In the evolving landscape of financial markets, crypto ETFs have emerged as a pivotal tool for bridging traditional investing with digital assets. These exchange-traded funds focused on cryptocurrencies allow everyday investors to gain exposure without directly handling volatile coins. As we approach 2026, with regulatory frameworks solidifying and institutional interest surging, understanding crypto ETFs becomes essential.

This article explores their mechanics, benefits, and potential impact, highlighting why they could reshape investment strategies. From Bitcoin ETF approvals to broader market integration, these instruments promise accessibility and reduced risk. Whether you’re a seasoned trader or new to the space, grasping this development could unlock new opportunities in cryptocurrency investment.

What Are Crypto ETFs? Why They’re a Game-Changer for 2026 Investors

As we approach 2026, with regulatory frameworks solidifying and institutional interest surging, understanding crypto ETFs becomes essential. This article explores their mechanics, benefits, and potential impact, highlighting why they could reshape investment strategies. From Bitcoin ETF approvals to broader market integration, these instruments promise accessibility and reduced risk. Whether you’re a seasoned trader or new to the space, grasping this development could unlock new opportunities in cryptocurrency investment.

Defining Crypto ETFs: The Basics You Need to Know

Crypto ETFs are investment vehicles that track the performance of digital currencies or related assets, traded on stock exchanges like any other ETF. Unlike buying Bitcoin directly, which requires wallets and security measures, these funds hold the underlying assets or derivatives, letting investors buy shares through brokerage accounts. The concept gained traction with the first Bitcoin ETF launches in 2024, marking a shift toward mainstream adoption.

At their core, they function by pooling investor money to purchase cryptocurrencies or futures contracts. This setup provides indirect exposure, mitigating some complexities of direct ownership. For instance, a spot ETF holds actual coins, reflecting real-time prices, while futures-based ones use contracts to mimic values. In 2026, with Ethereum ETF approvals expanding, these products are set to cover more altcoins, enhancing portfolio diversification. Their appeal lies in simplicity – no need for private keys or cold storage, just standard trading platforms.

Regulatory bodies like the SEC have scrutinized these for investor protection, ensuring transparency and custody standards. This oversight has boosted confidence, drawing in those wary of crypto’s Wild West reputation. As markets mature, crypto ETFs stand out as a regulated entry point, blending innovation with familiar structures.

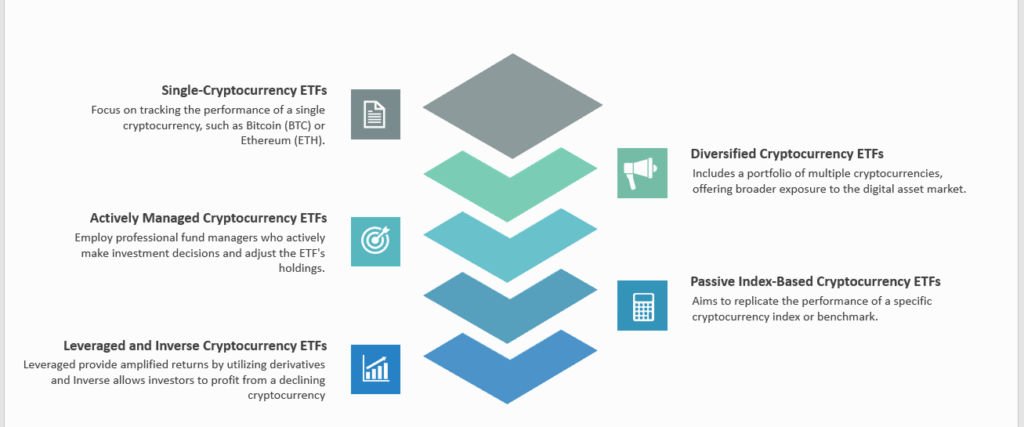

Types of Crypto ETFs: Spot vs. Futures and Beyond

Diving deeper, crypto ETFs come in various forms, each suited to different risk appetites. Spot ETFs, which directly hold the cryptocurrency, offer precise tracking but faced delays due to custody concerns. The 2024 Bitcoin spot ETF wave changed that, with products like BlackRock’s iShares leading inflows.

Futures ETFs, on the other hand, use derivatives to replicate prices without physical holdings. They’ve been around longer, like ProShares’ offering since 2021, providing leverage but with potential tracking errors from rollovers. In 2026, hybrid models might blend both, incorporating staking yields for added returns.

Other variants include thematic ETFs focusing on blockchain tech or DeFi sectors. For clarity, here’s a comparison table of key types based on current and projected offerings:

| ETF Type | Description | Key Advantages | Potential Drawbacks | Examples in Market |

|---|---|---|---|---|

| Spot Crypto ETF | Holds actual digital assets | Accurate price tracking, no expiry | Higher regulatory hurdles | iShares Bitcoin Trust (IBIT) |

| Futures Crypto ETF | Uses futures contracts | Easier approval, leverage options | Contango/backwardation risks | ProShares Bitcoin Strategy ETF |

| Thematic ETF | Tracks blockchain-related stocks | Broader exposure, less volatility | Indirect crypto link | Amplify Transformational Data ETF |

| Leveraged ETF | Amplifies returns (e.g., 2x) | Potential for higher gains | Amplified losses, daily resets | Volatility Shares 2x Bitcoin ETF |

This table illustrates how choices align with goals – spot for purity, futures for accessibility. As 2026 unfolds, expect more multi-asset ETFs combining Bitcoin and Ethereum for balanced plays.

