Solana has carved out a spot as one of the quicker blockchains around, pulling in folks who want fast deals without hefty fees. Heading into the back half of 2025, it’s holding its own while Bitcoin chills after its halving and Ethereum tweaks its tech. The setup here lets apps run smoothly, from money lending to games, putting it on the map for builders and users. The Solana ecosystem is explained in basic terms: it’s a speedy chain built to juggle lots of swaps at once, keeping things cheap and spread out. With its special time-stamping trick, it skips some of the jams other nets face, raking in billions tied up in value and sparking fresh ideas across fields. This look covers its roots, what it’s good for now, and where it’s headed, shining a light on why more eyes turn its way as markets pick up.

What Is Solana?

What is Solana? Picture a base-layer chain kicked off in 2020 by Solana Labs, tackling the big puzzle of making things fast, safe, and not too bossed around. It ditches the old energy-hog ways of early Ethereum, mixing proof-of-stake with its own Proof-of-History stamp to clock deals quicker. This setup cranks out up to 65,000 swaps a second for pennies each, landing it among the zippiest options out there.

The home token, SOL, keeps things ticking—covers fees, lets you stake for rewards, and votes on changes. By this point in 2025, SOL’s total worth floats near $116 billion, backed by faith from big-money players as the net gets beefed up with stuff like Firedancer for even better runs. It backs languages like Rust and C for easy app making, helping devs whip up stuff without headaches. As more join, Solana carves a niche for heavy-lift jobs where other chains bog down.

Key Use Cases

Solana packs a punch in real spots, thanks to its quick turns and tiny costs. Solana use cases kick off with DeFi, where setups like Serum let trades fly without big slips, and NFT hubs like Magic Eden churn millions of drops minus steep tabs. Games pop here too—titles like Star Atlas pull players with earn-while-play vibes, no lag in sight.

Payments zip along, with wallets like Phantom making sends a breeze for daily stuff. Businesses tap it for trackable supply lines, clear as day. Come 2025, tokenizing real stuff like shares or houses picks up, letting folks own bits without full buys. These bits show Solana’s knack for busy scenes, pulling over 100 million active spots.

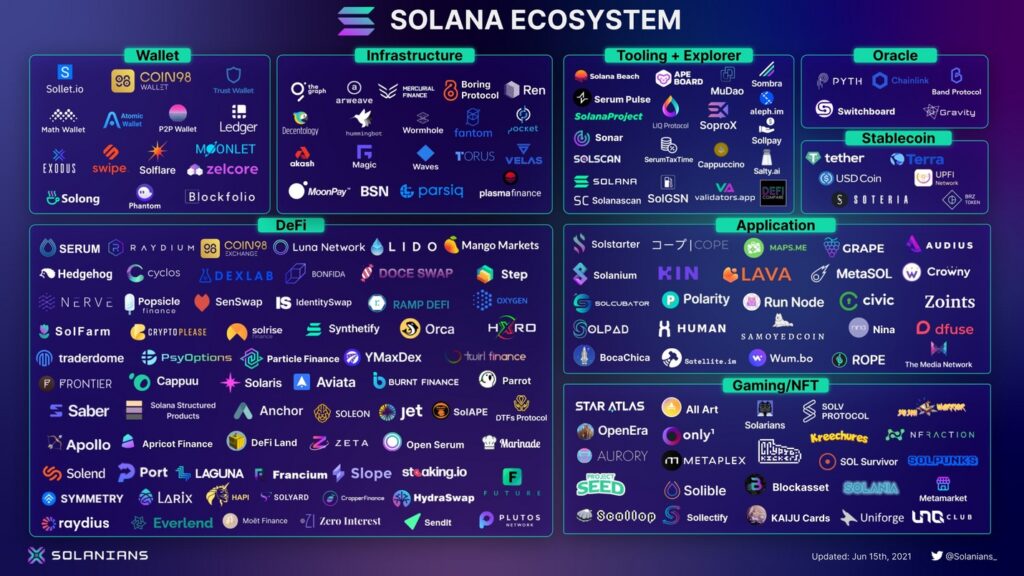

Ecosystem Components

Solana’s world builds on linked pieces that keep it humming, from apps folks use daily to ties that spread its reach. This web of stuff and team-ups makes a lively spot for everyone involved.

DApps

DApps anchor it all, with loads up and running by now in 2025. Standouts cover Jupiter for pulling the best swap rates across DEXs, saving on costs, and Raydium for pool-based trades that handle crowds smooth. Chat apps like Dialect let decentralized talks flow, while lending spots like Mango dish leveraged deals. Game ones such as Aurory mix NFTs with fun, hitting big user numbers. These highlight Solana’s strength in juggling tough tasks without hitches, keeping folks coming back.

