Bitcoin (BTC) Market Overview

Bitcoin (BTC) Market Overview

As of today, Bitcoin trades near six figures with deep, ETF-fueled liquidity and global name recognition.

Two structural shifts define today’s Bitcoin price outlook:

- Spot Bitcoin ETFs in the U.S. (approved on Jan. 10, 2024) opened a mainstream on-ramp for pensions, RIAs, and retail accounts. The SEC’s order approved multiple spot Bitcoin ETPs after a decade of debate, a watershed moment for market structure.

- Persistent ETF flows: At various points in 2025, Bloomberg reported sizable net inflows into U.S. spot Bitcoin ETFs, highlighting a new source of demand—even as outflow bouts show the market can cut both ways.

Bitcoin Historical Price Performance

![]()

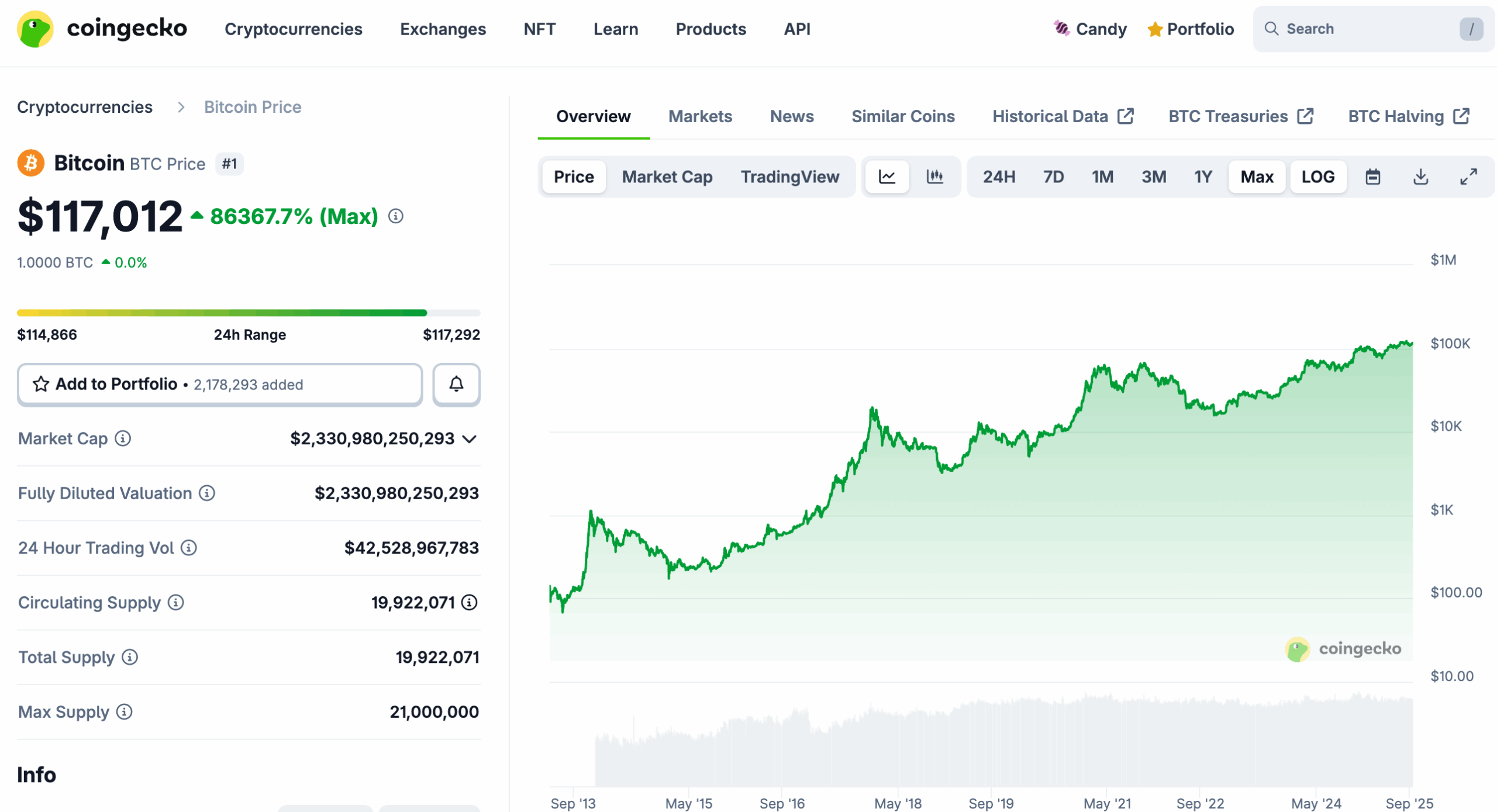

Source: Coingecko

Bitcoin’s latest cycle printed a new all-time high above $73,000 in March 2024, shortly before the fourth halving cut new issuance to 3.125 BTC per block at height 840,000. These two events—record price and a supply shock—framed the run into 2025.

Across cycles, Bitcoin has exhibited dramatic drawdowns and recoveries. The difference this time is the institutional access via ETFs, which CoinDesk and others argue has changed who can buy dips and how quickly capital rotates in.

Technical Analysis of Bitcoin

From a technician’s lens, the BTC price forecast often revolves around trend structure (200-day moving average), momentum (RSI/MACD), and prior-cycle levels (former highs around $73k as support/resistance). Without making trading calls, the setup heading into 2026 is a classic post-halving pattern: broad uptrend, volatility spikes around macro news, and flows from ETFs acting like a new “bid” during risk-on phases. (Use TA as a timing tool; the drivers below decide the multi-year path.)

Fundamental Factors Impacting Bitcoin

Technology & Ecosystem

Bitcoin’s codebase evolves slowly by design. The April 2024 halving reduced issuance to 3.125 BTC per block, and activity like Ordinals/Runes periodically elevates on-chain fees. These mechanics affect miner economics and short-run liquidity but don’t change the 21M cap thesis many cite in their Bitcoin investment prediction narratives.

