In the middle of the week Bitcoin stopped trying to update its ATH and slipped into a correction. The weakening of the cryptocurrency coincided with negative news from the Middle East, clearly showing how geopolitics affects crypto. In this article we explain why Bitcoin isn’t rising, spell out why Bitcoin can’t break ATH, give a concise Bitcoin price forecast, and consider whether investors who claim the rally is over are right.

What Is Happening to Bitcoin

At the beginning of the week the coin came close to its absolute maximum. Bitcoin’s ATH, according to CoinMarketCap, was recorded on 22 May 2025 at $111 970. On 11 June BTC reached $110 409 and began to weaken. At the time of writing the cryptocurrency is trading at $107 380, about 4% below the ATH, according to Bitcoin technical analysis today.

Depth of Bitcoin’s correction since 11 June. Chart: TradingView

Check Bitcoin price today

A drop of a couple of percent from the maximum would not look tragic in isolation, but the timing and the current balance of macroeconomics and Bitcoin matter: many community members expect further growth and keep asking, will Bitcoin go up? Yet each new correction and the inability to renew the peak point to the flagship’s vulnerability.

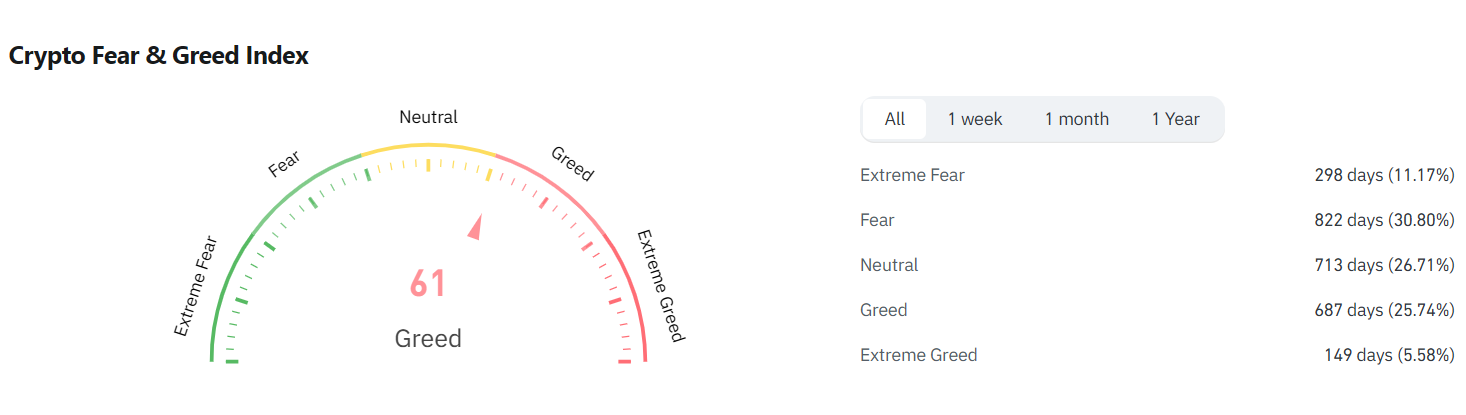

Meanwhile, the Bitcoin Fear & Greed Index is still in the “red” zone, signalling investors’ high willingness to buy the dip despite the setback.

Bitcoin Fear & Greed Index. Source: CoinGlass

Why Bitcoin Is Falling

The fresh slide is the most vivid Middle East Bitcoin impact so far this year. Reports emerged that the White House had decided to relocate embassy staff and their families from the region amid information that Israel is preparing to strike Iran. Bitcoin’s fall on the withdrawal headlines can be explained by classic risk-off behaviour:

- Heightened geopolitical uncertainty forces traders out of volatile assets into safe havens such as the dollar, gold and government bonds.

- Higher liquidity in money markets: fears of oil-supply disruption and potential military action channel capital toward traditional defensive instruments.

- Correlation with equities: in crisis periods crypto often moves in step with risk assets that decline during a broad flight from risk.

Against the backdrop of the decline, many popular crypto-bloggers started talking about a bull run over or correction and locked in profits; analyst DoctorProfit did exactly that.

On-chain analyst Willy Woo, for his part, drew attention to who is selling Bitcoin now: the main sellers are Bitcoin whales with balances of 10–100 BTC. Many of these investors bought below $1K, so taking profit looks logical. By contrast, there is virtually no significant Bitcoin miners selling: miners have been accumulating BTC since late May 2025.

