Cryptocurrency mining has again become an attractive line of business. After several down years, the market is gradually stabilizing. Hardware has become more energy-efficient, and competition has increased. The easy money is gone, but with a disciplined approach mining remains profitable. Below is a review of the coins whose mining can deliver the highest returns in Q4 2025.

Track the Bitcoin price on Revbit.

Bitcoin — stability with minimal profit

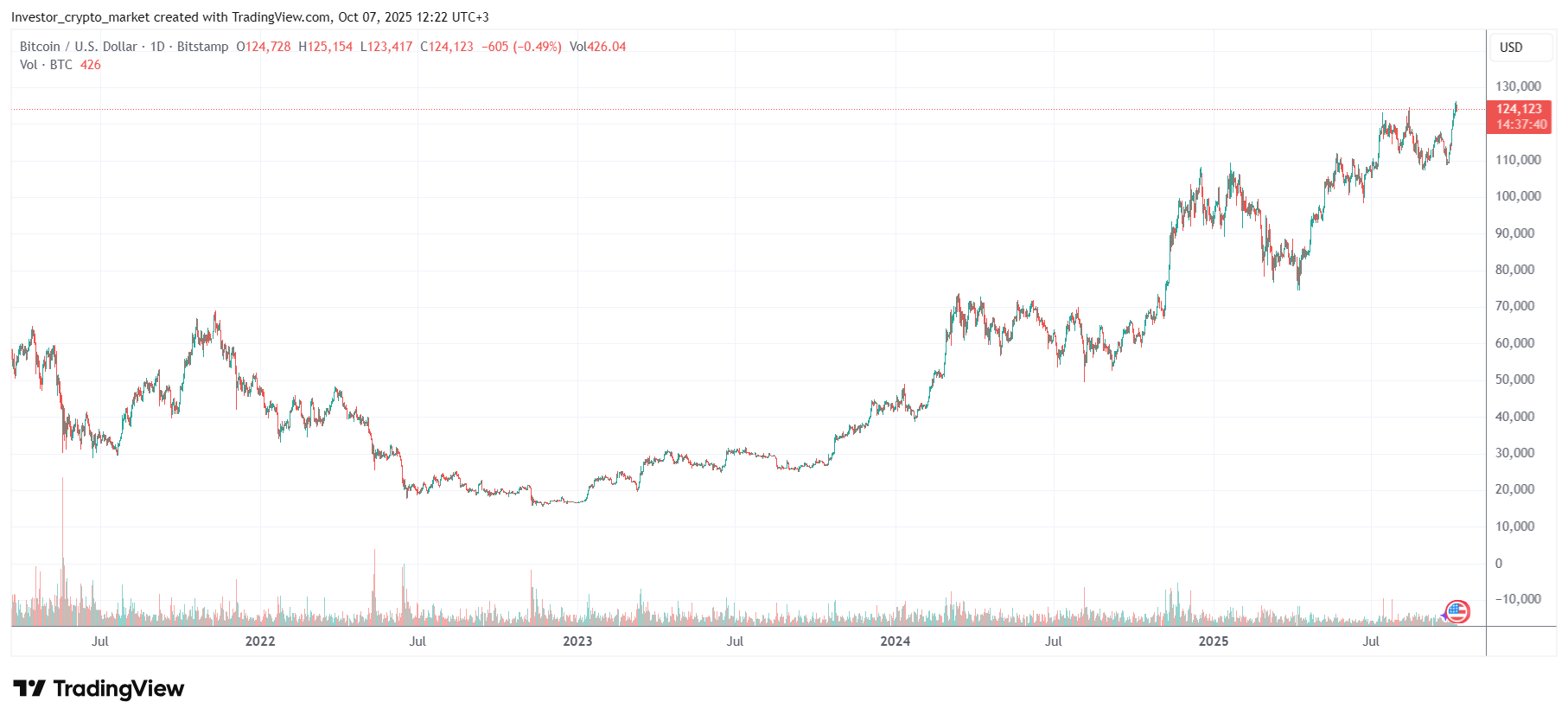

Bitcoin remains the industry flagship. After the 2024 halving, the block reward fell to 3.125 BTC and network difficulty climbed to 150.8 trillion (T). At the current $125,000–126,000 price, mining requires careful math.

Bitcoin chart. Source: TradingView

Key mining parameters:

- reward — 3.125 BTC per block;

- network difficulty — 150.8 T;

- yield — under $50 per petahash (PH/s) per day;

- profit possible with power costs up to $0.06 per kWh.

Takeaway: Bitcoin means stability and liquidity, but low margins. It suits large farms with cheap power and a long-term strategy.

Litecoin and Dogecoin — an ideal pair for ASICs

Litecoin and Dogecoin run on the same Scrypt algorithm and support merged mining. A single ASIC mines both coins simultaneously without consuming more electricity.

Litecoin and Dogecoin charts. Source: TradingView

- Litecoin reward — 6.25 LTC per block;

- Dogecoin reward — 10,000 DOGE per block (about 1 minute);

- An Antminer L9 (16 GH/s, 3.6 kW) yields $9–12 per day at $0.06 per kWh;

- hardware payback — 14–16 months at a $4,500–5,000 purchase price.

Takeaway: The Litecoin–Dogecoin combo remains one of the most profitable for ASICs. Stability, easy setup, and dual revenue make it a risk-return leader.

