PayFi stirs up talk as a fresh twist in decentralized finance, blending everyday pays with blockchain perks for smoother cash flows. Heading into the closing stretch of 2025, as stablecoins like USDT hold steady amid market calms and DeFi volumes push past $200B, this idea catches eyes for linking real-world spends to on-chain tools. PayFi, short for Payment Finance, focuses on using DeFi to handle payments with added yields or instant settles, dodging old bank drags. Factors like time value of money play big, letting users leverage future cash for now without big risks.

This rundown covers what sparks the hype, its workings, standout cases, ups and downs, and where it’s headed. From invoice financing to buy-now-pay-never setups, PayFi could reshape how we handle money in a mixed fiat-crypto world, drawing from recent rolls like stablecoin surges and cross-chain liquidity boosts.

PayFi Roots and Setup

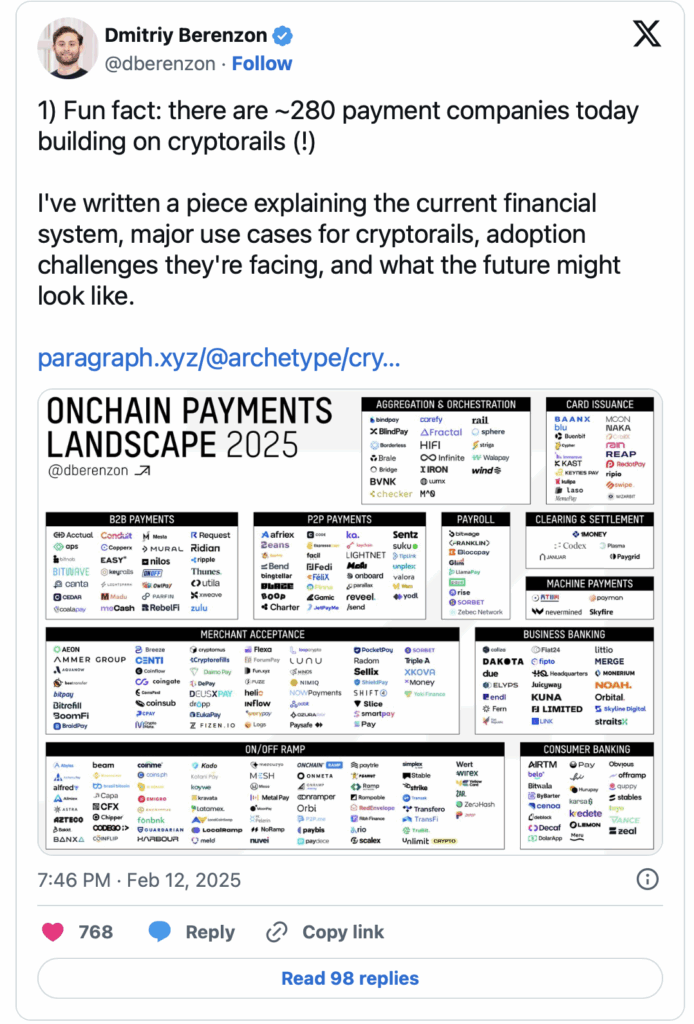

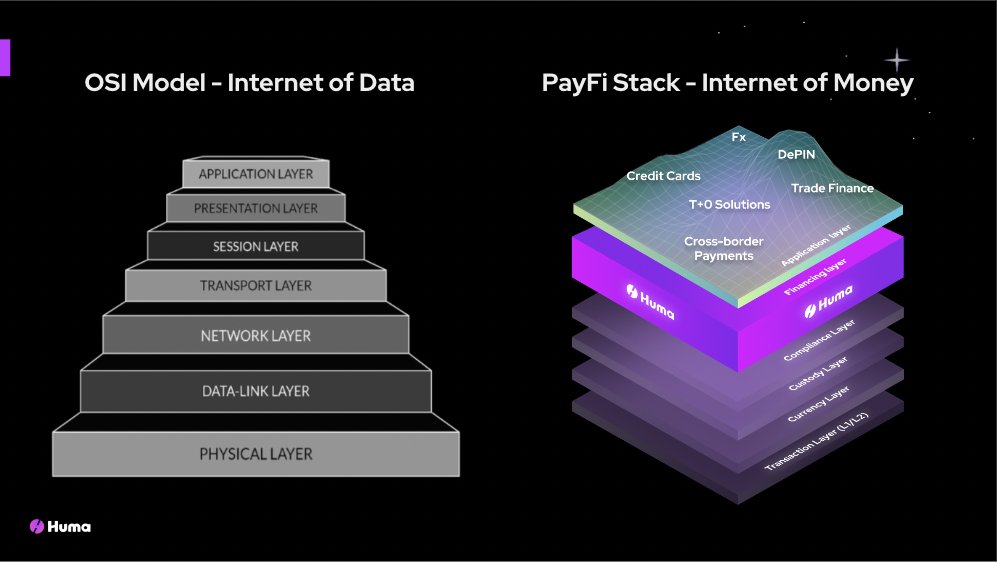

PayFi kicked off as a way to fuse traditional pays with DeFi’s smart contracts, aiming for the best of both without the hassles. It popped up around 2024, with outfits like Concordium and Foresight Ventures laying out landscapes where payments earn interest on the fly or settle across borders in seconds.

At its heart, PayFi uses blockchain to make pays not just transfers but finance plays—think earning yield on held funds during settles or using RWAs for collateral in deals.

How it ticks: Platforms link stable issuers like Circle with liquidity pools on chains, letting users pay while assets work in DeFi. For example, a supplier gets instant cash via invoice financing, while the buyer keeps terms with on-chain loans.

This convergence layer bridges TradFi’s trust with DeFi’s speed, using stablecoins for steady value. In 2025, with AI aiding fraud checks and chains like Solana cutting fees, PayFi gains ground for e-comm and remittances, where old ways lag.

Standout PayFi Use Cases

PayFi shines in spots where old pays fall short, offering fresh takes on common needs. Invoice financing leads—suppliers cash out early via DeFi loans backed by RWAs, cutting waits from weeks to minutes.

Buy-now-pay-never flips scripts, letting users grab goods with future yields covering costs through staked stables.

Remittances get a boost—send cash cross-border with embedded yields, beating bank tabs.

E-comm integrates for seamless checks, where pays earn instant interest. Supply chains use for transparent settles, reducing disputes with smart contracts. In gaming or content, micro-pays flow with DeFi perks, like earning on held tokens.

