August 4, 2025

~5 min read

It’s no secret that the market can throw curveballs, and Bitcoin (BTC) just caught one. As we kick off August 2025, the top cryptocurrency has taken a hit, dipping under that $115,200 threshold and stirring up some real worry among holders. Over the last week, we’ve seen losses hovering between 2% and 5%, mirroring the unease rippling through global markets. This isn’t just random noise; it’s a reminder of how tied crypto is to bigger economic shifts. If you’re feeling the pinch and looking to swap BTC without hassle, spots like Revbit (revbit.net) make it straightforward and safe, even when things get bumpy. Let’s break down what’s behind this slide and what experts are saying about where Bitcoin might head next.

Causes of the Decline in BTC Price

The drop in Bitcoin’s value didn’t come out of nowhere—it’s a mix of factors piling on, pushing sellers into action and leading to over $600 million in liquidations lately. Market watchers have zeroed in on a few main culprits that have shaken things up:

- U.S. Tariffs Sparking Caution: New tariffs from the U.S., hitting 10% to 41% on various goods, are aimed at shielding local businesses but have accidentally stirred fears of trade spats and rising prices. Folks are pulling back, favoring steady options like gold over riskier bets. Cryptos, often seen as the wild cards in tough times, are taking the brunt of this shift away from high-stakes plays.

- Shaky U.S. Job Numbers: The latest jobs report was a letdown, with only 73,000 new positions added in July 2025—the weakest since 2020 and way below what people hoped for. This has folks fretting about a slowdown, dropping the Fear & Greed Index to a middling 51. While bets on Fed rate cuts in September are still alive, the doubt has triggered some quick sales in crypto portfolios.

- Fed’s Tough Talk on Rates: Comments from Fed Chair Jerome Powell at the recent meeting came off as stern, cooling off excitement for quick rate drops. Even with some strong economic signs, the odds of a September trim fell from 63% to 40%, making BTC look less tempting next to stuff that pays interest.

- Outflows and Market Mechanics: Crypto funds bled $223 million last week, snapping a long run of gains. Add in the usual August slump—what some call the “August Curse”—and you’ve got extra downward pull. Tech-wise, BTC breaking below $110,000 support has revved up the bears, with tools like RSI flirting with oversold zones.

- Ripple Effects on Altcoins and Stocks: The pain isn’t just Bitcoin’s—Ethereum slipped 5.5%, Solana and Dogecoin shed up to 8%, and coins like Cardano or Chainlink lost 7-10%. Crypto stocks aren’t faring better; Coinbase shares tumbled 18% on weak earnings, dragging the mood down further.

These elements aren’t standalone; they feed into each other, amplifying the pressure. It’s like a perfect storm where one bad headline snowballs into more selling.

Deeper Market Analysis

Digging a bit further, this isn’t just surface-level stuff—longer trends are at play too. The 2024 Bitcoin halving cut miner rewards, tweaking supply in ways that usually boost prices over time, but right now, macro hurdles like possible rate delays and world tensions are keeping things in check mode. On the flip side, upcoming positives could flip the script; think about talks of a U.S. Strategic Bitcoin Reserve if crypto-friendly rules gain traction. That might spark some real upward momentum.Institutions are still in the game strong, with ETF cash flowing in and big players like MicroStrategy holding steady as anchors. Yet, watch out for snags—regulatory fog or rivals like Ethereum dominating DeFi could limit gains if not sorted. Overall, the market’s showing resilience, but short-term swings remind us why patience pays off. Many are asking: is this a blip or something bigger? History suggests Bitcoin bounces back, but staying informed is key.

Analysts’ Forecasts

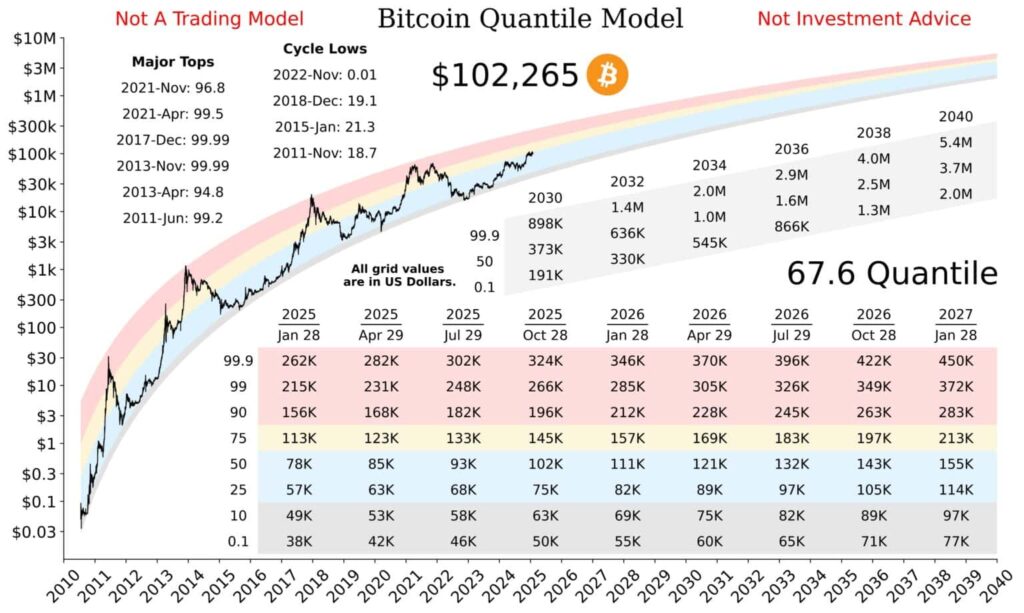

Turning to the crystal balls, most pros are upbeat for Bitcoin in 2025, though they flag near-term bumps. Some see tests down to $100,000 or $90,000 if recession talk heats up, but the big picture leans toward climbs fueled by ETFs, easier money policies, and wider use.

Here’s a quick look at what key voices are predicting:

|

Analyst/Firm

|

Short-Term Forecast (Aug 2025)

|

Year-End 2025 Target

|

Key Rationale

|

|---|---|---|---|

|

Bitwise

|

$115,000 – $121,000

|

$150,000 – $200,000

|

ETF inflows and institutional buying.

|

|

Standard Chartered

|

Potential rebound to $120,000

|

$135,000 – $200,000

|

Rate cuts and stablecoin regulations.

|

|

Arthur Hayes

|

Possible dip to $100,000

|

Limited downside

|

Macro instability but strong support levels.

|

|

Fundstrat (Tom Lee)

|

Steady gains

|

$250,000

|

Pro-crypto policies and adoption.

|

|

Average Consensus

|

$112,500 – $119,000

|

$145,000 – $162,000

|

Balanced view from 24 experts.

|

These outlooks hint that while BTC could probe $110,000 soon, a push to $140,000-$148,000 by year’s end feels doable, especially with a Fed shift. Gurus like PlanB and Elliott Wave fans stress Bitcoin’s track record of rebounding from dips, backed by past data.

Conclusion: Decline in BTC Price

Wrapping it up, Bitcoin’s current dip boils down to tariff worries, soft econ data, and some profit grabs, but the 2025 vibe is positive for long-haul folks. Smart traders should keep an eye on those pivotal levels and use trusty platforms like Revbit for smooth BTC/ETH swaps. With catalysts brewing, this could turn into a smart buy-in spot rather than a drag. Remember, the crypto world’s always changing—do your homework and manage risks wisely to ride it out. Stay sharp out there!