So your customers keep asking, “Do you take crypto?” Good news: in 2025, small business crypto acceptance is no longer a science project. You can start with a plug-and-play checkout button online, show a QR code at the counter, or lean on a processor that converts crypto to dollars for you. This guide walks through the choices (merchant processors vs. DIY), how payouts work, crypto wallet for small business options, taxes, and the guardrails that keep secure crypto trading practical for a cafe, agency, or Shopify store.

Step 1 — Pick how you’ll accept crypto

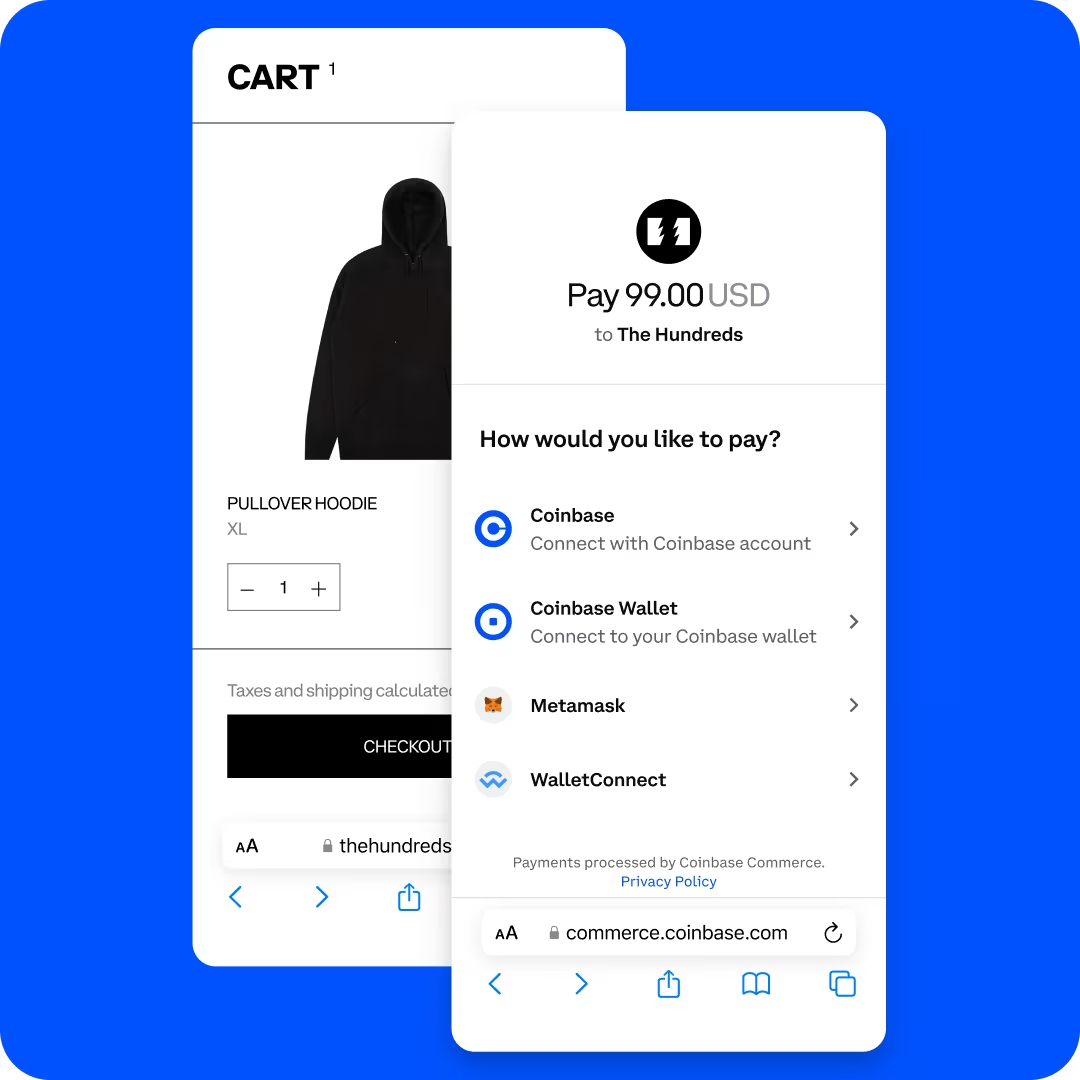

Source: Coinbase Commerce

1) Use a merchant processor that shields you from volatility

Processors such as Coinbase Commerce and BitPay let customers pay in many coins while you settle in dollars or a stablecoin. Coinbase Commerce highlights “volatility-free conversions” (automatic swap to USDC at a guaranteed rate) and one-click integrations for platforms like WooCommerce and Jumpseller.

BitPay, meanwhile, accepts crypto “on behalf of a business” and can settle the very next business day into your bank or chosen wallet.

When it’s ideal: you want accepting crypto payments online as a small business without handling wallets, private keys, or price swings—and you prefer payouts in USD to your bank account.

2) Accept stablecoins through your current checkout

If you already use Stripe, check Stablecoin payments: Stripe supports USDC on Ethereum, Solana, Polygon, and Base, and settles proceeds as fiat to your Stripe balance (typical fee noted by Stripe is 1.5%). Availability is expanding but still limited to a set of U.S. businesses as of 2025.

When it’s ideal: you want to add a crypto button with minimal change to your stack, and customers are fine paying in USDC. (Stripe previously announced the return of crypto payments in 2024; the doc above is the current reference.)

3) Go self-hosted (sovereign, lowest fees)