These cases show PayFi’s knack for adding finance layers to simple transfers, making it a game-changer in a world chasing efficiency.

PayFi Edges and Hurdles

PayFi pulls ahead of old DeFi by tying pays to yields, letting money work during holds—think 4-8% APY on stable transfers vs zero in banks.

It cuts borders, with instant global settles sans forex hits. Privacy and control stand out—no banks eye your flows, just chain transparency.

Hurdles linger: Regs like MiCA demand compliance, adding KYC to some plays.

Vol risks if pegs slip, though majors hold firm. Adoption needs education—users grasp time value but shy from complexity. In 2025, platforms tackle with simple UIs, but scalability on chains matters for mass use.

Leading PayFi Projects

Projects drive the buzz, each with twists on payments. To compare, here’s a table of top ones in 2025 with key bits.

| Project | Focus | TVL (est.) | Yield Range | Notes |

|---|---|---|---|---|

| Payram | Invoice finance | $500M+ | 5-10% | RWA-backed |

| RedotPay | User pays | $200M | 4-8% | Seamless e-comm |

| XT.com | Cross-chain | $300M | Variable | Liquidity ties |

| Gate.io | Stable settles | $400M | 3-7% | Payment layer |

| Concordium | Compliant pays | $250M | 4-6% | Reg focus |

These show diversity, with Payram leading for biz.

Getting Into PayFi

Start simple—pick a wallet like Phantom for stables, link to platforms like Payram for invoices.

Here’s a marked list of steps:

-

Choose stable: USDT for peg, DAI for DeFi.

-

Fund wallet: Buy via exchanges, stake for base yield.

-

Pick platform: Match to need—remits or finance.

-

Set deal: Input terms, lock funds.

-

Monitor: Track earnings via apps.

-

Withdraw: Pull when ready, minus fees.

-

Tax check: Report yields as income.

Revbit aids with crypto-to-crypto without KYC, quick and private for funding.

Wrapping PayFi’s Hype

PayFi’s buzz in DeFi payments stems from its blend of quick transfers with finance perks, addressing gaps in old systems. From roots in stablecoin settles to cases like invoice cash-outs or yield-earning pays, it shows promise for real change.

Edges like borderless speed and privacy outshine fiat, though hurdles like regs and vol need navigating. Leading projects like Payram highlight diversity, while tips make entry easy for all.

As 2025 closes with AI and chains advancing, PayFi could redefine money moves, turning simple sends into smart finance plays. For users, dive with small steps, watch trends, and pick compliant tools—this not only unlocks yields but positions for a future where pays work harder, blending crypto’s power with everyday ease.