With crypto markets heating up again as we head into 2026, folks are buzzing about ways to make their holdings work harder without constant screen time. Enter staking crypto – that low-key method where you lock up coins to help run a network and snag rewards in return. It’s like putting money in a high-yield savings account, but with blockchain flair. If you’re tired of just HODLing through dips or chasing pumps, this could be your shot at steady passive income. But is it all smooth sailing? We’ll dig into the hows, whys, and watch-outs, from newbie basics to 2026 trends. Think Ethereum upgrades or fresh altcoins – staking’s evolving fast. By the end, you’ll know if it’s worth tying up your stack. Let’s break it down without the jargon overload.

The Lowdown: What Staking Crypto Really Means

Picture this: Instead of mining with power-guzzling rigs, you just park your tokens in a wallet and let them vote on transactions. That’s staking in a nutshell – a key part of proof of stake systems where your coins help validate blocks and keep things secure. You earn passive income through staking rewards, usually extra tokens from the network. It’s been around since early PoS chains like Peercoin, but exploded with Ethereum’s switch in 2022.

Why care now? In 2026, with more chains ditching energy-hog proof of work, staking’s mainstream. It beats trading’s stress – rewards trickle in daily or weekly, compounding if you reinvest. But it’s not free money; you lock funds for weeks or months, missing quick sells. Still, for long-haulers, it’s a sweet gig supporting decentralization while padding your wallet. Just pick coins with solid tokenomics to avoid dilution traps.

Inside the Machine: How Proof of Stake Makes It Tick

At the heart, proof of stake picks validators based on how much they’ve staked – more coins, higher odds of scoring a block and its fees. Your role? Delegate or run a node, earning a slice of new mints or transaction cuts. It’s greener than mining, using way less juice, which fits 2026’s eco-push.

Networks like Cardano or Solana tweak it – some add randomness to avoid rich-get-richer vibes. Rewards? Tied to inflation rates, often 4-12% APY yearly. But watch slashing: Go offline or mess up, and you lose a chunk. It’s blockchain security at its core, with you as a mini-guardian. For passive earners, it’s hands-off once set – no constant tweaks needed.

The Upsides: Why Staking Rocks for Passive Income

No doubt, staking shines for folks wanting income without the grind. First off, it’s predictable – lock in, watch rewards roll. Unlike yield farming’s wild rides, this ties to network health. In 2026, with DeFi maturing, expect steadier yields from real usage, not hype.

Benefits stack up: Low entry – start with $100 on some chains. Governance perks let you vote on upgrades, giving voice. Plus, it hedges volatility; holding through stakes smooths bumps. Environmentally? It’s a win over mining’s carbon footprint. For passive income seekers, compounding turns small stacks into bigger ones over time. Just factor taxes – rewards count as income in many spots.

Hot Picks: Best Staking Coins Heading Into 2026

Choosing the right coin’s key – aim for established ones with growth. Ethereum leads post-Merge, offering 4-6% APY on 32 ETH nodes, but pools lower barriers. Cardano’s steady, with 5-7% via delegated staking. Solana? Faster, but volatile – 6-8% if you pick solid validators.

For emerging bets, Polkadot’s parachains could yield 10-15% with relay chain ties. Cosmos (ATOM) hubs interconnects, around 8-12%. But 2026 might see layer-2 boosts, pumping rewards.

Here’s a quick table sizing up top contenders based on current trends projected forward:

| Coin | Expected APY (2026) | Minimum Stake | Lockup Period | Network Strength | Risk Level |

|---|---|---|---|---|---|

| Ethereum (ETH) | 4-6% | None (pools) | Flexible | High | Low |

| Cardano (ADA) | 5-7% | Low | None | Medium-High | Low-Medium |

| Solana (SOL) | 6-8% | Low | 2-4 days | High | Medium |

| Polkadot (DOT) | 10-15% | Medium | 28 days | Medium | Medium |

| Cosmos (ATOM) | 8-12% | Low | 21 days | Medium | Medium-High |

These are estimates – check real-time via explorers. Diversify to spread staking risks.

Jump In: Your Step-by-Step to Staking Crypto

Eager to start? It’s simpler than you think. Here’s a straightforward list to get rolling:

-

Pick Your Coin: Research best staking coins 2026 – factor APY, lockups, and community vibe.

-

Grab a Wallet: Use non-custodial like Walletverse or hardware for control. Exchanges like Binance simplify but hold keys.

-

Buy Tokens: Swap fiat or other coins – platforms make it easy.

-

Choose a Method: Go solo node for max rewards (tech-heavy) or delegate to pools for ease.

-

Lock and Stake: Follow app prompts – approve transactions, set amounts.

-

Monitor Rewards: Apps track accruals; compound by restaking.

