Binance Coin (BNB) Market Overview

Binance Coin (BNB) powers the BNB Chain ecosystem (BNB Smart Chain, opBNB Layer 2, and BNB Greenfield) and serves as gas, staking, and utility across dApps. Its supply is deflationary via quarterly Auto-Burns aiming to reduce total supply to 100 million; the 32nd burn in July 2025 destroyed about 1.596M (~$1.02B), leaving ~139.29M supply at that time. This structural burn is central to any BNB price analysis and long term forecast.

On-chain activity remains robust: BscScan shows consistently high transaction throughput on BNB Smart Chain, with a highlighted daily peak of 32.68M transactions (Dec 7, 2023) and live network stats that reinforce active usage—useful context for a future BNB price outlook.

From the policy angle, sentiment around Binance improved after Reuters reported the SEC dismissed its civil lawsuit against Binance with prejudice in May 2025, removing a major overhang for the brand and, by extension, Binance Coin.

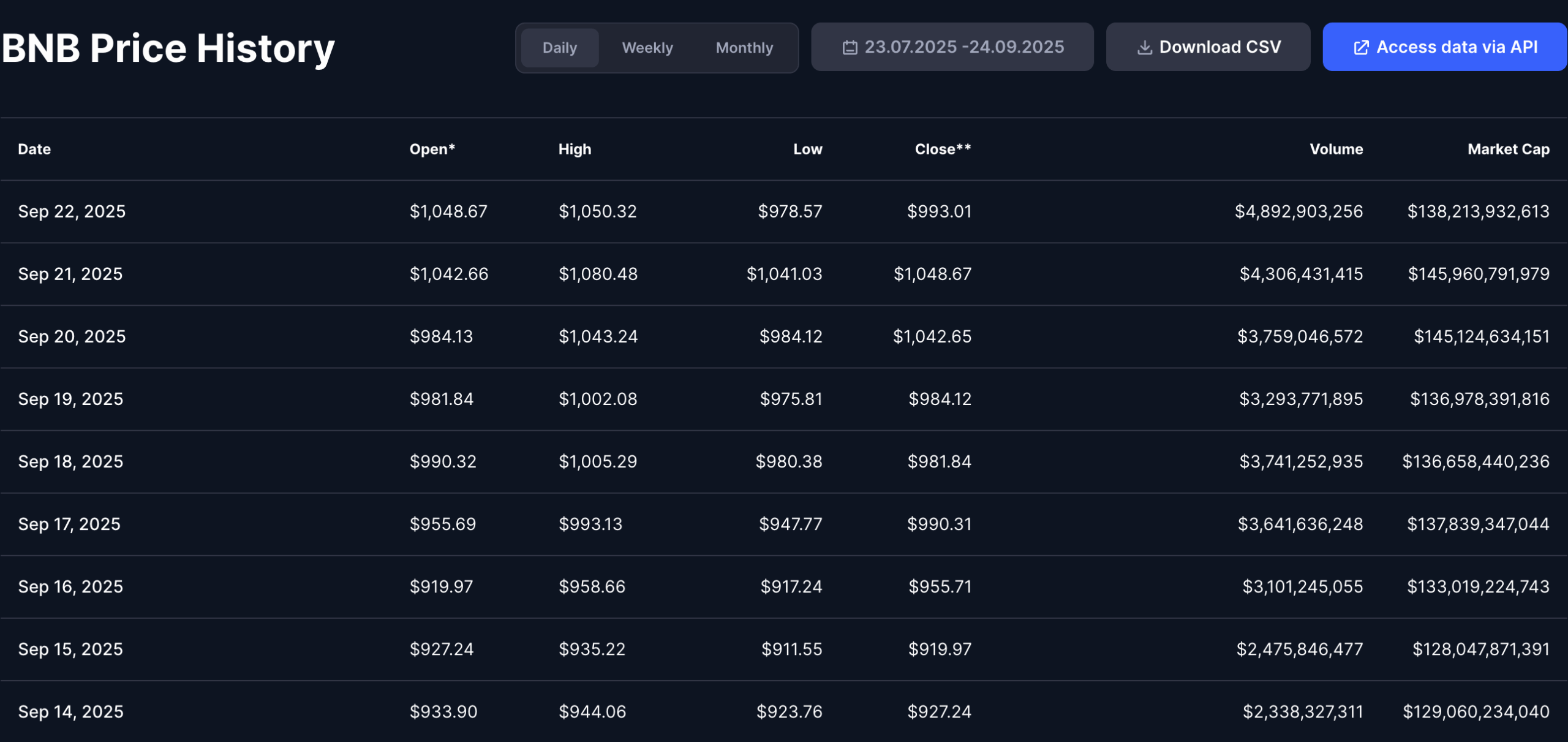

BNB Historical Price Performance

Source: Coinmarketcap

BNB’s story blends exchange utility and smart-contract demand. It rallied hard in prior cycles (notably 2021), retraced with broader crypto, then climbed to fresh multi-month (and, more recently, record) levels through 2025 as legal clarity improved and on-chain usage held up. CoinDesk’s market coverage through September 2025 repeatedly noted BNB challenging and breaking resistance areas (e.g., $930 and above), with price spikes on headlines around regulatory monitoring potentially easing.

