A few years ago, CBDC in crypto sounded like a niche policy debate. Today, central bank digital currencies (CBDCs) are edging into the mainstream, with pilots scaling and rulebooks taking shape. In 2024–2025, 91% of central banks surveyed by the BIS reported they’re exploring a CBDC—retail, wholesale, or both—underscoring how quickly the field is maturing.

What is a CBDC in crypto?

Source: Mungfali

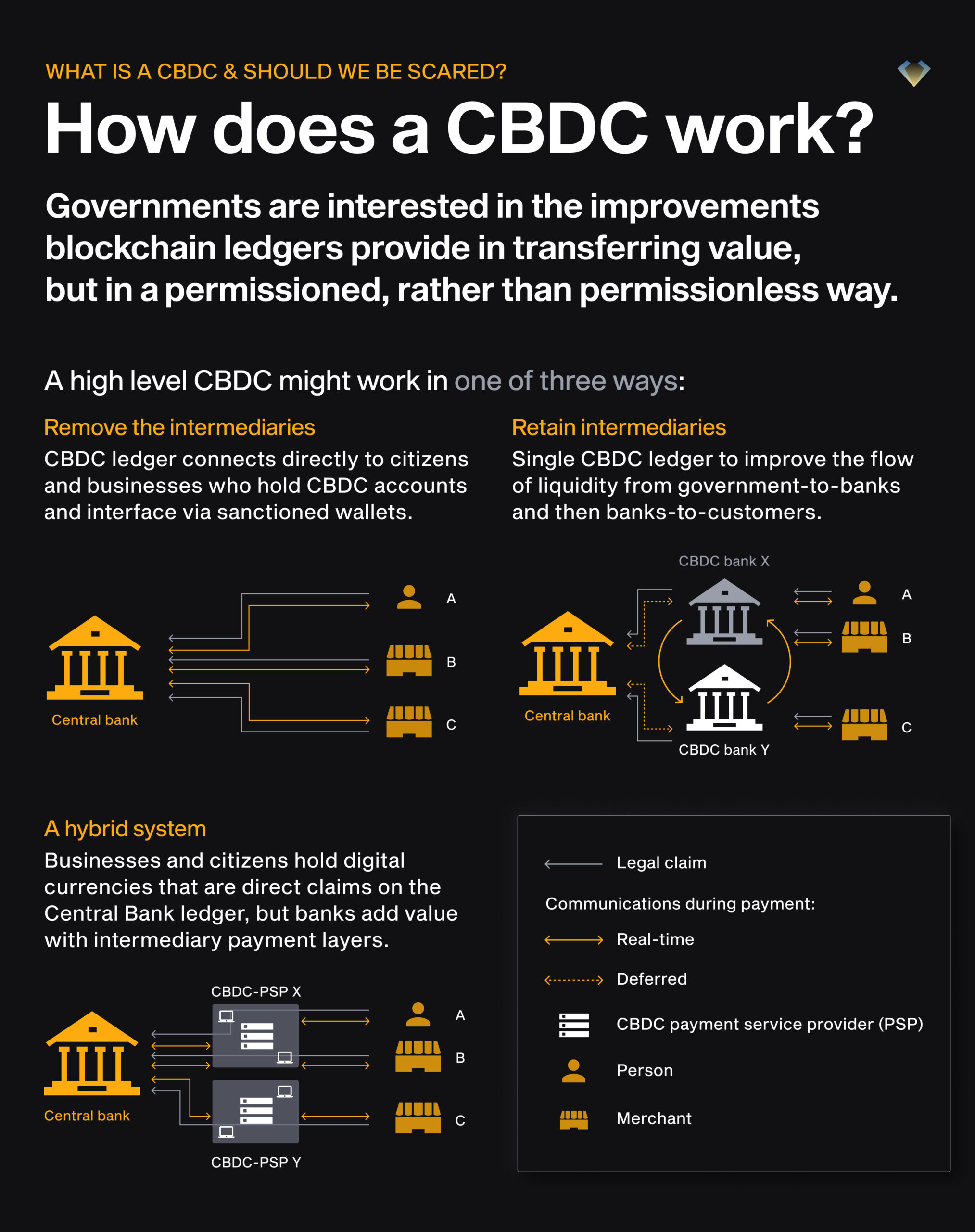

A CBDC is digital money issued by a country’s central bank—think of “digital banknotes” on your phone rather than paper in your wallet. Crucially, CBDCs are a direct liability of the central bank, which makes them risk-free in the way physical cash is. That’s different from balances at a commercial bank or an e-money app, which are liabilities of private companies.

In Europe, the prospective digital euro is framed as a “digital form of cash” available to everyone in the euro area. It’s in a preparation phase through October 2025 while the EU debates the legal framework and operating rulebook.