-

Unstake Wisely: Plan exits around periods to avoid penalties.

-

Stay Safe: Enable 2FA, avoid phishing – security first.

Start small, like $200, to test waters. In months, you’ll see passive gains build.

Heads Up: Staking Risks and Smart Dodges

It’s not all roses – staking risks lurk. Market dips can wipe rewards if coin values tank. Slashing hits if validators flop, costing 1-10%. Liquidity locks tie funds during crashes.

2026 adds reg twists – tighter KYC on platforms. Inflation dilutes if rewards outpace utility. Dodge by vetting validators (uptime 99%+), diversifying chains, and using liquid staking for tradeable tokens while earning.

Watch scams too – fake pools phish keys. Stick to audited staking platforms like Lido or Rocket Pool for peace.

Mix It Up: Types of Staking to Fit Your Style

Staking’s not one-size – varieties abound. Basic locks direct on-chain. Delegated proof of stake lets you vote reps, like in Tron. Liquid staking (LSTs) gives derivatives for DeFi plays while rewards flow.

Cold staking keeps coins offline for safety. Yield-bearing adds lending twists. In 2026, expect restaking – stake LSTs again for layered yields, like EigenLayer on ETH. Pick based on risk tolerance – liquid for flexibility, cold for paranoia.

Gear and Spots: Top Staking Platforms for 2026

Platforms ease the tech – Binance Staking locks with one click, yields competitive. Kraken’s secure, with fiat ramps. For DeFi fans, Aave or Compound blend staking with borrows.

Wallets like Ledger integrate staking apps. Tools? Dashboards track APY real-time. When prepping, acquiring coins matters – that’s where Revbit steps up. This exchanger nails fast, low-fee swaps from fiat to staking-ready tokens, keeping your setup secure without big exchange waits.

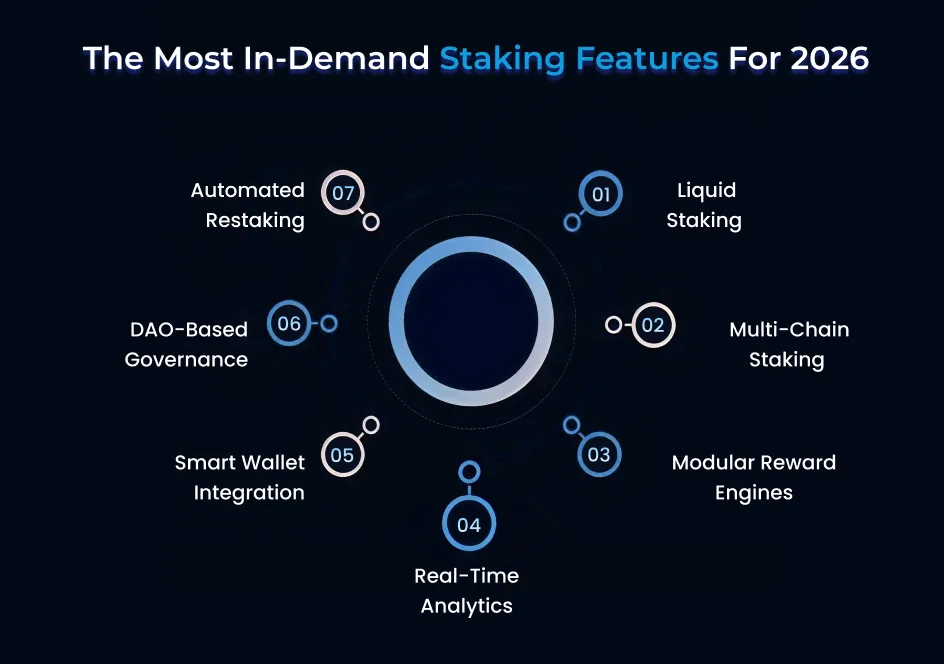

Crystal Ball: Staking Trends Shaping 2026

Peering ahead, 2026 sees staking boom with Ethereum’s Dencun upgrades slashing costs. More chains adopt PoS hybrids for speed. Liquid options dominate, blending with NFTs or gaming for fun yields.

Regs push transparency – expect audited rewards. Green staking ties to carbon credits. AI tools predict best validators, optimizing returns. Overall, it’s maturing into reliable passive income, less gamble.

The Verdict: Your Path to Passive Crypto Wins in 2026

Wrapping up, staking crypto’s a solid play for earning passive income in 2026 – greener, easier than mining, with rewards fueling growth. From proof of stake basics to picking platforms, it’s accessible for beginners yet deep for pros. Weigh risks, start small, and diversify. If markets hold, those compounded gains could snowball. Not for quick flips, but for patient builders? Golden. Dive in informed, and let your coins work overtime. What’s your first stake? Share thoughts.