-year arcs. Use ETF holdings/flows and on-chain usage as your leading indicators.

Ethereum Price Prediction 2030

- VanEck (asset manager research): public scenarios for 2030 range from ~$11.8k (assuming a specific share of smart-contract market economics) to a base case around ~$22k, depending on cash-flow/valuation inputs. These are research frameworks, not guarantees, but they’re among the most transparent long-dated models.

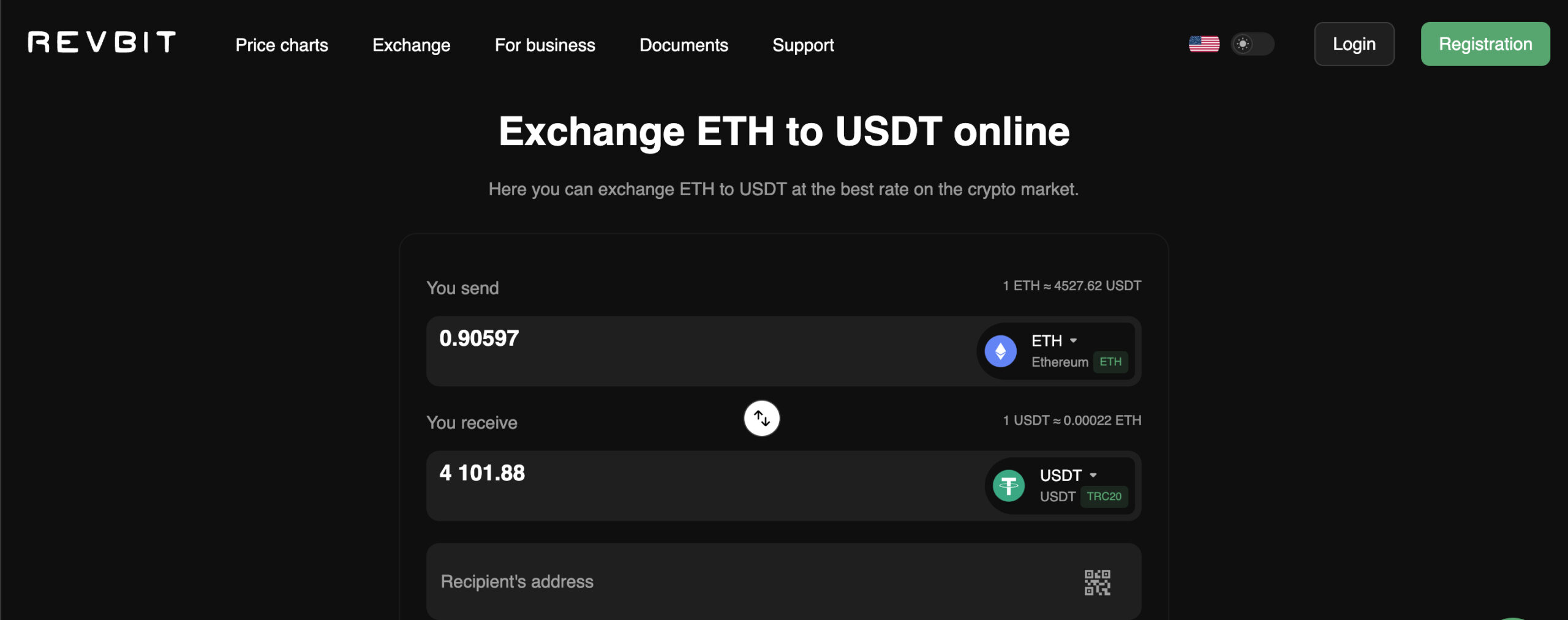

How to Buy or Exchange Ethereum

- Choose your route

- Brokerage account: buy a spot Ether ETF if it fits your situation.

- Crypto exchange: fund with fiat/stablecoins and buy ETH directly.

- Mind fees and slippage: Use limit orders on exchanges; check ETF expense ratios and spreads in brokerage accounts.

- Store safely:

- Custodial (ease): keep in your brokerage or exchange (understand counterparty risk).

- Self-custody (control): hardware wallet + backed-up seed phrase.

- Track drivers: Follow ETF flows, upgrade milestones (e.g., scaling work after EIP-4844), and macro data for clues on near-term trend.

So, Is Ethereum a Good Investment?

If your question is will ETH go up or will ETH go down?—both ways are possible, and the range is wide. For 2025, credible sell-side targets cluster between $4.3k and $7.5k (Citi vs. Standard Chartered). For 2030, VanEck’s research sketches ~$11.8k to ~$22k scenarios depending on adoption and cash-flow assumptions. The ETH investment prediction that matters most is your own process: size positions for volatility, and watch the few levers that truly move price—ETF flows, macro liquidity, and real usage unlocked by upgrades.