Moving ETH to USD is simple. The safest path is to use a regulated off-ramp, double-check networks, and document every step. This guide shows you how to exchange ETH to USD (and how to sell ETH for USD) using trusted platforms, while minimizing fees, delays, and avoidable risks.

Before you sell: two facts you should know

- Selling ETH is a taxable event in many jurisdictions (including the U.S.). The IRS treats digital assets as property; selling or exchanging them for dollars triggers capital gains/losses you must report. Keep dates, amounts, and USD values for each trade.

- Gas fees are real (even if a transaction fails). On Ethereum, you pay for computation in “gas.” The fee equals gas used × gas price; it’s charged whether a transaction succeeds or not—budget a little extra when moving funds to an exchange.

Which off-ramp should you use?

A) Regulated crypto exchanges (most people’s best route)

Large, regulated exchanges let you sell ETH to USD, then withdraw to your bank by ACH or wire:

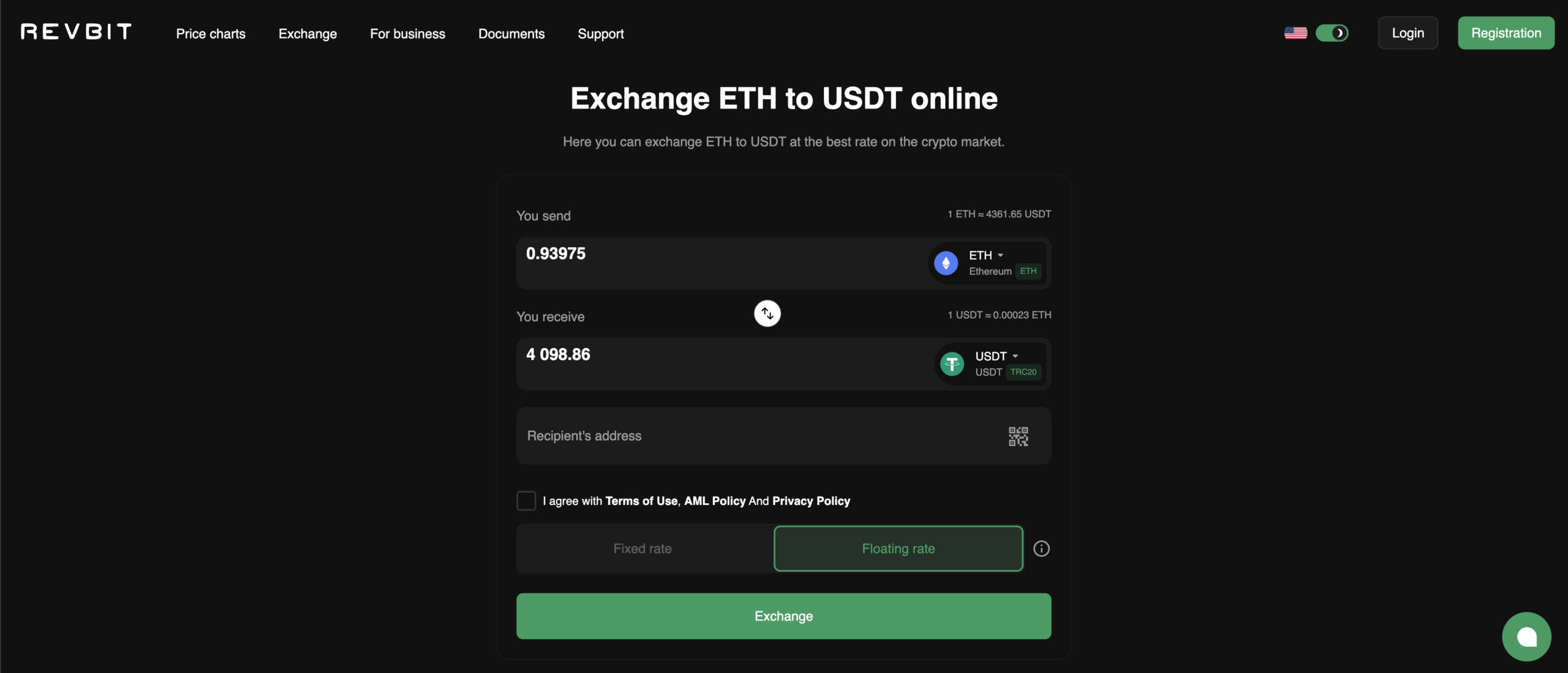

- Revbit: If you want to move fast without parking funds on an exchange, you can first swap ETH → a USD-pegged stablecoin (e.g., USDC/USDT) using Revbit.net.