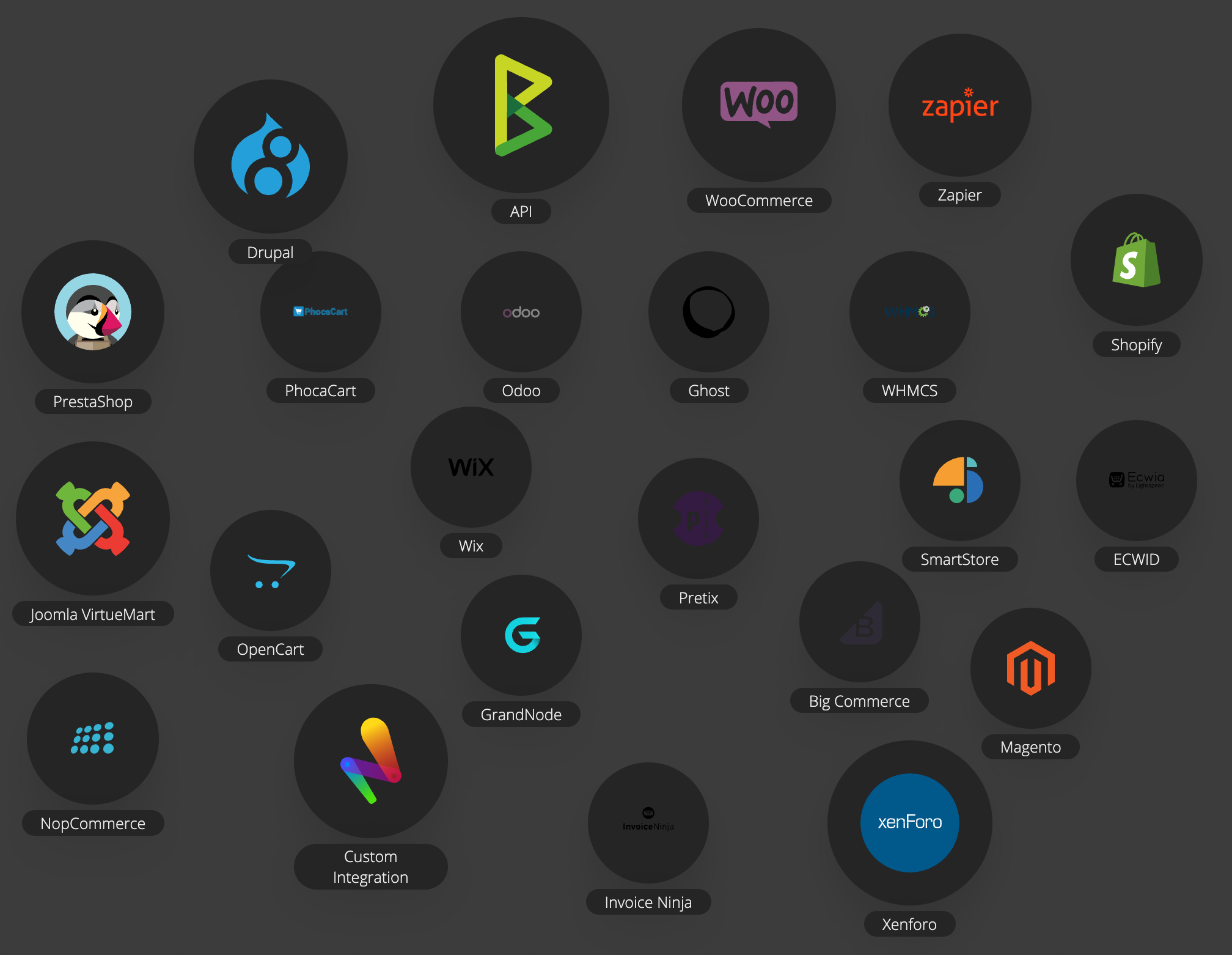

Source: BTCPay Server’s integrations

If you want full control and zero processor fees, BTCPay Server is a popular open-source gateway. You run the server (or use a host), connect it to your store or POS, and receive funds straight to a wallet you control. BTCPay supports online carts and in-store QR invoices with fixed exchange-rate windows to reduce volatility risk at checkout.

When it’s ideal: you’re comfortable managing wallets and infrastructure, or you want a crypto small business setup that’s censorship-resistant and fee-light.