Not Everything Is Bad

The market’s negative reaction to Middle-East news is unlikely to mean the rally has finished. Several supports could still let the cryptocurrency grow:

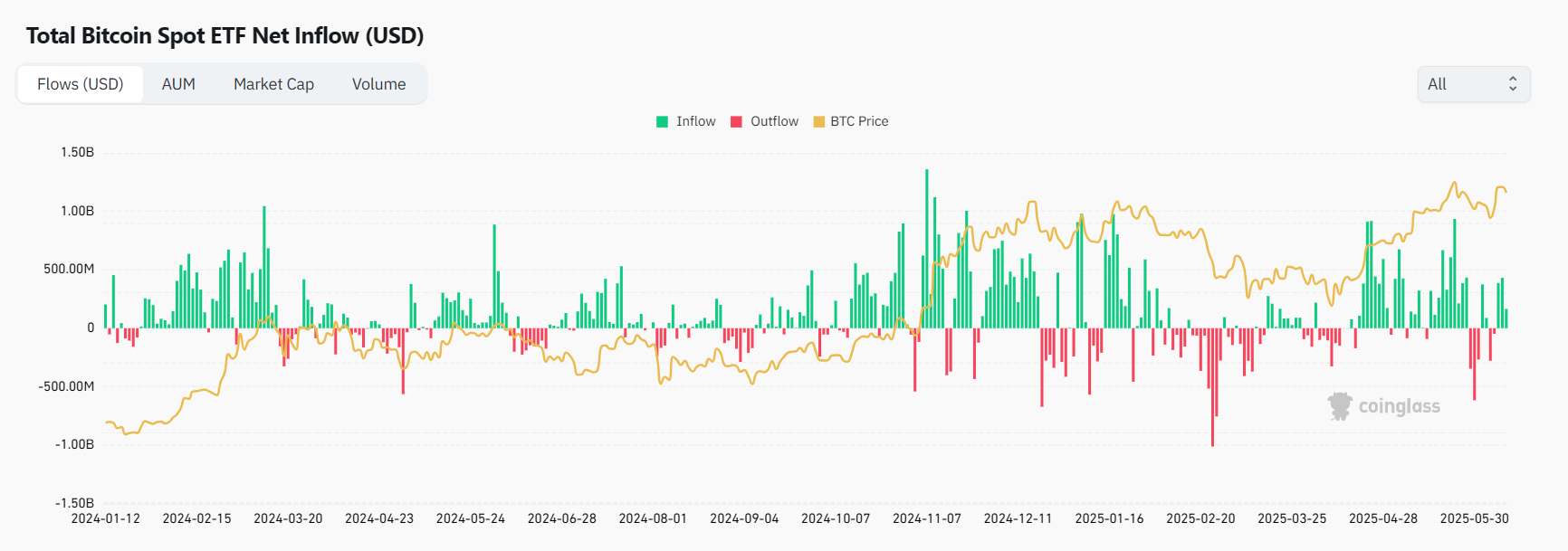

- Inflows into spot Bitcoin ETFs have resumed. Institutions keep pouring money into BTC-based funds. Fresh Bitcoin ETF inflows outflows data show that BlackRock’s iShares Bitcoin Trust alone has already bought 3.17% of the entire supply.

Statistics on spot Bitcoin-ETF inflows and outflows. Source: CoinGlass

- Bitcoin reserves on exchanges keep shrinking. Falling supply can lead to a shortage of coins, as happened in previous post-halving cycles. A lack of free coins is one of the main drivers of rallies, especially while miners are accumulating.

Bitcoin exchange reserves. Source: CryptoQuant

- The United States could give the rally a powerful push. Fed policy crypto impact comes to a head on 18 June 2025, when the next FOMC meeting takes place. Donald Trump is actively lobbying for a rate cut, and this thrust of Trump crypto policy keeps optimism alive even though more than 99% of market participants expect no move this time.

A record $10 billion buy-back of U.S. Treasuries illustrates the treasury buybacks crypto effect and resembles early stages of quantitative easing and crypto surges, because the Fed repaid creditors with fresh dollars that had not been in circulation—some of that liquidity may settle in Bitcoin.

According to a popular theory, BTC echoes global M2 liquidity with a roughly three-month lag; if history repeats, participants believe the coin could fly “to the Moon”, and many are wondering when will Bitcoin hit new all-time high.

Overlay of the Bitcoin chart (colored curve) on the M2 curve (yellow curve). Charts: TradingView

Potential sovereign demand could add fuel: Senator Cynthia Lummis said that Trump has approved the purchase of 1 million BTC for a U.S. reserve.

At the same time Congress is working on a clear legal framework for stablecoins; transparent rules for “digital dollars” could greatly increase the sector’s investment appeal.

Summing Up

The market faced a sell-off amid escalating tension in the Middle East. Yet the shallow depth of the correction, upbeat investor mood, prospects of new purchases by institutions—and even by the U.S. authorities—suggest the rally is far from finished. For anyone asking, should I invest in Bitcoin now, the answer will hinge on the next Fed decision, ETF demand and the geopolitical backdrop in the coming weeks.

Earlier, Revbit’s editors compiled a single review of the best crypto exchanges of 2025. With its help you can find a convenient trading platform to profit from moves in your favorite cryptocurrency.