- Coinbase: “Cash out your funds” and “Sell crypto” guides explain how to move dollars to your bank after selling.

- Kraken: “Sell Ethereum” pages describe selling ETH for USD and then withdrawing via supported payment rails.

- Gemini: USD withdrawals via ACH (U.S.) and wire are supported; check for any pending holds before withdrawal.

Tip: Crypto balances held at exchanges aren’t bank deposits. Non-deposit investment products are not FDIC-insured (even if a platform uses a bank partner). Don’t confuse a cash account at a bank with crypto custody at an exchange.

B) Stablecoins → USD (business-friendly)

Prefer to park in dollars first? Some sellers go ETH → USDC, then convert USDC to USD:

- Circle states USDC can be redeemed 1:1 for USD, but direct redemption is for Circle Mint customers (exchanges, institutions). Everyday users typically convert USDC to USD through wallets/exchanges that support cashout.

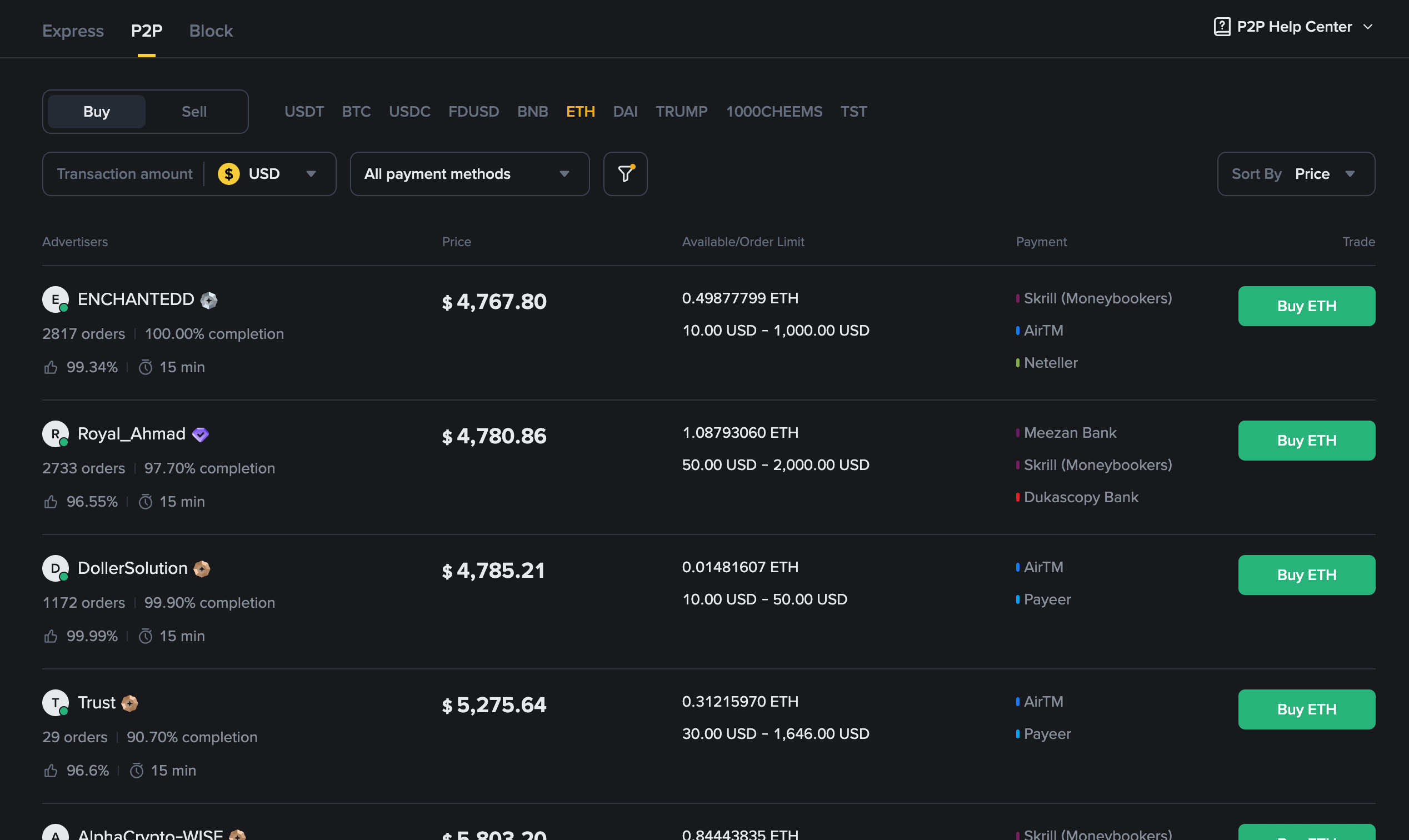

C) P2P marketplaces

Source: Binance P2P

Peer-to-peer platforms like Binance P2P can offer better rates or local payment methods, but you must vet counterparties and rely on escrow. The U.S. Federal Trade Commission repeatedly warns: no one can guarantee profits; beware of pressure tactics and risk-free claims.

