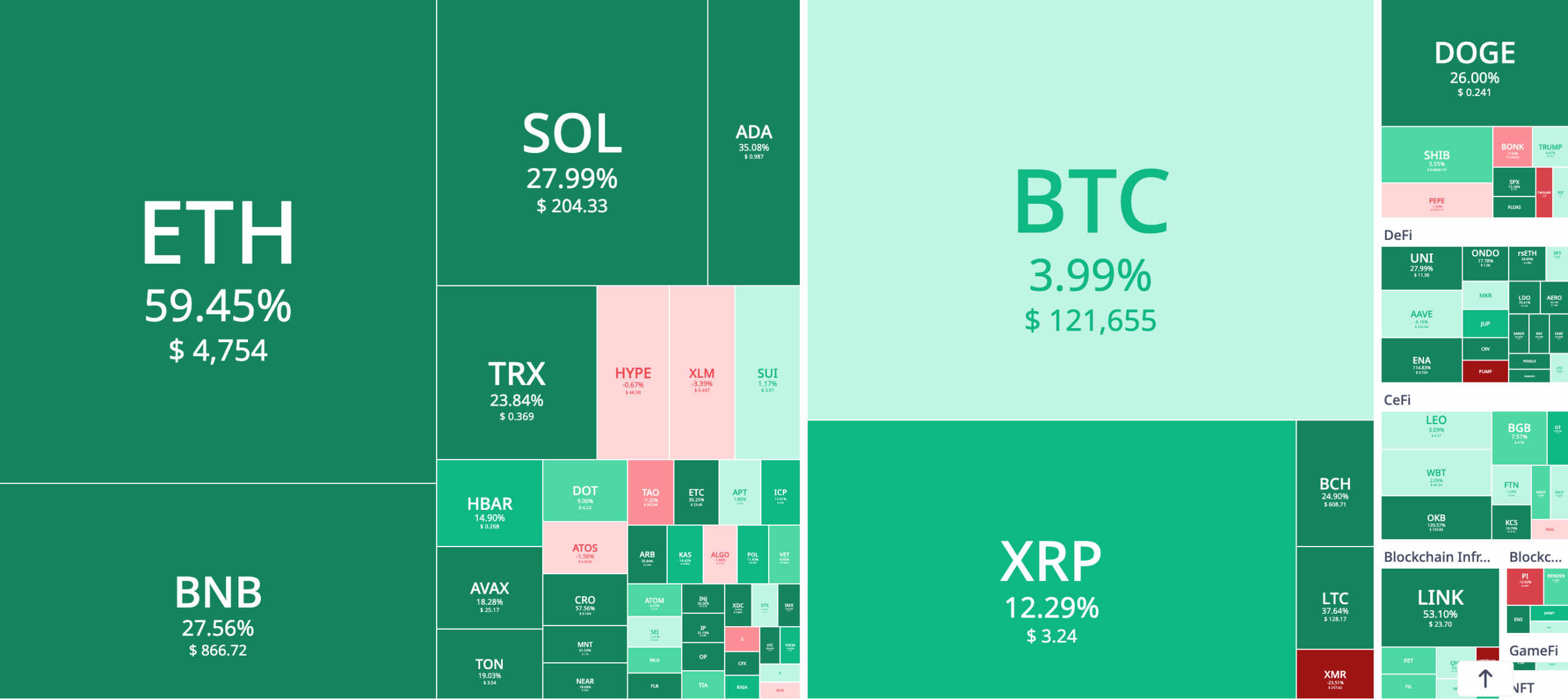

August Market Overview

Source: Cryptorank

August opened with a supportive macro tape and fresh crypto-specific catalysts. Bitcoin is hovering around record territory after breaking above $120,000 earlier this month amid upbeat sentiment and a friendlier policy outlook, with some analysts eyeing $130K–$134K if key supports hold.

Ether has taken the spotlight: U.S. spot ETH ETFs logged their first-ever $1B net inflow day on Aug. 12, led by BlackRock and Fidelity—an institutional stamp of approval that typically tightens spreads and deepens liquidity. ETH has also outperformed BTC on recent momentum, with traders framing a “catch-up” trade into late summer.

Rotation beyond the top two is alive as well. BNB briefly pushed above $850 on Aug. 13, nearing its all-time high after a headline $160M corporate treasury buy—a reminder that institutional treasuries can move individual ecosystems when liquidity is supportive.

If you’re asking what crypto to buy in August, think in themes: ETF flows and macro for the majors; client diversity and upgrades for smart-contract platforms; real-world integrations and infra demand for sector picks. The list below blends those angles.

Criteria for Selection

When curating investment-worthy coins (not financial advice), we used five filters:

- Real adoption or institutional access (ETFs, large integrations, or corporate usage).

- Upcoming catalysts in August–Q4 (network upgrades, launches, new geographies).

- Ecosystem health (developers, liquidity, stablecoin settlement, tooling).

- Narrative durability (not just hype; ties to long-run demand).

- Risk profile & position sizing (can you size it without blowing up the portfolio?).

These filters tend to surface hot coins to invest in that also have staying power—your best defense against headline whiplash.

Best Coins to Watch in August 2025

Bitcoin (BTC)

- Why now: Macro tailwinds and resilient flows. As of early August, Bitcoin pushed back toward records with analysts highlighting upside scenarios if support around the low $110Ks holds. That backdrop keeps BTC on nearly every “best cryptos to buy August 2025” short list.