Partnerships

Team-ups crank up the juice—Solana links with outfits like Visa for stablecoin sends, making cross-border cash quicker. Hooks with Google Cloud amp node runs, cutting downtimes. Deals with phone makers push Solana Saga devices, stuffing wallets right in for easy grabs. These bonds bring everyday use, from pays to big biz, locking Solana in as a go-to.

Community and Adoption

Solana’s crowd buzzes with drive, tallying over 2 million active folks and heaps of builders by 2025. Spots like Reddit’s r/solana and Discord groups share hacks, while meets like Breakpoint pull thousands for swaps and chats. Solana adoption forecast eyes 500 million users by 2030, pushed by phone ties and low hurdles. Big-money flows spike, with ETFs stashing billions in SOL.

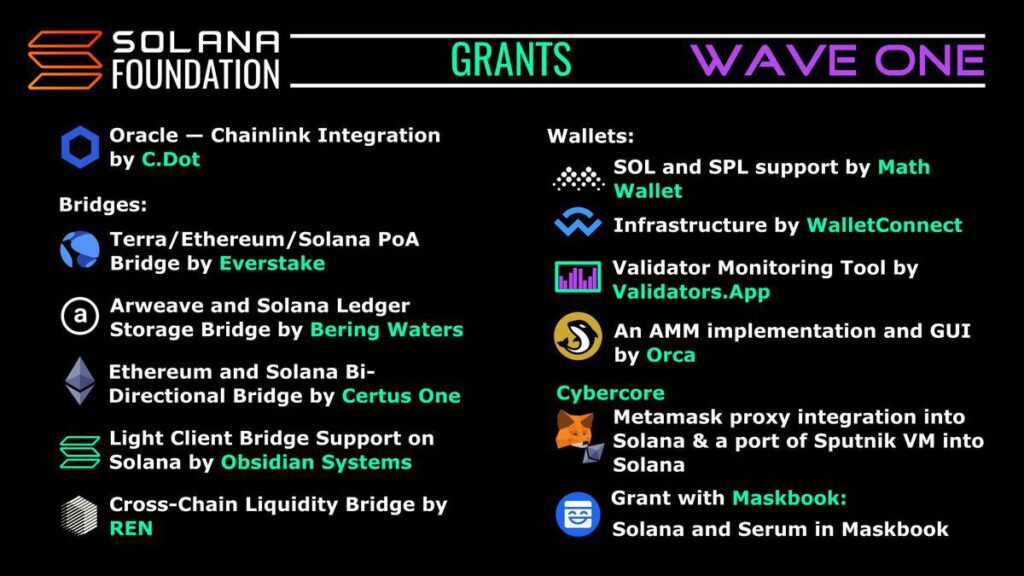

Boosts come from Solana Foundation grants, funding apps and gear. In fresh markets, cheap sends draw the unbanked for cash home. Past glitches get patched with tweaks, rebuilding faith. All in, lively chats keep the push going, turning Solana into a crowd-pulled power.

Solana Long-Term Outlook

Solana long-term outlook looks up, with guesses hitting $500+ per SOL by 2030 as scale-ups roll. Tweaks like Firedancer target 1M swaps a second, outrunning others and pulling mass crowds. Team-ups with comms firms might stuff Solana in phones, spreading to billions. DeFi locked value could top $50B, fueled by slick lending and swaps.

Hurdles like rivalry from L2s or fresh chains linger, but Solana’s pace gives it legs. Green lights from rules in EU and US amp belief. For flips inside the setup, Revbit dishes crypto-to-crypto without ID checks, keeping things quick and under wraps for smooth shifts. Pick chains smart—ones with low tabs fit best.

Wrapping up, the Solana ecosystem rolls as a lively player in chains, mixing pace, cheap runs, and a buzzing crowd to push real change. From its base as a fast platform to varied uses in lending, games, and more, Solana dishes tools that pull devs and folks alike. The setup’s pieces, like fresh apps and key team-ups, keep growth humming, while strong uptake hints at a sunny road. Bumps like net steadiness get sorted with fixes, setting up for lasting spread. Peeking ahead, Solana’s long haul promises big, with guesses spotlighting its spot in wide uptake and worth building. For cash folks and makers, dipping into Solana taps a net ready for top spots in crypto’s shift—stay tied, dig its gear, and gear up for the chances it frees.