If you’ve ever wondered what is Ripple or what is XRP/XRPL, you’re not alone. Ripple (the company) builds enterprise payment and custody software and now issues a USD stablecoin (RLUSD). The XRP Ledger (XRPL) is a public blockchain first launched in 2012 with a built-in decentralized exchange, ultra-low fees and fast finality; XRP is its native asset. The two overlap—Ripple uses XRPL where it fits—but they’re not the same thing.

Below, you’ll find the Ripple ecosystem explained in one place: the tech pillars, key Ripple utilities, what’s actually shipping on XRPL, and a grounded Ripple long-term outlook for 2025 and beyond.

Technology: what’s under the hood

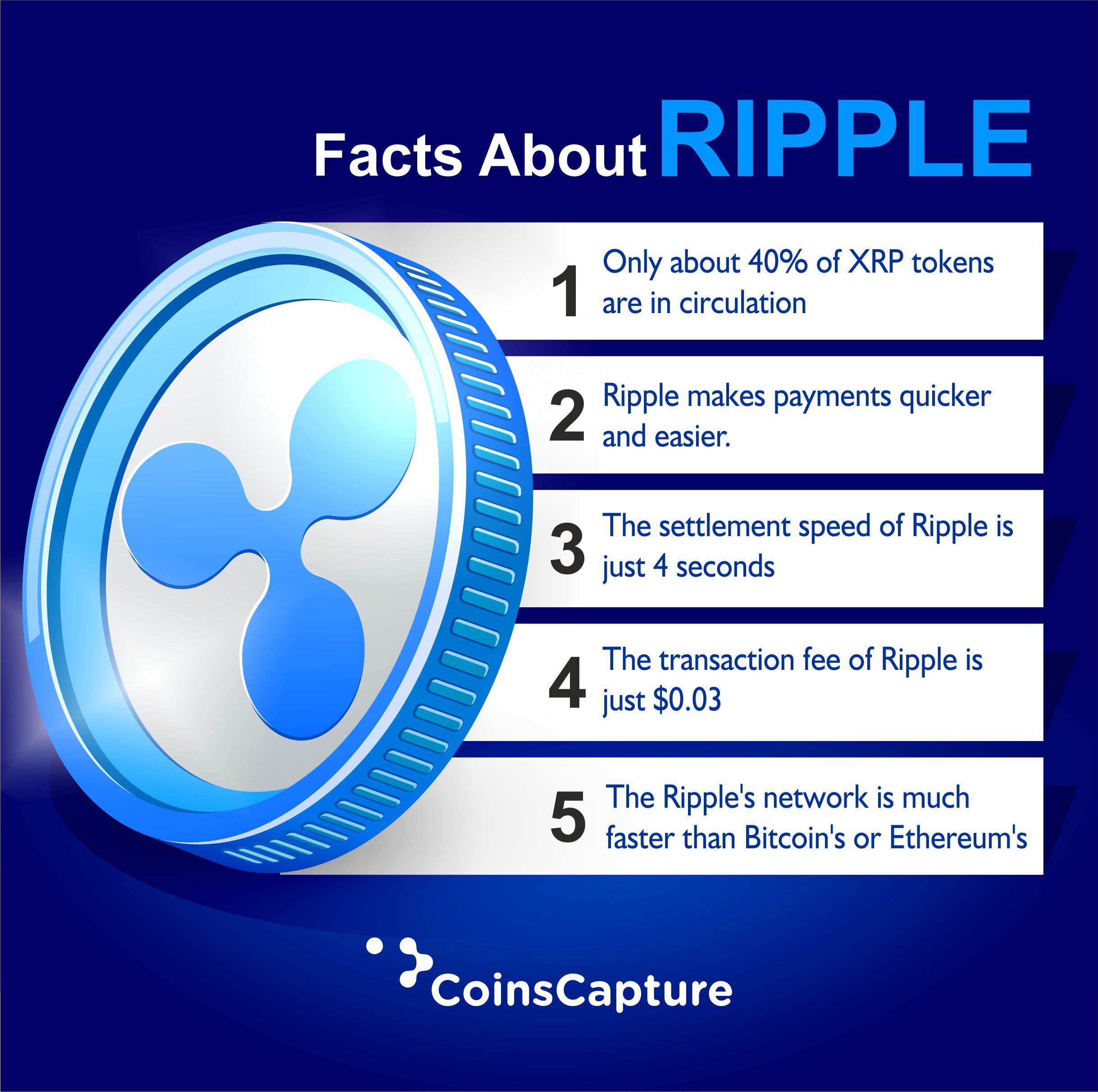

Source: Pinterest

XRPL’s core features (fast, low-cost, payments-first)

XRPL is a public, permissionless ledger with a history of payments features: native multi-currency accounts, pathfinding for cross-currency payments, payment channels, and tiny, burn-based transaction fees that help resist spam. It also has a built-in DEX (order book) that predates most DeFi, and now a native AMM to complement order-book trading.

XRPL added native NFTs (XLS-20) and continues to ship protocol upgrades via amendments. The docs track each amendment—handy if you’re checking whether a feature is live on mainnet.