- What to watch: Inflation prints and the September Fed meeting path—risk assets typically breathe with macro. Positioning remains constructive so long as ETF demand and “digital gold” narratives stay intact.

Use case fit: Core allocation and liquidity anchor—helpful when layering in smaller, higher-beta bets.

Ethereum (ETH)

- Why now: Record $1B single-day net inflows into U.S. spot ETH ETFs on Aug. 12 signal accelerating institutional participation. ETH has also led large-cap gains into mid-month.

- What to watch: Sustainability of ETF inflows, the ETH/BTC ratio trend, and how builders leverage L2s for cheaper blockspace (a structural driver for on-chain activity). Traders are watching ~$4,800—the 2021 record—as a psychological magnet if momentum persists.

Use case fit: Blue-chip smart-contract beta; gateway to L2 ecosystems and tokenization rails.

Solana (SOL)

- Why now: Two threads: (1) a major design push (the Alpenglow initiative from a Solana Labs spin-out) aimed at improving responsiveness and finality; and (2) client diversity via Firedancer, a second validator client from Jump that targets higher throughput and resilience. Both are about hardening the network for the next demand wave.

- What to watch: Milestones on Firedancer testing and timelines toward wider rollout later in 2025, plus continued traction in DeFi and consumer payments where Solana’s speed/fees matter.

Use case fit: High-throughput L1 exposure with clear upgrade roadmaps—appealing among top cryptocurrencies August lists when you want growth plus active engineering.

BNB (BNB)

- Why now: Corporate treasury accumulation. CEA Industries’ treasury arm disclosed a 200,000 BNB (~$160M) purchase, and on Aug. 13 BNB rallied ~4% to the $850s, within a whisker of ATH. That combination—headline buyer + rising price—often attracts momentum screens for trending coins in August 2025.

- What to watch: Whether more treasuries follow, and if price can decisively clear $860 to enter price discovery—otherwise a consolidation band can form just below highs.

Use case fit: Exchange-ecosystem beta with strong liquidity; size with care given proximity to resistance.

Chainlink (LINK)

- Why now: Institutional tokenization plumbing. SWIFT’s official write-up shows a pilot with Chainlink and UBS Asset Management to settle tokenized fund flows via existing payment rails—exactly the sort of “TradFi handshake” that can compound quietly over time.

- What to watch: Expansion of CCIP connections and production-grade tokenization projects. Chainlink positions itself as orchestration for on-chain finance, citing prominent institutions now experimenting across data, messaging and cross-chain settlement.

Use case fit: Infrastructure toll-booth thesis within a diversified basket of investment-worthy coins.

Toncoin (TON)

- Why now: Telegram rolled out the TON Wallet mini-app to 87M U.S. users in July, taking embedded crypto closer to mainstream messaging. Telegram also reported a profitable 2024 with a growing “partnerships & ecosystem” line tied to TON—useful context for demand.

- What to watch: Adoption of in-app payments and mini-apps, U.S. user traction post-launch, and whether DeFi/commerce tools inside Telegram become sticky.

Use case fit: Consumer-distribution bet: a large funnel (Telegram) meeting a chain designed for low-friction onboarding—squarely in the hot coins to invest in conversation this month.

Celestia (TIA)

- Why now: The data-availability (DA) trade. As rollups proliferate, modular stacks need cheap, reliable DA. Celestia is a purpose-built DA network used by many L2s to post blob data, with risk and design choices cataloged by L2BEAT. Celestia’s own materials argue DA can cut costs dramatically for builders, a driver for medium-term demand.

- What to watch: Rollup adoption and DA-cost curves; dashboards tracking blob usage and validator economics through H2.

Use case fit: Picks-and-shovels exposure to the modular scaling wave; complements ETH/L2 allocations.

Investment Tips

- Anchor, then tilt. Use ETH/BTC as a liquid core; tilt into SOL/BNB for execution-layer beta, and LINK/TON/TIA for infra + distribution + modular theses. This keeps your top cryptocurrencies August basket balanced between momentum and durability.

- Stagger entries. August is event-heavy (CPI, Fed expectations). Consider dollar-cost averaging, and be explicit about invalidation levels before entering.

- Catalyst calendars win. Track near-term unlocks/upgrades (e.g., Solana client milestones), ETF flow trends for BTC/ETH, and corporate-treasury headlines that can concentrate liquidity (BNB).

- Mind correlations. Alt beta still dances to BTC. If the market wobbles into macro events, smaller caps move more—size positions accordingly.

- Fees and slippage matter. If you express views via funds/ETPs, check expense ratios and whether products distribute income (covered-call ETFs) or simply track price.

Final Recommendations

If your question is “what crypto to buy in August 2025?”, a pragmatic shortlist is:

- Core: BTC for liquidity/defensive beta; ETH for ETF-driven adoption and L2 flywheel.

- Growth platforms: SOL (client diversity + design overhaul), BNB (ecosystem strength + treasury demand near highs).

- Infra & distribution: LINK (institutional tokenization rails), TON (Telegram funnel), TIA (modular DA).

This basket checks the boxes for best cryptos to buy August 2025, trending coins August 2025, and long-run, investment-worthy coins—while giving you different engines for upside. Keep allocations flexible, review catalysts weekly, and remember: in crypto, survival (risk control) is strategy number one!