Kaspa — high returns but fast hardware turnover

Kaspa has fully moved into the ASIC zone. GPUs are no longer efficient here, but new-generation ASICs deliver excellent results.

Kaspa chart. Source: TradingView

- A KS5L unit (12 TH/s, 3.5 kW) yields $6–8 per day at $0.05 per kWh;

- payback — 12–15 months;

- new models arrive every 8–10 months.

Takeaway: Kaspa is profitable if you’re ready to refresh hardware frequently. High profits are possible only with timely upgrades and close monitoring of the coin price.

Monero — CPU mining without noise or dust

Monero, despite the scandal over hash-power hijacking by the Qubic pool, remains the leader among coins mined on CPUs. The RandomX algorithm is ASIC-resistant, so you can mine XMR even on consumer processors.

Monero chart. Source: TradingView

- reward — 0.6 XMR per block;

- A Ryzen 9 5950X (14 kH/s) yields about 0.002 XMR per day;

- profit possible with power costs up to $0.04 per kWh.

Takeaway: Monero is a great option for putting idle compute to work. Returns are modest but steady and require little extra cost.

Flux — the GPU leader after halving

Flux halving occurred on 6 August 2025: the reward dropped to 18.75 FLUX and the price rose by roughly 25%. That kept mining attractive.

Flux chart. Source: TradingView

- algorithm — Zelhash (Equihash-125,4);

- an RTX 3070 (45 Sol/s, 140 W) yields $0.25–0.30 per day at $0.05 per kWh;

- payback — around 24 months.

Takeaway: Flux is among the most resilient GPU projects. Strong community activity and a stable economy make it a miners’ favorite.

Ravencoin — reliable GPU classic

Ravencoin has been a steady GPU option for years. The KawPoW algorithm is optimized for cards with 6 GB or more of memory, and mining is simple and predictable.

Ravencoin chart. Source: TradingView

- reward — 2,500 RVN per block;

- an RTX 3060 Ti (20 MH/s, 140 W) yields about $0.25 per day at $0.05 per kWh;

- next halving expected in January 2026.

Takeaway: Ravencoin is a solid market middleweight. It won’t set profit records but offers steady mining with transparent economics.

Ethereum Classic — the GPU leader in stability

After Ethereum’s move to Proof-of-Stake, Ethereum Classic became the main destination for GPU miners. The network is stable, liquidity is high, and the price is predictable.

Ethereum Classic chart. Source: TradingView

- reward — 2.048 ETC per block;

- network hashrate — 90–100 TH/s;

- an RTX 3060 Ti (60 MH/s, 130 W) yields $0.25–0.30 per day at $0.05 per kWh.

Takeaway: Ethereum Classic is the best option for stable GPU mining. Good liquidity and moderate price swings make it a reliable bet.

Ergo and Alephium — niche but promising coins

Ergo and Alephium appeal to advanced miners who are ready to take on risk for potentially higher returns. These coins are less liquid but can deliver good results when prices rise.

Ergo and Alephium charts. Source: TradingView

- Ergo uses the Autolykos v2 algorithm;

- Alephium — the BLAKE3 algorithm with yields 10–15% higher;

- GPU power draw — 140–160 W.

Takeaway: Ergo and Alephium are suitable for portfolio diversification. These projects are riskier but can add extra profit if market dynamics are favorable.

Comparative mining profitability table

| Coin | Hardware type | Performance | Daily revenue | Power cost | Payback |

|---|---|---|---|---|---|

| Bitcoin | ASIC (S21, S23) | 200–250 TH/s | $10–13 | $0.06/kWh | 26–30 months |

| Litecoin + Dogecoin | ASIC L9 | 16 GH/s | $9–12 | $0.06/kWh | 14–16 months |

| Kaspa | ASIC KS5L | 12 TH/s | $6–8 | $0.05/kWh | 12–15 months |

| Monero | CPU Ryzen 9 5950X | 14 kH/s | $0.20–0.25 | $0.04/kWh | 30+ months |

| Flux | GPU RTX 3070 | 45 Sol/s | $0.25–0.30 | $0.05/kWh | 24 months |

| Ravencoin | GPU RTX 3060 Ti | 20 MH/s | $0.25 | $0.05/kWh | 26–28 months |

| Ethereum Classic | GPU RTX 3060 Ti | 60 MH/s | $0.25–0.30 | $0.05/kWh | 22–24 months |

| Ergo / Alephium | GPU | — | $0.27–0.35 | $0.05/kWh | 25–30 months |

Figures are indicative and depend on coin prices, network difficulty, and pool fees. For precise calculations, use calculators such as “WhatToMine” or “AsicMinerValue”.

Bottom line

Bitcoin remains a byword for reliability but delivers minimal profit. Among ASICs, the Litecoin–Dogecoin duo offers the best returns, while Kaspa can yield high income if you actively refresh hardware.

On the GPU side, Flux and Ethereum Classic stand out — combining stability, liquidity, and balanced risk. Ravencoin remains a “workhorse,” while Ergo and Alephium appeal to those exploring new niches.

Monero suits calm miners who prefer stability and low overhead.

The cardinal rule of mining in 2025 is to count every cent. Hardware efficiency, power management, and precise calculation matter more than chasing the “hot” coin. Discipline and adaptability determine who stays profitable today.

Exchange Bitcoin for USDT or another cryptocurrency on favorable terms — on Revbit.