On energy, the Cambridge Bitcoin Electricity Consumption Index (CBECI) provides widely used estimates and methodology for tracking network power demand—useful context for ESG and policy debates that can sway sentiment.

Adoption & Partnerships

Regulated access matters. The SEC’s 2024 approval of spot BTC ETPs brought Bitcoin into brokerage accounts and retirement platforms at scale; Bloomberg subsequently tallied multi-billion-dollar inflow waves into these funds, underscoring how the investor base has broadened.

Market Sentiment

Macro still moves BTC. Periods of cooling inflation or rate-cut expectations have coincided with strong crypto risk appetite, while ETF outflows or policy headlines can reverse momentum. Even so, Bitcoin dominance remains elevated, reflecting BTC’s role as crypto’s “reserve asset”.

BTC vs Competitors

- Bitcoin: Hard-cap scarcity, monetary narrative, and the deepest liquidity/ETP access.

- Ethereum/altcoins: Programmable platforms with evolving cash-flow models (staking/fees), but different risk profiles and tokenomics.

In allocation terms, many treat Bitcoin as the “core” of digital-asset exposure and other networks as satellites—especially when the goal is a Bitcoin long term forecast anchored to macro adoption rather than app-layer innovation.

Risks & Challenges for Bitcoin

- Regulation & policy: The SEC approval didn’t end regulatory risk; shifts in ETF rules, taxation, or AML scrutiny can jolt flows. (SEC materials and congressional research outline the legal path and remaining uncertainties.)

- Energy & ESG: Power usage remains a persistent talking point; policymakers and investors reference CBECI/EIA analyses when evaluating externalities.

- Market plumbing: ETF outflows, exchange incidents, or custody shocks can hit near-term price even in a favorable long-run trend. Bloomberg and Investopedia coverage of ETF flow swings illustrate both tailwinds and air pockets.

