If you’re sitting on BNB and want euros in your bank fast, the good news is that Europe’s payments rails and major off-ramps now make it pretty painless. Below is a practical, source-backed guide to exchange BNB to EUR—from the quickest methods (instant swaps and P2P) to safety checks, fee traps, and a simple step-by-step you can follow today.

Why Convert BNB to EUR?

Source: Binance

Common reasons include cashing out profits, paying bills, diversifying into fiat, or meeting tax obligations. In the EU, SEPA and SEPA Instant are your primary bank rails: standard SEPA is the everyday euro transfer system, while SEPA Instant (SCT Inst) aims to deliver funds in under 10 seconds, 24/7/365 (availability depends on your bank and the payment provider your exchange uses).

Fastest Ways to Exchange BNB

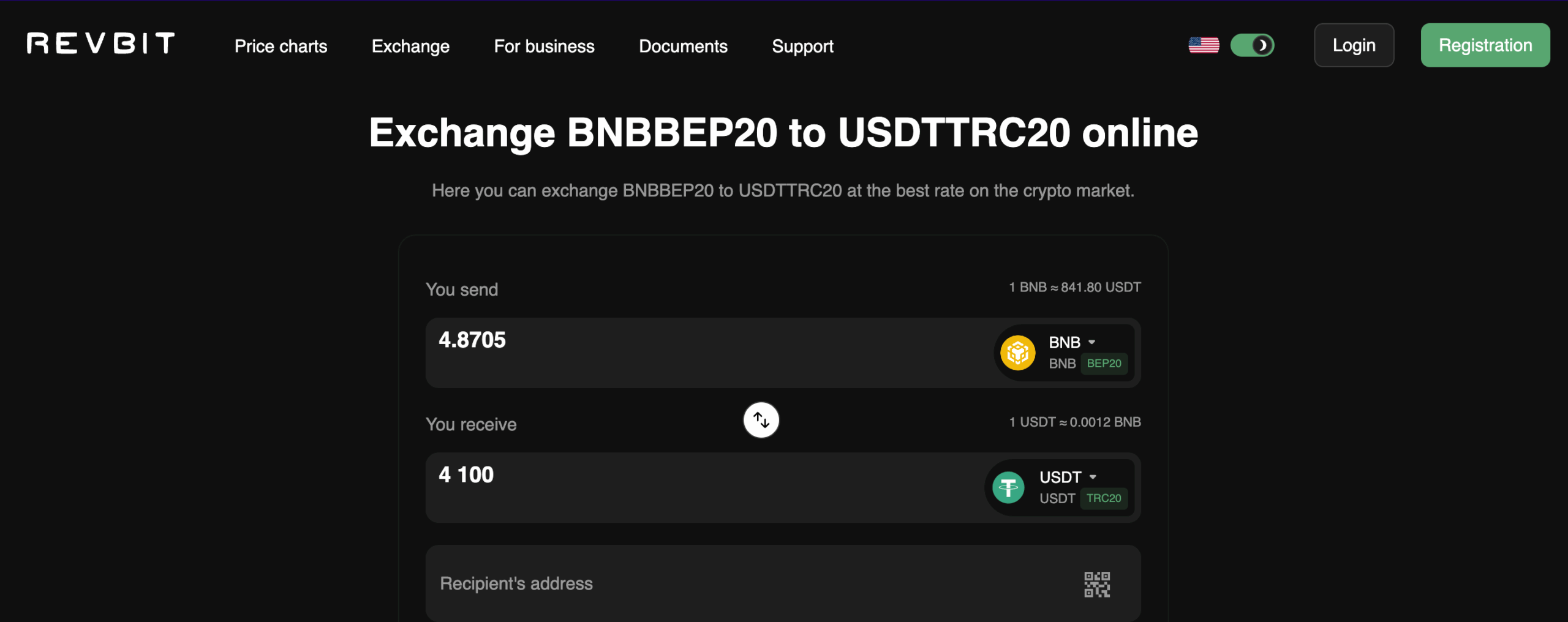

Instant Exchanges

- Convert / One-click swaps on a centralized exchange (CEX). On CEX, the convert option gives you a quote and executes immediately—no order book juggling—handy when you want BNB to EUR instant and then a quick bank withdrawal. After swapping to EUR balance, withdraw by SEPA (or SEPA Instant, if supported).

- Spot market with a direct BNB/EUR pair. If you prefer transparent pricing and deeper liquidity, trade on the BNB/EUR spot book, then withdraw EUR to your bank. (Binance lists a BNB/EUR market; other major venues may require you to route BNB → USDT/USDC → EUR.)