The U.S. position is more cautious: the Federal Reserve has made no decision to issue a CBDC and says it would only proceed with clear authorization from Congress.

CBDC vs cryptocurrency: what’s the difference?

Source: Pixelplex

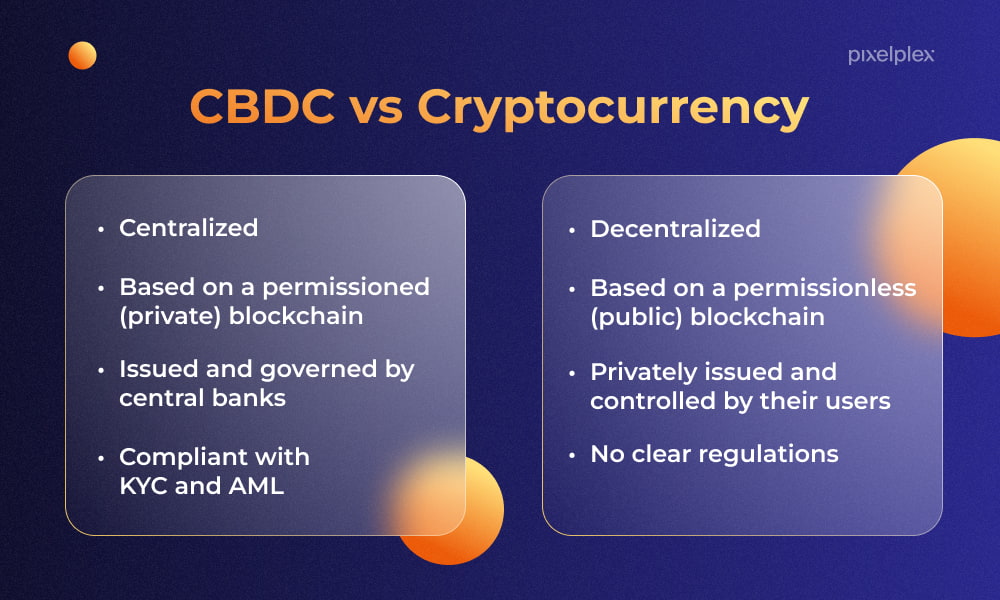

If you’re comparing CBDC vs cryptocurrency, the core contrasts are:

- Issuer & liability: A CBDC is public money—issued by a central bank and a claim on that bank. Bitcoin, Ether, and most cryptoassets have no issuer; stablecoins are privately issued.

- Legal status: CBDCs can be granted legal-tender status (like banknotes). Crypto generally isn’t legal tender (exceptions are rare) and depends on private acceptance or regulation. The EU explicitly envisions the digital euro stablecoins as legal tender.

- Governance & policy: CBDCs are designed to integrate with monetary policy and payment oversight; crypto networks rely on code, economic incentives, and open networks. IMF notes highlight how CBDC design choices affect monetary operations.

- Privacy & compliance: CBDCs aim to balance data protection with AML/CFT rules; crypto is pseudonymous by default, with compliance layered on top by exchanges and wallets. IMF papers caution that CBDC data use must protect privacy to maintain public trust.

So, is a CBDC a cryptocurrency? Not really. A CBDC is digital fiat—state money in electronic form. Crypto is a broader category of privately issued or decentralized digital assets. Stablecoins sit somewhere in between, pegged to fiat but not central-bank money.

Why CBDCs are rising now

Two forces are pushing CBDCs forward:

- Payment modernization & sovereignty. Policymakers want resilient, competitive payment rails that don’t rely solely on private platforms or foreign networks. The ECB’s digital euro work is explicit about safeguarding monetary autonomy and harmonizing payments across the euro area.

- Stablecoins changed the conversation. As dollar-denominated stablecoins surged, central banks warned about run risks, opacity, and monetary sovereignty concerns, urging stronger rules and (in some cases) public alternatives. BIS and IMF publications in 2024–2025 repeatedly flagged stablecoin risks and urged robust regulation.

On the regulatory side, the EU’s MiCA regime began applying to stablecoins in June 2024, with the rest of the crypto-asset and service-provider rules following in December 2024—one reason Europe can push CBDC and private crypto rules in tandem. FATF also tightened “travel rule” expectations in 2025 to align payment transparency for virtual assets.

CBDCs in the wild: a quick crypto list

If you’re looking for a practical CBDC crypto list, these examples illustrate where things stand:

- Bahamas — Sand Dollar (live since Oct 2020). The world’s first nationwide CBDC; adoption has been modest, and authorities are moving to require banks to provide access to improve usage.

- Nigeria — eNaira (launched Oct 2021). Africa’s first CBDC; uptake has been slower than hoped, but it remains in circulation and policy focus.

- Jamaica — JAM-DEX (phased rollout 2022). Legal-tender CBDC introduced to the public on a phased basis from 2022.