Ripple Payments (formerly “RippleNet/ODL”)

On the enterprise side, Ripple’s flagship is Ripple Payments—APIs that let banks/fintechs send real-time cross-border payouts across 90+ markets and 55+ currencies, with optional use of digital assets. In 2025, the product materials emphasize stablecoin on/off-ramps and a one-API reach into a global payout network.

Ripple leans on existing payment data standards, notably ISO 20022, and has even showcased dev-components that translate ISO 20022 payment instructions into crypto flows—important if you want traditional finance systems to talk to blockchains without rebuilding everything.

New in 2025: an EVM sidechain for XRPL

In June 2025, the XRPL EVM sidechain went live on mainnet, giving developers an Ethereum-compatible environment that stays connected to XRPL via the Axelar bridge. The aim: bring Solidity apps (DeFi, NFTs, tooling) while keeping XRPL’s payment-centric mainnet lean. It’s early days, but the launch matters for developer choice and composability.

Reality check: public dashboards and independent coverage suggest adoption is still ramping and, for now, modest—so treat it as a medium-term bet, not an instant growth hack.

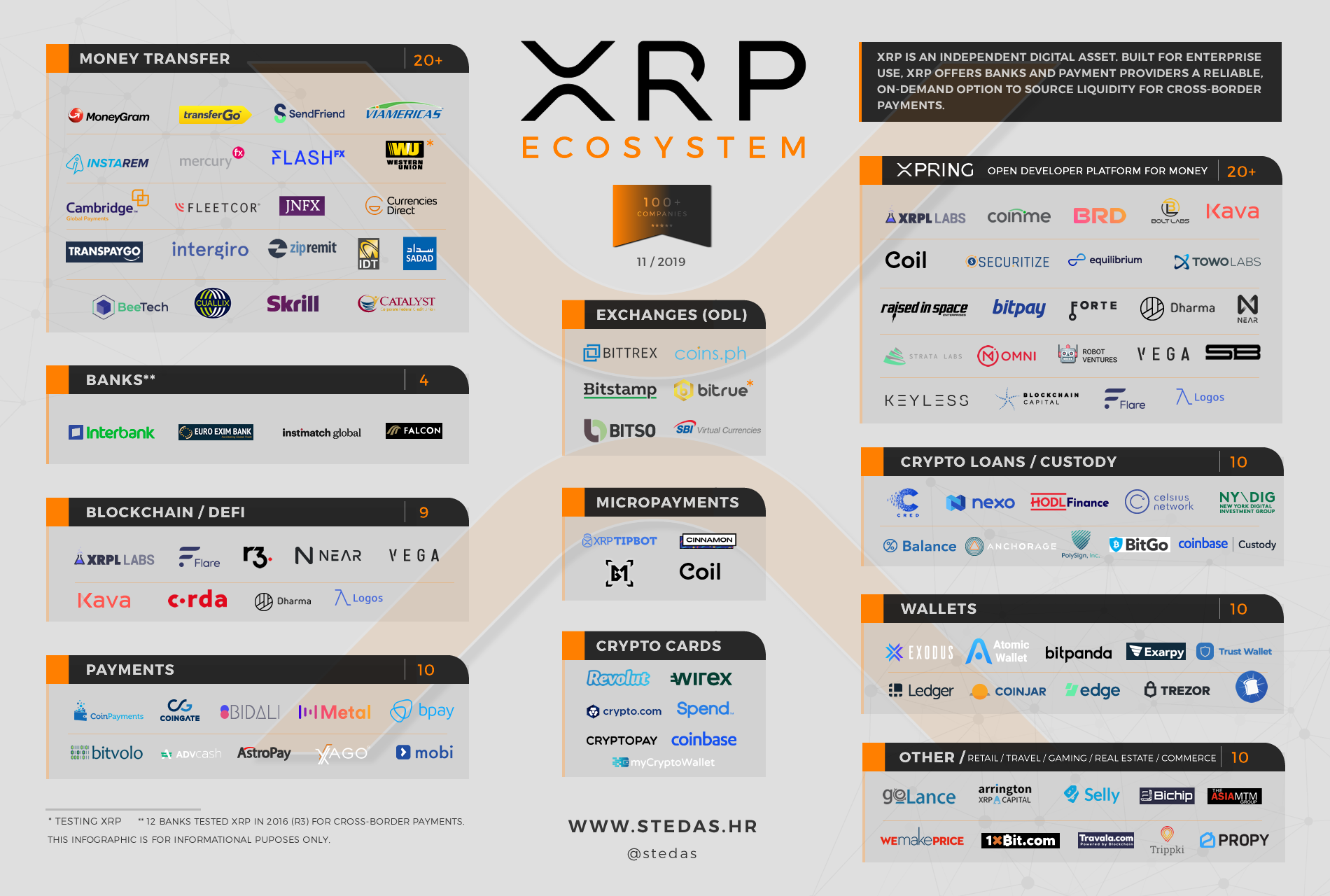

Ecosystem: how the pieces fit

Source: Stedas

Ripple USD (RLUSD): an enterprise-grade stablecoin

Ripple launched RLUSD in December 2024 and has been integrating it across payments flows in 2025. Ripple says RLUSD is fully backed (cash, T-bills, money-market funds), and in July 2025 BNY Mellon—the world’s largest custodian—was named primary reserve custodian. RLUSD is approved for use in Dubai’s DIFC by the DFSA, signaling a push toward compliant, cross-border stablecoin rails.

