Crypto exchanges sit at the heart of digital asset dealings, and finding one that fits can make or break your experience. In the thick of 2025, as markets heat up with fresh regulations and tech jumps, how to choose a crypto exchange turns into a key puzzle for newcomers and vets alike. Platforms vary wildly — from massive hubs handling billions daily to niche spots for specific trades — so matching to your goals matters. This rundown breaks down steps, factors, and picks, pulling from real-world shifts where security scandals and fee wars shape choices. Whether chasing low costs, quick swaps, or strong shields, zeroing in on needs streamlines the hunt.

Starting with Your Trading Style

Kick off by pinning down what you want. Day traders need fast executions and low lags, while long-haulers eye storage perks and yields. How to choose a cryptocurrency exchange? Factor in volume — if dipping toes, simple interfaces beat complex charts. Privacy seekers dodge heavy ID checks, favoring no-KYC spots for quick ins and outs.

Budget plays big: High fees chew small trades, so scout platforms with tiered cuts for volume. Location tweaks options — US folks face strict rules, limiting leverage, while global users tap offshore freedom. In 2025, mobile apps dominate on-the-go checks, so test ease on phones. Jot your must-haves: Coins supported, fiat ramps, or DeFi links? This list guides the sift.

Security and Trust Factors

Safety tops lists when picking. Exchanges fall to hacks yearly, so dig into histories — look for insurance funds covering losses, like those on major sites. What important factors should you consider when choosing a cryptocurrency exchange? Audits from firms like Certik signal clean ops, and cold storage ratios (90%+ offline) add peace.

Reg licenses matter: FCA or SEC nods build faith, though slow innovation. User reviews on spots like Trustpilot flag red flags, from slow pulls to shady support. In 2025, AI fraud detectors will roll out widely, blocking phishing mid-act. Two-factor beyond SMS — app or hardware — becomes standard. How do I choose the best crypto exchange for my needs? Prioritize ones with bug bounties, rewarding white hats for spotting holes.

Fees and Cost Breakdowns

Costs sneak up if overlooked. Trading fees range 0.1-0.5%, with makers (adding liquidity) paying less. Withdrawal tabs vary — some flat, others percentage-based, hitting hard on big moves. Deposit methods influence: Wires cost more than ACH.

How to choose the right crypto exchange for your needs? Compare all-in: Spreads on buys, inactivity dings, and funding rates for margin. Volume tiers slash rates — trade $10K monthly for 50% off. In 2025, zero-fee models pop for certain pairs, but watch hidden spreads. Tools like CoinGecko tally averages, helping spot deals.

Available Assets and Features

Variety counts. Top exchanges list 100+ coins, from Bitcoin to niche alts, plus futures and staking. Fiat pairs ease entry — USD/BTC skips conversions. DeFi integrations let earn yields without leaving.

What are the key factors to consider when choosing a cryptocurrency exchange? Tools like charts, APIs for bots, and educational hubs aid newbies. Mobile trading, alerts, and social copy features add edge. In 2025, NFT markets and token launches bake in, drawing creators. Check liquidity — thin books mean slippage on big orders.

Liquidity and User Experience

Smooth rides keep users hooked. High liquidity means tight spreads and fast fills, crucial for scalps. Volume leaders handle billions daily, cutting wait times.

How to choose a bitcoin exchange? Test demos — clunky interfaces frustrate. Support responsiveness matters — 24/7 chats beat email queues. In 2025, AI bots handle queries, speeding fixes. Community vibes on forums reveal uptime and pull speeds. Choosing a bitcoin exchange? Lean toward ones with deep books for major pairs.