For day-by-day history (opens, closes, ranges), CoinMarketCap maintains a continuously updated time series that traders can benchmark when back-testing strategies or calibrating stop levels.

Technical Analysis of BNB

From a technician’s lens, 2025’s structure has been characterized by:

- Higher highs / higher lows since Q1 2025, consistent with a constructive primary trend. CoinDesk analysis flagged repeated tests and breaks of overhang levels (e.g., $930 area), preceded by strong volume—classic momentum continuation behaviour.

- Round-number psychology around $900–$1,000, where reactions have been sharp. These zones often become pivot regions where “will BNB go up” or “will BNB go down” in the very short term hinges on liquidity pockets, derivatives positioning, and headline risk.

A sensible TA takeaway: treat $900–$1,000 as a congestion band where break-and-hold vs. rejection can set the next multi-week tone, while the broader uptrend remains defined by rising swing lows.

Fundamental Factors Impacting BNB

Technology & Ecosystem

Binance underpins BNB Smart Chain (BSC), opBNB L2 (lower fees / higher throughput), and Greenfield (decentralized storage). The Auto-Burn program plus real-time fee burn (BEP-95) reduce supply over time. When on-chain activity is healthy, this combination supports the BNB price outlook via demand + deflation.

Adoption & Partnerships

Usage spans DEXs, DeFi lending, gaming, payments, and token launches. BscScan’s charts show heavy address growth and transaction counts, indicative of a large active user base relative to peers—an important driver for Binance Coin investment predictions grounded in utility, not hype.

Market Sentiment

BNB has been sensitive to legal headlines. In mid-September 2025, CoinDesk reported that Binance Coin jumped on talk the DOJ may end compliance monitoring imposed on Binance after its 2023 settlement—an example of how policy news can add momentum. Improving legal clarity helps the “will Binance Coin go up” side of the debate (short-term), though it doesn’t erase long-term regulatory risks.

Risks & Challenges

- Regulatory risk: While the SEC case dismissal removed a key U.S. overhang, regulatory environments shift. Any adverse actions (in major markets) can weigh on its liquidity and perception.

- Concentration & platform risk: its fortunes are tied to Binance/BNB Chain traction. Outages, governance controversies, or competition from other L1/L2 ecosystems could dilute demand.

- Market cyclicality: As a high-beta crypto asset, it tends to amplify broader crypto cycles; drawdowns of 40–60% can happen even within higher-timeframe uptrends.

Binance Coin Price Prediction by Year

Below we summarize what credible sources are predicting today (where they publish actual numbers), then offer clearly labeled scenario ranges for intermediate years where reputable outlets avoid precise targets.

BNB Price Forecast 2025

- Finder expert panel (Apr 28, 2025): $872 year-end 2025 average. Their survey of 25 specialists ranges widely but anchors near the high-$800s.

- Benzinga roundup (Sept 22, 2025): Their aggregated look at analyst/industry forecasts cites an average ~$1,108.89 for 2025, with a band roughly $725–$1,142 depending on risk tone. (Benzinga discloses sources like Changelly/CoinCodex and flags volatility.)

Take: With its already challenging four-digit prices intra-year, credible forecasts cluster from high-$800s to low-$1,100s. Macro, ETF/risk flows, and policy headlines could tip which end of the band we see.

BNB Price Forecast 2026

- Benzinga’s compiled outlook suggests ~$1,060 average with a rough band ~$931–$1,224—a mild step up, consistent with a maturing uptrend rather than a moonshot.

BNB Price Forecast 2027

- In a continued adoption path, compounding from 2026 would put Binance Coin in a $1,050–$1,450range. In a bear phase or rotating liquidity, $600–$900 is plausible.

BNB Price Forecast 2028

- With ecosystem expansion (L2s, new dApps) and ongoing Auto-Burns, $1,150–$1,650 (base case). In a prolonged downturn, $500–$800.

BNB Price Forecast 2029

- If crypto market cap grinds higher and its chain keeps share, $1,300–$1,800. Competitive displacement or a regulatory drag could cap it near $700–$1,000.

BNB Price Forecast 2030

- Finder panel (Apr 2025): $1,525 by year-end 2030.