Bitcoin (BTC) Price Prediction by Year

Below we synthesize what trustworthy sources actually publish—and where they don’t, we frame scenario drivers instead of guesswork. Remember: forecasts are not guarantees.

Bitcoin Price Forecast 2025

Standard Chartered (global bank): Projects Bitcoin price around $200,000 by end-2025, citing ETF demand and gold analogies. This is one of the clearest, bank-level targets on record for 2025.

What could shift 2025 up or down? Sustained ETF inflows and a benign macro path argue up; policy surprises or risk-off shocks argue down. Bloomberg’s flow tallies give a real-time read on that balance.

Bitcoin Price Forecast 2026

Bernstein (sell-side research): Expects BTC could reach $200,000 by early 2026, extending the cycle as institutional demand compounds. Multiple reputable outlets summarized this call during July 2025.

Drivers to watch: Fed path, ETF AUM growth, and miner health post-halving.

Bitcoin Price Forecast 2027

There’s less bank-grade precision this far out. If ETF holdings, corporate treasuries, and sovereign interest expand, 2027 could see cycle extension; if flows normalize and liquidity thins, consolidation is plausible. Treat 2027 as a scenario year rather than a target year—and weigh evidence like ETF assets/flows and macro liquidity.

Bitcoin Price Forecast 2028

Hard numbers are rare. By 2028, the market will be looking ahead to the next halving and to how Bitcoin competes for portfolio share versus tokenized Treasuries, stablecoins, and real-world-asset rails. Expect range-bound outcomes without a fresh structural catalyst—unless nation-state adoption or new use-cases materialize at scale (still a debated topic in mainstream finance research).

Bitcoin Price Forecast 2029

Late-cycle years often bring dispersion: some models forecast sustained appreciation on scarcity/ETP compounding; others expect mean-reversion as growth slows. Keep an eye on whether Bitcoin dominance stays elevated (a sign institutions still prefer BTC risk) or rotates toward higher-beta assets.

Bitcoin Price Prediction 2030

ARK Invest: Base case ~$710,000 by 2030, with a bear ~$300,000 and bull ~$1.5 million, anchored to assumptions about corporate treasuries, nation-state adoption, and capital markets integration. This is one of the most detailed public 2030 frameworks.

Reading the spread: 2025 targets from banks (e.g., $200k) and 2030 frameworks from asset managers (e.g., $300k–$1.5M) underscore the uncertainty bands. Your future Bitcoin price view should weigh ETF adoption, macro liquidity, and policy direction—three variables that can dominate any on-chain metric.

How to Buy or Exchange Bitcoin

- Pick your venue. For regulated access, U.S. spot Bitcoin ETFs (approved in 2025) are available in many brokerage accounts; direct buyers can use reputable exchanges with strong custody standards.

- Fund and execute. With ETFs, place a standard stock order. With exchanges, fund in fiat/stablecoins, then buy BTC.

- Store securely. Decide between custodial convenience and self-custody (hardware wallet, backed-up seed).

- Track flows and news. ETF flows (Bloomberg), policy updates (SEC/CRS), and macro data often precede trend shifts.

Conclusion: Is Bitcoin a Good Investment?

If your core question is “will Bitcoin go up or will Bitcoin go down?” The responsible answer is: both are possible, and the range is wide. Credible 2025 views from a global bank cluster around $200k, while a well-known asset manager frames 2030 anywhere from $300k (bear) to $1.5M (bull).

What bridges those endpoints isn’t magic—it’s plumbing: ETF adoption and flows, policy clarity, macro liquidity, and Bitcoin’s ability to keep its “digital gold” narrative while addressing energy and market-structure critiques. Use this guide for BTC price analysis, but size positions and time horizons to your own risk tolerance.

Not financial advice. Consider professional guidance if you’re building a long-term allocation.