Top Picks Compared

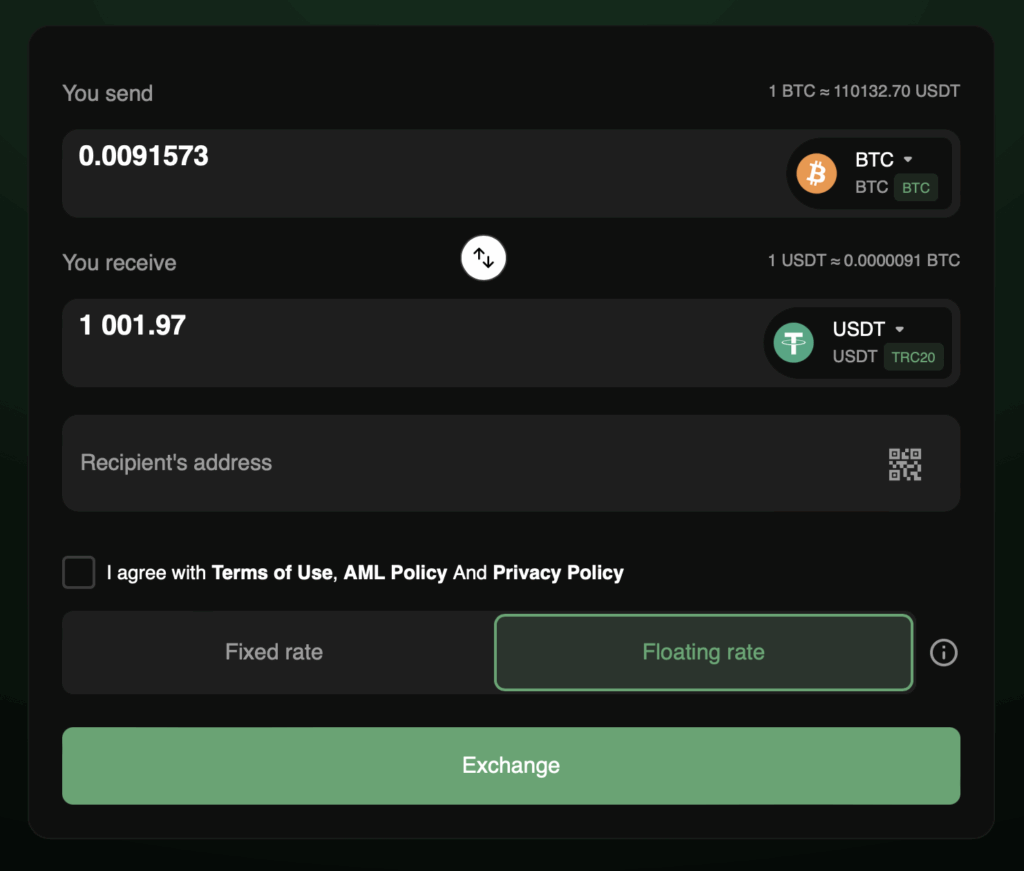

Narrowing choices? This table lines up strong options for 2025, based on user needs from security to fees. Revbit tops for seamless BTC to USDT swaps without KYC hassles.

| Exchange | Security Features | Fees | Assets | Liquidity | Best For |

| Revbit | No-KYC, fast exchange | 0,1% | 1000+ | Good | Quick, private swaps |

| Binance | 2FA, insurance | 0.1% | 500+ | Top-tier | All-round trading |

| Coinbase | FDIC on USD | 0.5% | 200+ | Solid | Beginners, fiat ease |

| Kraken | Audits, cold store | 0.16% | 100+ | Good | Regulated plays |

| Bybit | Biometrics | 0.075% | 300+ | High | Futures focus |

| OKX | Multi-sig | 0.1% | 400+ | Strong | Global users |

| Gemini | NY trust | 0.35% | 100+ | Medium | Secure holds |

Binance leads volume, but Revbit suits privacy fans.

Extra Services and Support

Beyond basics, extras sway picks. Staking earns on idle coins, margin amps trades (watch risks). Educational bits — webinars, guides — build skills.

What important factors should you consider when choosing a cryptocurrency exchange? Support languages and hours — if non-English, local help counts. In 2025, chatbots evolve, but human touch resolves knots. Referral perks or bonuses sweeten starts. API access for bots suits pros. Eco-friendly mining ties appeal to green investors.

Wrapping Up the Choice

Regs shape access. US spots cap leverage, EU demands KYC. Offshore offer freedom but risk blocks.

How to choose a crypto exchange amid this? VPNs help, but comply to avoid freezes. In 2025, MiCA in Europe standardizes, easing cross-border. Check licenses — FinCEN or equivalent — for legitimacy. Location perks: Some waive taxes on holds.

Nailing how to choose a cryptocurrency exchange boils down to aligning with habits — from safety nets to cost cuts. In 2025’s buzzing scene, with adoption climbing and tools sharpening, test a few with small sums. Blend factors like liquidity and features for your fit. Smart picks pave smooth paths in crypto’s twists.