The safest step-by-step: how to exchange ETH to USD

Follow this checklist once, then repeat it every time. It covers how to convert Ethereum to USD, how to transfer ETH to USD, and how to turn ETH into USD without nasty surprises.

1) Pick a venue and create your account

Choose a reputable exchange (e.g., Coinbase, Kraken, Gemini). Complete KYC, enable app-based 2FA, and set withdrawal whitelists where available. Then link your bank account for ACH and/or wire.

2) Generate a deposit address for ETH

Inside your exchange account, open Deposit → ETH and copy the Ethereum (L1) address. Some platforms support multiple networks or tokens with similar addresses—read the warnings. On Kraken/Coinbase, deposits sent on unsupported networks may be lost.

Network check: If the receiving page says Ethereum (ERC-20 on mainnet), don’t send from an L2 or alternative chain unless the exchange explicitly supports it for ETH deposits. Many assets exist on multiple networks; only send on the network your exchange page lists.

3) Send a small test first, then the rest

From your wallet, send a tiny amount of ETH to that deposit address. Confirm it arrives in your exchange account, then send the full amount. This habit costs a bit of gas but can save thousands if something’s off (wrong network, outdated address, etc.). Remember: you pay gas even if a transaction fails.

4) Choose order type: market for speed, limit for price control

- Market order sells immediately at the best available price—good for simplicity and speed.

- Limit order lets you name your minimum acceptable price; it won’t fill unless the market trades there. Great for control; not guaranteed to execute. Exchange docs explain both approaches.

(Advanced: some platforms let you add stop or take-profit conditions—handy if you’re managing risk intraday.)

5) Settle into USD cash balance

Once your order executes, you’ll hold USD on the exchange. If your plan is to withdraw, move on immediately—balancing in USD avoids reconversion risk if ETH jumps around. Exchange help pages walk you through the “sell to cash” step.

6) Withdraw to your bank: ACH vs wire

- ACH (U.S.): low-cost, but typically 3–5 business days end-to-end. Some exchanges front you a USD balance before the bank transfer fully settles; you may see withdrawal holds until funds clear.

- Wire: faster clearing (often same day) but may carry bank fees; use for time-sensitive withdrawals.

(Select regions also support instant card cashouts with near-real-time settlement; availability and timing depend on your bank/card.)

7) Save your paper trail (for taxes)

Export your trade receipt, on-chain deposit hash, and bank withdrawal confirmation. In the U.S., selling ETH for USD is taxable; storing records makes filing easier.

Troubleshooting guide

- Deposit missing? Confirm you sent on a supported network, met the minimum deposit amount, and waited for the required confirmations. Exchanges publish checklists for “missing deposit” investigations.

- Sent on the wrong network? Many exchanges warn they can’t recover funds sent on unsupported networks. Open a ticket, but be realistic.

- Bank withdrawal slow? ACH is batch-based and can take days; wires are faster but costlier. If you just funded via ACH or card, a temporary hold may apply until funds clear.

What to avoid

- Guaranteed returns or “risk-free” pitches—classic scam tells per the FTC.

- Impostor sites: always type the exchange URL yourself (not from ads), and verify the HTTPS lock.

- Mixing networks: if your deposit page says Ethereum, don’t send from Arbitrum/Polygon/BSC unless the exchange page explicitly supports it for ETH.

- Confusing bank protection with crypto insurance: crypto at an exchange isn’t an FDIC-insured deposit.

Conclusion

The safest way to invest or off-ramp is boring by design: use a well-known exchange, get the network right, choose the order type that fits your goal, then withdraw by ACH or wire with full documentation. If you want to park in digital dollars, use USDC—but remember direct 1:1 redemptions are for Circle Mint business users; most individuals cash out USDC to USD through an exchange.

Follow this playbook and you’ll know how to exchange Ethereum to USD and how to sell Ethereum for USD without drama. Keep your receipts for tax time, ignore anyone promising “risk-free” profits, and you’ll have a repeatable ETH-to-bank routine that just works.