In crypto, rules aren’t set in stone, they’re encoded in software and updated by people. When those rules change, a chain can “split.” If you ever need a quick, no-signup swap during network events, you can exchange ETH to BTC in a few clicks. Below, you’ll find the core ideas behind what are blockchain forks, how they happen, and what to watch out for.

Blockchain forks explained

At a high level, a fork is just a change in a blockchain’s rules or history. Nodes (computers running the network) must agree on the same rulebook to validate blocks. When some nodes adopt new rules and others don’t, their views of “valid” blocks diverge, creating two branches. That’s the gist without the jargon.

A fork is governance happening in code. Consensus on the rules is what makes one chain; disagreement makes two.

Soft vs hard fork: the quick idea

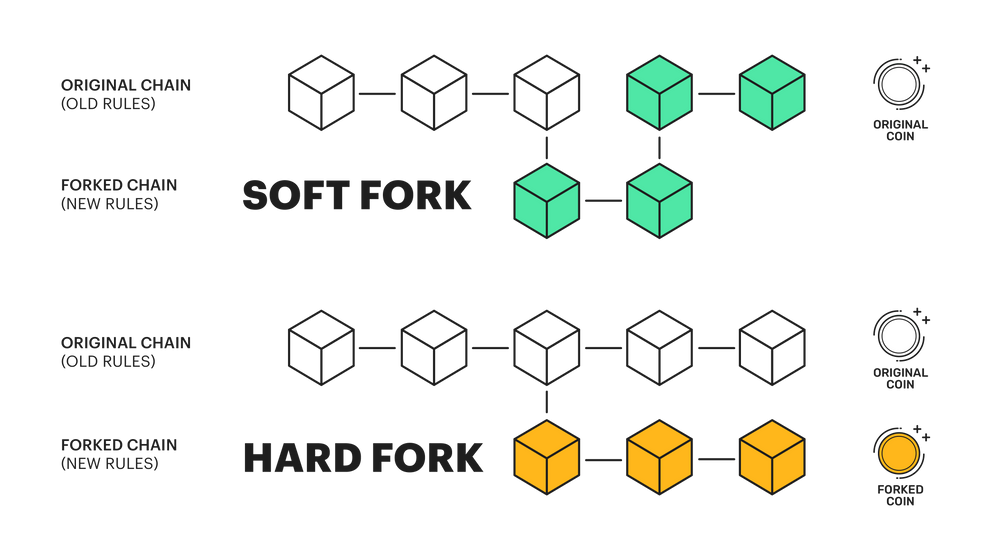

A soft fork tightens the existing rules. Old nodes still see the new blocks as valid (because the new rules are a subset of the old), so the update is backward-compatible.

A hard fork, by contrast, relaxes or changes rules in a way that old nodes will reject, so everyone must upgrade to remain on the same chain.

This difference between hard and soft fork blockchain mechanics boils down to one word: compatibility.

What are the two types of forks blockchain?

In practice, communities talk about soft vs hard fork as the two main categories. Soft — compatible and usually one continuing chain. Hard — incompatible and can create a permanent split if part of the community doesn’t upgrade.

How forks happen

Forks arise for a few common reasons:

- Upgrades & new features. Adding opcodes, improving performance, or enabling new use cases.

- Bug fixes & security. Closing vulnerabilities or tightening validation rules.

- Governance disputes. Economic or philosophical disagreements (fees, monetary policy, block size, privacy).

- Emergency responses. Coordinated actions after major incidents.

When timing, communication, and incentives align, nodes upgrade together and the network continues seamlessly. When they don’t, you may get a lasting chain split.

Practical impacts for users and builders

When a fork is announced, here’s who it affects and how:

- Node operators & miners/validators. Must pick a side (which software to run).

- Exchanges & wallets. Decide which chain to support, how to label tickers, and how to handle deposits/withdrawals during the transition.

- Developers. May need to adjust tooling, libraries, RPC endpoints, and smart-contract assumptions.