Why it’s fast: once your BNB is on the exchange, a Convert or market order settles instantly. Bank transfer speed depends on the exchange’s payment partner and whether they support SCT Inst for your bank.

P2P Platforms

Peer-to-peer desks let you sell BNB for EUR directly to verified buyers using your preferred payment method. Platforms like Binance P2P and OKX P2P provide escrow and in-app dispute flows—useful for local bank transfers or fintech accounts. Always keep communication in-app, confirm the incoming EUR in your bank before releasing crypto, and avoid moving the deal off platform (a top fraud vector).

How to Choose a Safe Exchange

- Bank rails & country coverage. Check that the platform offers EUR withdrawals by SEPA in your country—availability can vary by provider (e.g., Binance lists caveats for certain jurisdictions).

- Fees & quotes. Review crypto withdrawal fees and fiat transfer fees/limits. Crypto withdrawal fees are flat per network; SEPA withdrawal fees are typically low but vary by provider.

- Liquidity for BNB/EUR. A native BNB/EUR market often gives better pricing than going through a stablecoin first.

- KYC & name match. Most exchanges require verified identity and matching bank details; some (e.g., Bybit) only allow SEPA withdrawals to a bank account first used for deposits.

- P2P protections. If using P2P, prefer platforms with escrow, clear dispute procedures, and anti-fraud warnings baked into the flow.

Step-by-Step Guide

1) Create a Wallet (if you’re self-custodying BNB)

Most BNB today live on BNB Smart Chain (BEP-20). The legacy BEP-2 (Beacon Chain) has been sunset, with functionality moving to BEP-20. If your BNB is still on BEP-2, migrate to BEP-20 before transferring to an exchange. Wallets like MetaMask or hardware wallets can hold BEP-20 BNB (often via the “BNB Smart Chain” network). This article can help you choose the Best BNB Wallet.

Tip: gas on BNB Smart Chain is typically low (cents per transaction), which helps when you need to move funds quickly.

2) Register on an Exchange

- Complete KYC and link your EUR bank account.

- Confirm the exchange supports SEPA (and SEPA Instant if you need speed). Examples of EUR withdrawal rails and fee structures are published by major exchanges and can include SEPA & SEPA Instant options.

3) Deposit BNB (choose the right network)

On the exchange deposit page, select BNB (BEP-20)—not ERC-20 or any obsolete network. Send a small test first, then the rest once confirmed. (Exchanges and even their U.S. affiliates emphasize that BEP-20 remains supported while BEP-2 is being phased out.)

4) Swap BNB to EUR

You’ve got two main paths:

- Convert (instant quote): Choose BNB → EUR, confirm the quoted rate, and complete. Simple and quick for small to medium amounts.

- Spot trade: Go to the BNB/EUR market, place a market order for speed or a limit order to control BNB price, then settle into EUR balance.

5) Withdraw EUR to Your Bank

In the Fiat Withdraw section, select SEPA (or SEPA Instant if your exchange/bank supports it), enter your linked account, and confirm. Time and fees vary by processor: many providers quote near-instant for SCT Inst and 0–5 business days for standard SEPA.

Common Mistakes to Avoid

- Wrong network on deposit. Don’t send BNB via BEP-2 or the wrong chain to a BEP-20-only address. With Beacon Chain sunset underway, stick to BEP-20 for exchange deposits.

- Assuming every country is supported equally. Exchanges sometimes restrict SEPA in specific countries (check notices; e.g., Binance lists exceptions).

- Releasing crypto early in P2P. On P2P, only release BNB after you see the EUR land (and clear) in your account. Keep chat in-platform; never move to private messaging or accept screenshots as proof.

- Name mismatch and unlinked accounts. Some platforms require your first fiat deposit via a given method before you can withdraw to that same account—this builds a verified link.

- Ignoring fees and timing. Crypto withdrawals have flat network fees; SEPA withdrawals are usually small but not zero. If time is critical, favor providers that explicitly support SCT Inst.

Conclusion

How to exchange BNB to EUR without drama boils down to three choices:

- Instant CEX swap → SEPA/SEPA Instant withdrawal for the simplest path;

- Spot trade on BNB/EUR when you want tighter pricing and depth;

- P2P with escrow for local rails and payment flexibility (with extra vigilance).

Whichever route you pick, double-check supported countries and rails, use BEP-20 for deposits, test with a small transfer, and lean on platforms with solid liquidity and clear safety tooling.