- Benzinga (Sept 2025): $1,800–$1,911 (avg $1,876) by 2030, based on aggregated crypto-native models with caveats.

Take: Credible published numbers for BNB price prediction 2030 cluster around $1.5K–$1.9K, implying moderate real growth from 2025 levels rather than 10x claims you might see on speculative blogs.

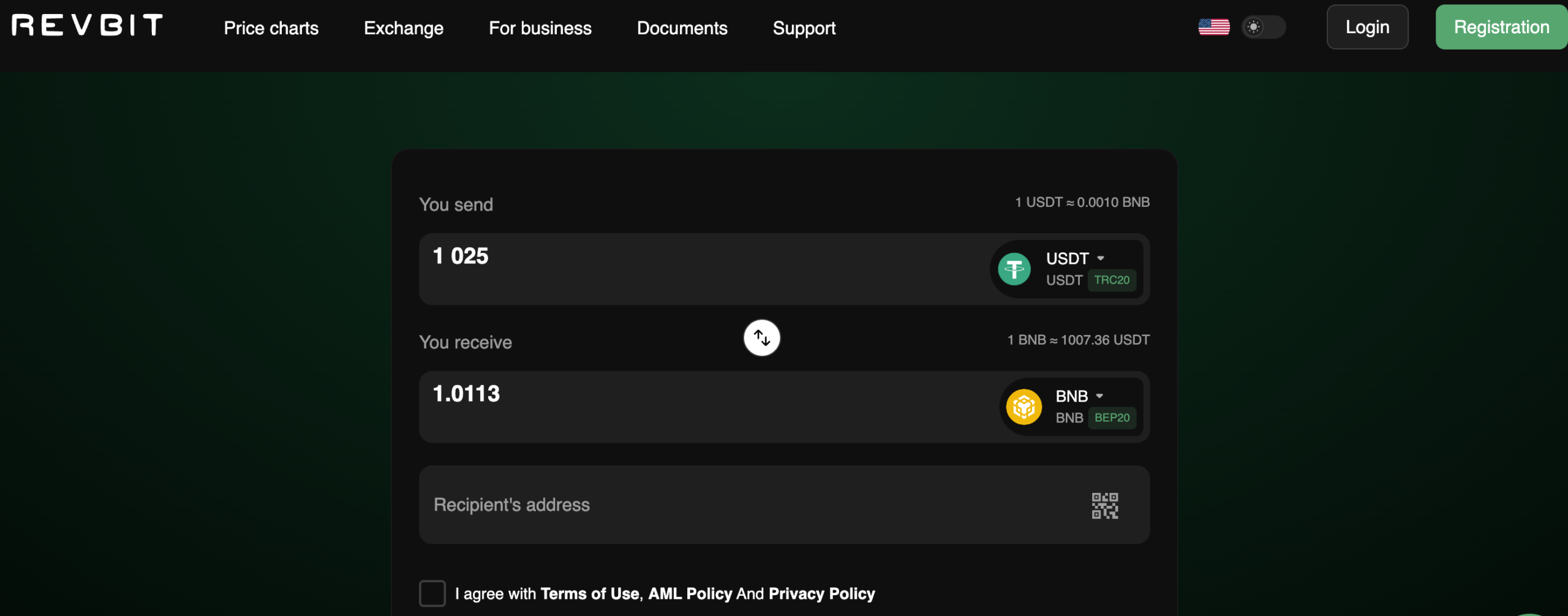

How to Buy or Exchange BNB

- Choose a compliant venue in your country (KYC required in most jurisdictions).

- Fund with fiat (bank transfer/card) or swap from another crypto.

- Consider self-custody for longer holds; keep exchange balances minimal.

- Mind fees and networks: on BSC/opBNB, fees are low, but always verify you’re withdrawing on the intended chain.

- Track burns and on-chain health: The BNB Chain blog posts quarterly burn data; BscScan shows activity. Both help inform a Binance Coin investment prediction grounded in fundamentals, not just charts.

Conclusion: Is Binance Coin a Good Investment?

Short answer: BNB has a credible bull case—utility + deflation—and a credible risk set—regulation + platform concentration. On the bull side, the Auto-Burn and steady network usage can support Binance Coin price over time. On the risk side, centralized-platform perception and policy shifts can add volatility or cap multiples.

What do trusted forecasts say? The Finder expert panel and Benzinga’s compilation peg BNB price prediction 2025 near $0.9–1.1K and its price prediction 2030 near $1.5–1.9K—measured, not sensational. That lines up with a BNB long term forecast of gradual appreciation if adoption holds, rather than runaway exponential claims.

Not financial advice. Crypto is volatile; do your own research and never invest money you can’t afford to lose.