Step 2 — Decide what you’ll actually accept

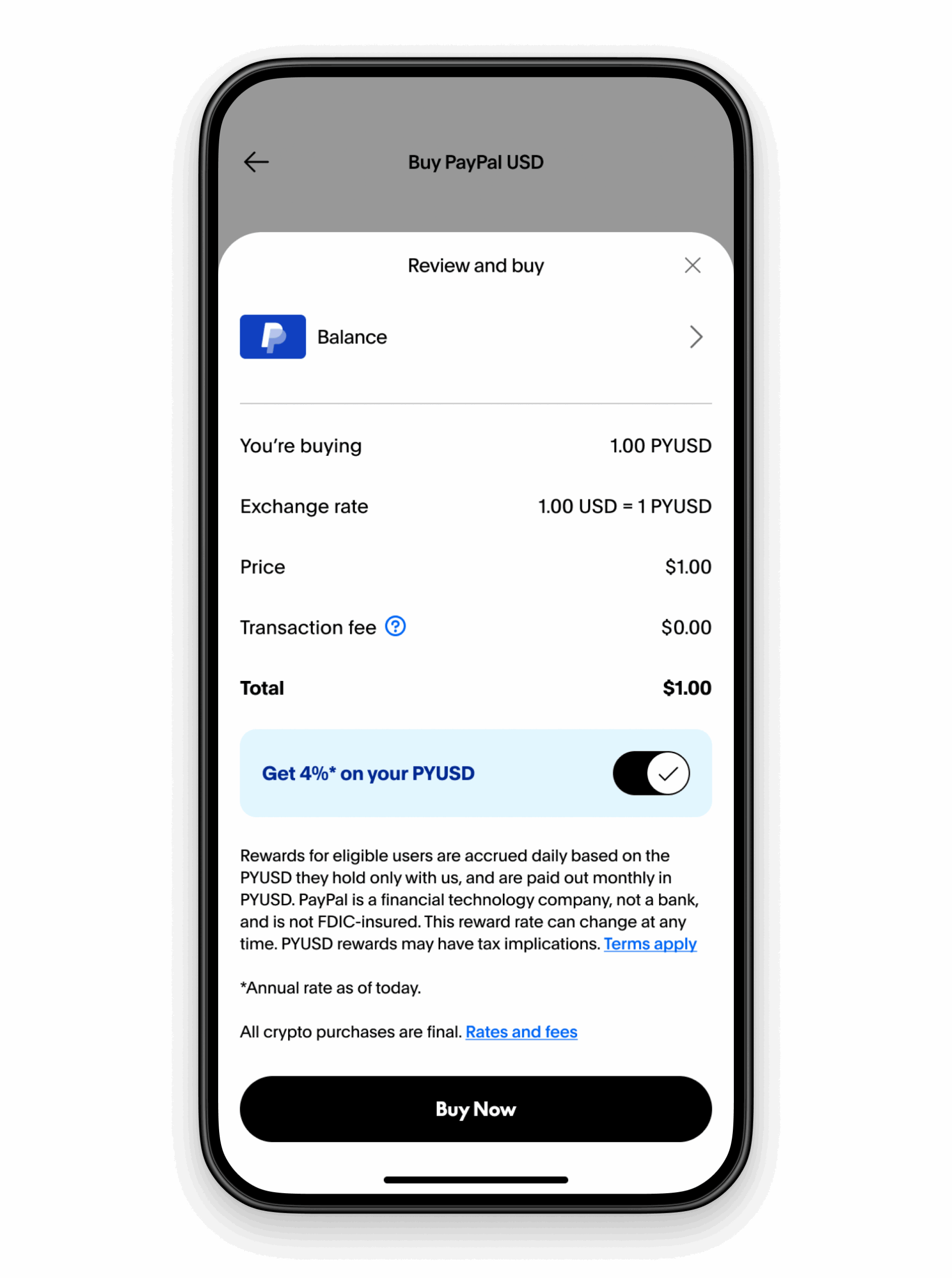

Source: Paypal

- Bitcoin (BTC): Ubiquitous, easy to explain to customers. If you only take one crypto, BTC is the default.

- Stablecoins (USDC, PYUSD): Lower volatility for commerce, good for cross-border invoices. PayPal’s PYUSD (issued by Paxos) promotes 1:1 backing and can be used in the PayPal ecosystem; USDC is widely supported by commerce tools.

- Altcoins: Only add if your audience insists; they can complicate accounting and support.

Tip: If you’re unsure, start with BTC–USDT stablecoin. That covers most demand while keeping bookkeeping clean.

Step 3 — Online vs. in-store: what the checkout looks like

Online checkout (e-commerce)

- Coinbase Commerce / BitPay: add a button or plugin, show a dynamic invoice with a lock-in timer and amount; the processor does confirmations and auto-converts to USDC or USD.

- Stripe: offer Pay with Crypto (USDC); Stripe handles on-chain acceptance and settles as fiat in your Stripe balance.

- BTCPay: your store displays a hosted invoice page with an address/QR; once paid, your node marks it settled.

In-store (POS)

- With BTCPay’s POS app or processor apps that generate a QR invoice at the counter. The customer scans, sends, and you see confirmations on the cashier screen.

Step 4 — Payouts and accounting

Where does the money go?

- Processors can settle to your bank (fiat) or to a business exchange account (USDC/USD on an exchange you already use). BitPay supports bank settlement and split settlements (e.g., partly crypto, partly fiat).

- If you want to embed on/off-ramping inside your app (SaaS or marketplace), Coinbase Onramp/Offramp lets users transition between fiat and crypto without leaving your flow. That’s handy for platforms serving many small merchants.

Accounting & tax basics (U.S. framing):

- Income at receipt: The IRS treats crypto received for goods/services as ordinary income measured at fair market value (USD) on the date you received it. Keep the USD value and transaction ID with each invoice.

