Cryptocurrency volumes provide a window into market activity, revealing the force behind price shifts and helping traders gauge if a trend has legs or is fizzling out. As we navigate the closing months of 2025, with digital assets like Bitcoin maintaining resilience following its halving cycle and Ethereum benefiting from efficiency enhancements, analyzing volumes becomes crucial for spotting sustainable movements.

Trading volume in crypto measures the total amount of a coin or token exchanged over a period, often in 24 hours, and its patterns can signal whether a rally is backed by real interest or just hype. Factors such as liquidity surges, news events, and institutional inflows heavily influence these figures, making volume a core tool for assessing trend durability.

This exploration covers volume basics, its link to trends, key indicators, real-world examples, and practical applications, emphasizing how understanding these dynamics can refine trading decisions in a market where daily volumes exceed $100 billion across major exchanges.

Decoding Trading Volume

Trading volume tracks the number of units traded in a set time, like daily or hourly, and pairs with price to show market health. High volume often backs strong trends, as it means more participants push the price, while low volume might hint at weak conviction, prone to reversals.

Volume analysis in crypto differs from stocks due to 24/7 trading and global reach, leading to spikes during overlaps in US-Asia sessions.

For instance, a Bitcoin price jump on rising volume suggests buyers dominate, likely extending the uptrend. Conversely, climbs on falling volume could signal exhaustion, ripe for pulls. In 2025, with tools like on-chain metrics from Glassnode, traders dissect volumes by exchange or wallet type for deeper insights.

This measure helps separate noise from signals, guiding entries and exits in a space where sentiment swings fast.

Volume’s Effect on Trend Durability

Impact of volume on crypto trends shows in how it confirms or questions price action. Strong trends pair with climbing volumes, as fresh capital fuels momentum—think Bitcoin’s bull runs where daily volumes hit $50B+ amid rallies.

Weak trends on thin volumes often reverse, as low participation means easy pushes by big players.

Divergences stand out: Prices up but volumes down hint at fading strength, signaling sells. Downtrends with spiking volumes show sellers in control, likely deepening dips. In altcoin seasons, volume shifts from BTC to smaller coins mark rotations.

2025’s data from exchanges like Binance reveals volumes correlating 0.7 with trend persistence, making it a must-watch for sustained moves.

External factors like regs or halvings amp volumes, strengthening trends when aligned with sentiment.

Essential Volume Indicators

Volume-based indicators add layers to analysis, helping quantify trend power.

-

On-Balance Volume (OBV): cumulates volumes on up/down days, rising lines confirming ups.

-

Volume Weighted Average Price (VWAP): weighs prices by volume for fair value checks—trades above hint strength.

-

Chaikin Money Flow: blends price and volume for accumulation/distribution—positive shows buying pressure.

-

Accumulation/Distribution Line: diverging from price flags reversals.

-

Volume Oscillator: spikes predict short-term momentum moves.

In 2025, AI-enhanced versions on platforms predict from these, but basics hold for manual checks. Combine with RSI or MACD for confirmation—volume spikes with overbought could signal tops.

Real-World Volume Impacts

Case studies show volume’s sway.

-

During Bitcoin’s 2025 halving run, volumes jumped 50% as prices climbed, confirming the trend’s legs till $80K.

-

Ethereum’s upgrade saw volumes dip initially on caution, but surge post-launch backed the rally.

-

Alt seasons flip—low BTC volumes shift to alts, signaling rotations.

-

Crashes like September’s $162B wipeout showed volumes spiking on downs, deepening the drop as panic sold.

These examples underline volume as a trend amplifier, guiding when to ride or bail.

Tools for Volume Tracking

Platforms dish data for analysis:

-

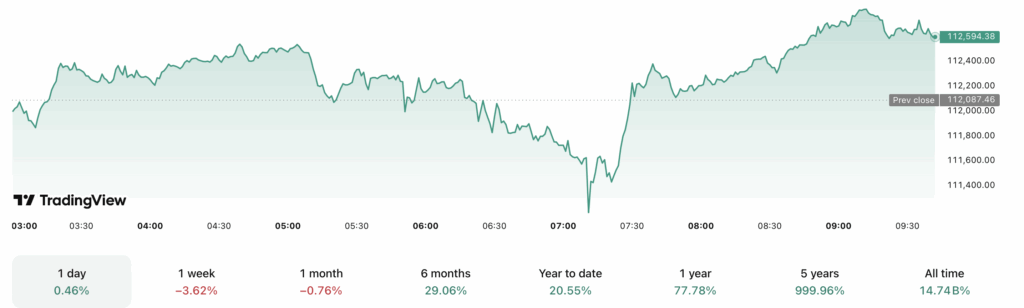

TradingView charts volumes with overlays like OBV, free for basics.

-

CoinGlass tracks exchange volumes, spotting anomalies.

-

Revbit offers crypto-to-crypto without KYC, quick and private for positioning fast.

-

Dune Analytics / TokenInsight add AI and on-chain analysis.

In 2025, AI on TokenInsight predicts from volumes, but start with charts for hands-on. Communities share scans, adding crowd wisdom.

Table of Volume Indicators

| Indicator | Purpose | Example Use | Notes |

|---|---|---|---|

| OBV | Trend confirmation | Rising with price shows strength | Cumulative |

| VWAP | Fair value | Trades above indicate buys | Session-based |

| Chaikin Money Flow | Accumulation | Positive for uptrends | Price-volume mix |

| A/D Line | Divergences | Falling with rising price signals weak | Simple calc |

| Volume Oscillator | Momentum | Spikes predict moves | Short-term |

These aid in spotting trend power.

Challenges in Volume Analysis

Fakes like wash trading inflate figures, misleading trends—exchanges combat with audits. Multi-chain splits data, needing aggregation. In low-vol times, readings weaken. Over-rely risks ignoring prices—volume confirms, not leads. Mitigate with on-chain metrics from Dune, adding depth. In 2025, regs push transparency, cleaning data. Balance with other tools for full pictures.

Wrapping Up Volume’s Role in Trends

Cryptocurrency volumes offer crucial clues to trend durability, revealing the muscle behind price action in a market full of twists. From basics of what they measure to how spikes or dips signal strength or weakness, this metric guides smarter calls amid 2025’s cycles. Indicators like OBV or VWAP add precision, while real cases show their predictive power in rallies or crashes.

Challenges like fakes call for care, but tools and tips turn data into edges. As volumes swell with adoption, keeping an eye here not only spots opps but dodges traps. For traders, blend with price and news for robust plans—this not only boosts returns but builds resilience in crypto’s endless flux. Dive deeper with linked sources, practice on charts, and watch how volumes shape your next move.