- Everyday users. Should pause large transfers until the situation is clear and network conditions stabilize.

If you follow markets, it’s handy to keep an eye on the Bitcoin price today during contentious debates, volatility can spike around upgrade windows.

Risks of blockchain forks

Even planned upgrades can carry hazards. The major hazards include:

- Replay or confusion. If a transaction can be valid on both branches, users might accidentally send funds on the wrong chain unless protections (like replay protection) are in place.

- Liquidity fragmentation. Two chains may mean two markets, split hash power or stake, and thinner order books.

- Ticker ambiguity. Which one is “the real” BTC/ETH/etc.? Custodians and exchanges may disagree, at least temporarily.

- Security assumptions. A split can lower a chain’s security budget (hash rate or stake), changing attack costs.

- App breakage. Contracts or dApps that rely on specific opcodes or consensus behavior can malfunction after upgrades.

Decision checklist: hard vs soft fork in blockchain governance

When a community weighs hard vs soft fork in blockchain roadmaps, leaders typically assess:

- Urgency & scope. Is the change strictly tightening rules (soft) or fundamentally altering them (hard)?

- Ecosystem readiness. Can node operators, exchanges, and wallets upgrade in time?

- User safety. Are replay protections, versioning, and communications clear?

- Economic incentives. Will miners/validators and major apps prefer one path?

- Long-term maintainability. Does the change simplify or complicate future updates?

Developer’s view: compatibility and contracts

Soft forks usually make rules stricter (e.g., limiting certain script paths), so old nodes accept the new blocks, but newly added features might require upgraded tooling to use. Hard forks can unlock big features (new opcodes, data structures, or execution models) but require coordinated migration. Documentation, deprecation plans, and testnets are the unsung heroes of smooth upgrades.

For a broader operational angle on keeping transactions safe, see: “What Happens If You Send Crypto to the Wrong Address” — it’s a practical primer that pairs well with this topic.

User playbook

When the rumor mill starts or a formal upgrade date is announced, the safest move is to slow down, verify details, and act deliberately. Use the checklist below to reduce avoidable mistakes and keep operations smooth, especially if you’re moving funds across services.

- Don’t rush large transfers. Wait for network and exchange notices.

- Verify chain identifiers. Double-check deposit networks (e.g., “ETH Mainnet” vs a fork).

- Update your wallet. Use the latest client from official sources; watch for replay-protection notes.

- Track service status. Some platforms may temporarily pause deposits/withdrawals.

- Document your actions. Keep TXIDs and screenshots if you operate a business or manage treasury.

If you do need liquidity movement mid-upgrade, act deliberately, confirm networks, and consider making a small test transaction first, then move the main amount.

FAQ

Soft vs hard fork blockchain: which is safer for end users?

Neither is automatically “safer.” Soft forks are backward-compatible, but poorly scoped changes can still break app assumptions. Hard forks require broad coordination; when executed well, they can be smooth, but if the community splits, you’ll see more operational complexity.

Hard vs soft fork: does one always create a new coin?

Not necessarily. A hard fork can create two active chains if both sides retain communities, miners/validators, and markets. If nearly everyone upgrades, the old chain may fade quickly.

What are blockchain forks in the context of governance?

They’re rule changes decided (implicitly or explicitly) by communities. Consensus makes one chain; disagreement makes two. The process is social first, technical second.

How can I prepare my operations around upgrade windows?

Freeze non-urgent transfers, read official client notes, confirm exchange policies, and run test transactions. Have a communication plan if you manage user funds.

Do forks impact tickers and liquidity?

Yes. Markets may temporarily re-label assets, pause services, or list both branches. Liquidity can fragment until a dominant chain emerges.

Conclusion

Forks aren’t anomalies, they’re how decentralized networks evolve. Understanding the trade-offs between compatibility and capability helps users, builders, and businesses make level-headed decisions when changes arrive. If you’re repositioning liquidity ahead of an upgrade, consider a small test swap first, then execute the main move — tools like BTC to XMR can help you adjust exposure without creating additional accounts.