- If you hold crypto after sale: Subsequent gains/losses are capital gains/losses. (Record the basis—USD at receipt.)

- Financial statements: New FASB guidance (ASU 2023-08) requires certain crypto assets to be reported at fair value with changes in earnings; it’s effective for fiscal years beginning after Dec 15, 2024 (i.e., 2025 for many) and applies broadly in 2026 for private entities. Talk to your accountant about adoption timing.

For cryptocurrency for small business records, export a monthly report from your processor/exchange with: invoice IDs, coin, USD value at receipt, fees, and settlement details.

Step 5 — Risk, fees, and compliance

Volatility & settlement risk

- If you settle in USDC or USD at checkout (Coinbase Commerce, Stripe, BitPay), you largely sidestep price swings. Many advisors (including the U.S. Chamber of Commerce’s small-business site) suggests auto-converting quickly to reduce exposure.

Fees

- Expect a processor fee (often ~1%–1.5%) or network fee. With BTCPay, you avoid processor fees entirely—but you’ll manage infrastructure and wallets yourself.

Sanctions & screening (U.S.)

- If you sell into sanctioned regions or to blocked persons, you have obligations. OFAC has a virtual currency compliance guide and a Sanctions List Search tool; the “50 Percent Rule” can make entities sanctionable due to ownership, even if not named. Processors help, but you still own your risk program.

Stablecoin rails change

- Occasionally, networks are added/removed. Example: Circle ended USDC on Tron support in 2024–2025 windows; know which networks your tool accepts.

The quick start checklist

- Choose your path:

- Worry-free payouts → Coinbase Commerce / BitPay.

- Keep your Stripe stack → Add Stablecoin payments (USDC).

- Max control/lowest cost → BTCPay Server.

- Set your tender types: BTC + one stablecoin (USDC or PYUSD).

- Decide your settlement: USD to bank, USDC to exchange, or hold crypto. (If you hold, track basis; FASB/IRS rules apply.)

- Integrate checkout: Add plugin/button (web) and configure POS QR (store).

- Write a short policy: refunds in original currency, when you “lock” price (invoice timer), who holds keys (if self-custody).

- Turn on monitoring: export monthly reports; screen for sanctions if you sell cross-border.

Picking tools by scenario (mini “crypto platforms comparison”)

- I just want to add a button and be done.

Use Coinbase Commerce or Stripe’s USDC checkout. You’ll get clean settlement and minimal overhead—great for accepting online crypto payments for small business. - I need invoices for B2B clients.

BitPay’s email invoicing flow is simple; it settles next business day and doesn’t require a deep website integration. - I care about sovereignty and fees.

Self-host BTCPay Server, connect it to your store/ERP, and keep keys in a hardware wallet. It’s a strong answer to “how can my small business accept cryptocurrency without a third party?” - I want the “best crypto exchange for small business” to park funds.

Look for exchanges that support business accounts and clean off-ramping (e.g., Coinbase’s Offramp/Exchange). Keep an operational wallet for day-to-day and an exchange account for off-ramp liquidity.

Smart ways to cut cost & headaches

- Auto-convert at checkout to USDC/USD to avoid surprise P&L swings.

- Use stablecoin rails for cross-border invoices—settlement is fast and fees are predictable (Stripe/Commerce).

- Keep good records (FMV at receipt, coin, tx hash, fees); that’s the difference between effortless filing and tax-season chaos.

- Start with a pilot. Turn it on for one product line or location, measure uptake, then expand.

Conclusion

For crypto for small business, you don’t need to reinvent checkout. A processor (Coinbase Commerce, BitPay) or USDC via Stripe gets you live fast with accepting crypto payments online small business and clean settlement. If you want maximum control (and minimal fees), BTCPay Server is a strong self-hosted answer. Whichever route you take, keep it boring: auto-convert if you don’t want volatility, export tidy reports, and follow the basic compliance playbook. That’s how small business crypto goes from “maybe someday” to “we accept it today”—online and at the counter.