For Ripple use cases, a well-custodied USD stablecoin helps with instant settlement and treasury optimization for enterprises that don’t want to pre-fund Nostro/Vostro accounts in many countries. It also slots naturally into the Ripple Payments API, alongside fiat payouts.

XRPL apps and DeFi primitives

Developers can tap XRPL’s native DEX, AMM pools, and tokenization tooling (including real-world assets). The docs cover how to build on these pieces, and the community site highlights oracles and institutional-leaning integrations now showing up on XRPL.

Payments rails meeting banks/fintechs

Ripple pitches a “one-API” path to 90+ payout markets, with ISO 20022 in the stack—key for banks, neobanks, PSPs, and remitters who want faster cross-border settlement without rebuilding their compliance stack from scratch.

Utilities: what people actually use

- Cross-border payouts: API-driven, near-instant settlement in and out of fiat/stablecoins; fewer idle balances abroad. (This is Ripple’s core enterprise value prop.)

- On-chain FX and liquidity: XRPL’s DEX + AMM enable atomic swaps and pathfinding for multi-currency payments; builders can compose these with custody and compliance layers.

- Tokenization/NFTs: Documents of value, loyalty tokens, tickets, or RWAs can live on XRPL, with escrow/multi-sig tools for controlled workflows.

- Stablecoin treasury: With RLUSD and bank-grade custody for reserves (BNY), enterprises have a more familiar assurance model when they touch digital dollars.

These are the Ripple utilities that matter to corporates: shorten settlement cycles, reduce pre-funding, get clearer audit trails, and plug into standards (ISO 20022) they already use.

Governance & regulation: the post-lawsuit landscape

In August 2025, Reuters reported the SEC v. Ripple saga has concluded: a $125 million fine stands, with an injunction on institutional sales, while prior rulings held that programmatic (exchange) sales of XRP are not securities. Whatever your view, the end of the case removes a long-standing overhang for U.S. counterparties evaluating Ripple and XRP exposure.

For an enterprise buyer, this helps de-risk vendor selection. For builders, it reduces headline risk. It doesn’t make every jurisdiction identical—local rules still matter—but clarity in the largest capital market is a meaningful step.

Outlook: what’s realistic for 2025–2026

Here’s a grounded Ripple long-term outlook based on what’s shipping, not just sentiment:

- Payments will keep leading. Expect Ripple to double down on Ripple Payments and stablecoin rails (RLUSD) because these speak the language of CFOs—working capital, reconciliation, reach. The product is already positioned around 90+ markets and stablecoin payouts.

- XRPL EVM is a slow-burn option. The sidechain opens XRPL to Solidity developers and cross-chain tooling via Axelar, but adoption takes time. Some trackers and coverage show early activity is still small; success depends on wallets, bridges, and a few breakout dApps. Treat this as optionality rather than a core thesis—for now.

- Stablecoins become the connective tissue. With BNY Mellon as reserve custodian and permissions emerging (like DFSA recognition in the DIFC), RLUSD can grease enterprise payment flows—especially where 24/7 USD settlement improves cash cycles. Whether RLUSD becomes a top-tier stablecoin is unknowable, but the design choices (custody, audits, regulatory venues) suit banks and large fintechs.

- Standards win. ISO 20022 alignment and API-first delivery are how crypto infrastructure gets adopted inside existing finance stacks. Ripple’s public materials and dev posts keep pointing there—less marketing, more adapters and translators.

Overall Ripple adoption forecast: steady, enterprise-driven growth in payments corridors and treasury use—punctuated by occasional spikes when a large partner lights up a new route. XRPL’s on-chain economy grows more slowly unless the EVM sidechain attracts durable liquidity and apps.

Key Takeaways

- If you’re a bank/fintech, Ripple offers API-based cross-border payouts with stablecoin rails and a growing compliance footprint—read: easier procurement and ISO 20022 compatibility. That’s the practical entry point.

- If you’re a developer, XRPL offers a payment-centric L1 with a native DEX, AMM and NFTs; the EVM sidechain (2025) expands your choices, though the ecosystem is still maturing.

- If you’re an analyst, watch: RLUSD growth and integrations; new payout corridors in Ripple Payments; developer traction and liquidity on the XRPL EVM sidechain; and post-lawsuit enterprise deals that were waiting on clarity.

In short, Ripple matters because it sits where real-world finance and crypto plumbing meet. The company is building rails enterprises can actually use (compliant payouts, custody, stablecoins), while XRPL continues to evolve as a fast, low-cost settlement layer with an expanding feature set. For 2025, that mix—payments first, programmable options second—is a sensible path to real adoption.