- China — e-CNY (large-scale pilot). Expanding pilots include Hong Kong, where residents can spend e-CNY locally—a step toward cross-border use. Reported wallet and transaction figures underscore the pilot’s scale.

- India — e₹ (retail & wholesale pilots). The Reserve Bank of India is broadening use cases, including offline and programmability, as it experiments with distribution beyond banks; usage has waxed and waned as incentives change. Atlantic Council tracks India as one of the largest pilots.

- Brazil — Drex (pilot). The central bank’s Drex program has been piloting wholesale tokenized settlement; timelines have shifted, but experimentation continues as designs evolve.

For a global picture—including who’s in research, development, pilot, or live—the Atlantic Council CBDC Tracker is the most-cited, continuously updated dashboard.

The difference between CBDC and cryptocurrency in practice

Here’s where CBDC and cryptocurrency might collide—or coexist:

- Retail payments. CBDCs aim to be wallet-friendly, instant, and cheap for day-to-day spending—territory where crypto’s user experience has often lagged. If CBDC wallets plug into existing QR and instant-payment networks (as seen in India’s UPI experiments), CBDCs could become a default digital cash option.

- Cross-border rails. Wholesale CBDCs and cross-border projects (for example, mBridge, now joined by Saudi Arabia) target bank-to-bank settlement efficiencies—and could chip away at stablecoins’ cross-border niche if they deliver speed and certainty at scale.

- Stablecoins vs CBDC. Stablecoins are critical in crypto markets and tokenized finance, but central banks and the IMF highlight run, backing, and governance risks. The policy direction is clear: regulate stablecoins as financial products and keep CBDC options open.

- DeFi & tokenization. CBDC could be the “risk-free leg” in tokenized markets, reducing settlement uncertainty. Whether central banks allow programmability and smart-contract hooks will decide how far CBDC reaches into DeFi. The ECB’s digital euro work and BIS discussions of a “unified ledger” hint at that future.

- Financial inclusion. In theory, CBDCs can widen access, but real-world adoption has been uneven (Caribbean and Nigeria show the UX and incentive challenges). Design, merchant acceptance, and integration with existing payment habits matter.

Risks and trade-offs you should watch

Even CBDC advocates acknowledge trade-offs:

- Privacy vs compliance. A “digital trail” has benefits (fraud detection, anti-money laundering) and costs (surveillance concerns). IMF guidance stresses getting privacy, data minimization, and governance right or risk undermining trust in central bank money.

- Bank disintermediation. If CBDC is too attractive, deposits could migrate from banks to CBDC wallets, raising funding costs and altering monetary transmission. IMF notes analyze scenarios and design mitigants (limits, non-interest CBDC, tiered wallets).

- Operational resilience & cyber. A retail CBDC would be critical national infrastructure; cyber resilience and fallback (including offline) features are core design goals in multiple pilots.

- Policy fragmentation. The U.S. and EU are taking different routes—Washington more supportive of regulated stablecoins and skeptical of a retail CBDC; Brussels advancing MiCA and pushing ahead with the digital euro rulebook. This divergence will shape how CBDC crypto ecosystems interoperate across borders.

What this means for crypto investors, builders, and policymakers

- On-/off-ramps get stricter, not looser. With MiCA live for stablecoins and FATF tightening the travel rule, compliant rails become table stakes. Expect regulated stablecoins, deposit tokens, and CBDC interfaces to dominate fiat-to-crypto gateways.

- Stablecoin selection may compress. Stronger reserve, redemption, and disclosure rules will likely favor a smaller set of large, well-regulated issuers; others could exit or pivot. BIS critiques accelerate that trend.

- New opportunities in tokenized finance. If CBDCs (or central-bank-settled rails) can plug into tokenized deposits and securities, builders get more reliable cash-leg settlement—fertile ground for on-chain capital markets.

- Narrative shift, not a zero-sum game. CBDCs aren’t designed to replace crypto. They’re a public option for digital cash and bank-to-bank settlement. Crypto will keep pushing at the frontier—programmability, permissionless innovation, and global access—while CBDCs modernize the sovereign core of money. Expect a mixed stack: CBDC, regulated stablecoins/deposit tokens, and open crypto rails side by side.

Conclusion

If you came here asking for the difference between CBDC and cryptocurrency or is CBDC a cryptocurrency, the short answer is:

- CBDC = digital cash from the state;

- Cryptocurrency = digital assets from networks or private issuers.

The long answer is the story unfolding now: central banks are racing to design digital money that fits modern life, while regulators corral crypto’s risks without choking off innovation. Keep an eye on three signposts in 2025: the EU’s digital euro rulebook and legislation, the U.S. congressional stance on CBDC and stablecoins, and cross-border pilots like mBridge.