The Game-Changing Benefits for Investors in 2026

What makes crypto ETFs a breakthrough? For starters, they democratize access. Traditional barriers like technical know-how or security fears fade away, opening doors for retail investors. In 2026, with economic uncertainties, these funds offer a hedge against inflation, much like gold ETFs did in past decades.

Liquidity stands out – trade during market hours without wallet transfers. This ease boosts adoption, potentially stabilizing prices through steady inflows. Institutional investors, previously hesitant, now pour billions, as seen in 2025’s record ETF volumes. Diversification benefits too; mix crypto with stocks or bonds for balanced risk.

Tax efficiency is another plus – capital gains handling mirrors standard ETFs, simplifying filings. For passive strategies, automatic rebalancing keeps portfolios aligned. Overall, they lower entry thresholds, fostering broader participation in cryptocurrency markets.

Here’s a bulleted list of core advantages:

-

Regulatory Safeguards: Backed by oversight, reducing scam risks compared to direct buys.

-

Cost-Effective Entry: Lower fees than managing personal wallets or mining setups.

-

24/7 Market Access: Though traded in sessions, underlying assets provide constant valuation.

-

Portfolio Integration: Seamlessly fit into IRAs or 401(k)s for retirement planning.

-

Volatility Mitigation: Some ETFs use strategies to dampen swings, appealing to conservatives.

-

Educational Perk: Exposure educates users on blockchain without full immersion.

These points underscore why crypto ETFs could transform how people approach digital assets in the coming year.

Navigating the Regulatory Landscape: Progress and Predictions

Regulation has been the linchpin for crypto ETFs’ rise. The SEC’s 2024 approvals signaled a thaw, emphasizing robust custody and surveillance. In Europe, MiCA frameworks pave similar paths, ensuring consumer protection. By 2026, expect global harmonization, with Asia’s hubs like Hong Kong launching their versions.

Challenges remain – concerns over market manipulation or wash trading persist. Yet, approvals for Ethereum spot ETFs in 2025 hint at expansion to Solana or others. This evolution could attract trillions in assets under management, per Bloomberg estimates. Investors benefit from clearer rules, reducing uncertainty that plagued early crypto days.

For 2026, watch for ESG-focused ETFs, aligning with sustainable blockchain trends. Regulatory nods will likely accelerate inflows, solidifying ETFs as a staple in diversified portfolios.

Market Impact: How Crypto ETFs Reshape the Ecosystem

The influx from crypto ETFs ripples across markets. In 2025, Bitcoin ETF launches spiked prices, drawing over $50 billion in assets. This institutional money stabilizes volatility, as funds hold long-term. For altcoins, similar products could legitimize them, boosting liquidity and innovation.

Broader effects include increased adoption – financial advisors now recommend small allocations, normalizing crypto. Competition among providers drives down fees, benefiting users. However, concentration risks arise if a few giants dominate holdings.

In 2026, with potential rate cuts, ETFs might fuel a bull cycle, amplifying gains. They also bridge fiat and crypto, easing transitions for newcomers.

Getting Started: How to Invest in Crypto ETFs

Ready to dive in? Start with a brokerage like Fidelity or Vanguard, many now offer these. Research via Morningstar for ratings and fees – aim under 0.5% expense ratios. Decide allocation: 5-10% of portfolio for balance.

Buy shares like stocks – no need for exchanges. Monitor via apps for performance. For those converting gains, seamless tools help.

When building your position in crypto ETFs, consider Revbit for efficient exchanges. This platform offers quick, low-commission trades between fiat and digital assets, ensuring smooth portfolio adjustments without unnecessary delays.

Looking Ahead: Why 2026 Could Be the ETF Boom Year

Projections for 2026 paint an optimistic picture. With maturing tech like layer-2 scaling, ETFs could incorporate yields from staking, enhancing returns. Global events, such as elections favoring pro-crypto policies, might accelerate approvals.

Analysts forecast $100 billion-plus inflows, dwarfing early figures. This surge could propel Bitcoin beyond $150,000, with Ethereum following. For investors, it means more choices, from inverse ETFs for hedging to sector-specific ones.

Risks linger – market crashes or reg reversals – but the trend points upward. ETFs democratize wealth building in this space.

Final Insights: Embracing the ETF Revolution

Crypto ETFs represent a seismic shift, making digital assets approachable for 2026 investors. From spot precision to futures flexibility, they offer tools for smart exposure. Benefits like liquidity and regulation outweigh drawbacks, positioning them as game-changers. As markets evolve, staying informed on trends ensures you capitalize. Whether hedging or growing wealth, these instruments bridge old and new finance. Explore wisely, and they might redefine your strategy.